FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

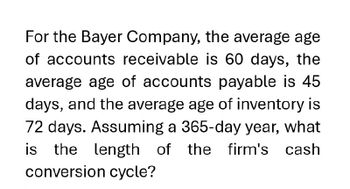

Transcribed Image Text:For the Bayer Company, the average age

of accounts receivable is 60 days, the

average age of accounts payable is 45

days, and the average age of inventory is

72 days. Assuming a 365-day year, what

is the length of

of the firm's cash

conversion cycle?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps with 1 images

Knowledge Booster

Similar questions

- A cash flow series is described by the following: $10,000 + $250(t), where t is the number of compounding periods. The present worth of this series at the end of five periods, where interest is 2% per t, is nearest what value? (a) $11,250 (b) $50,620 (c) $56,432 (d) $60,620?arrow_forwardZane Corporation has an inventory conversion period of 79 days, an average collection period of 43 days, and a payables deferral period of 50 days. Assume 365 days in year for your calculations. What is the length of the cash conversion cycle? Round your answer to two decimal places. days If Zane's annual sales are $3,598,365 and all sales are on credit, what is the investment in accounts receivable? Do not round intermediate calculations. Round your answer to the nearest cent. $ How many times per year does Zane turn over its inventory? Assume that the cost of goods sold is 75% of sales. Use sales in the numerator to calculate the turnover ratio. Do not round intermediate calculations. Round your answer to two decimal places. timesarrow_forwardDreamz Unlimited INC has accounts payable days of 30 , inventory days of 60 , and accounts receivable days of 35 . What is its Cash conversion cycle?arrow_forward

- If a firm has sales of $21,752,000 a year, and the average collection period for the industry is 45 days, what should this firm’s accounts receivable be if the firm is comparable to the industry? Assume there are 365 days in a year. Do not round intermediate calculations. Round your answer to the nearest dollar.arrow_forwardSuppose that Freddie's Fries has annual sales of $620,000; cost of goods sold of $495, 000; average inventories of $21,000; average accounts receivable of $37,000, and an average accounts payable balance of $32, 000. Assuming that all of Freddie's sales are on credit, what will be the firm's cash cycle? (Round your answer to 2 decimal places.) a. 37.26. b. 60.86. c. 1.82. d. 13.66.arrow_forwardYour company forecasts that next year's sales will be $78.00 million and the Days Sales Outstanding (DSO) ratio will be 24.84. What is the forecasted accounts receivable for next year? Note: your answer should in millions of dollars..arrow_forward

- Average account receivables-60 days, Inventories-85 days, Average account payable-55 days Company spends Rs.21, 00,000 annually and can earn 10% on its investments. (i) Find out cash cycle and cash turnover assuming 360 days in a year, (ii) Minimum amount of cash required to meet the payment. Also calculate the above, if inventory age is reduced to 75 days. What will be the savings for the company?arrow_forwardSuppose that LilyMac Photography has annual sales of $233,000, cost of goods sold of $168,000, average inventories of $4,800, average accounts receivable of $25,600, and an average accounts payable balance of $7,300.Assuming that all of LilyMac’s sales are on credit, what will be the firm’s cash cycle? (Use 365 days a year. Do not round intermediate calculations. Round your final answer to 2 decimal places.)arrow_forwardStratosphere Wireless is examining its cash conversion cycle. The company expects its cost of goods sold, which equals 60 percent of sales, to be $144,000 this year. Stratosphere normally turns over inventory 24 times per year, accounts receivable is turned over 12 times per year, and the accounts payable turnover is 45. Assume there are 360 days in a year. Calculate the cash conversion cycle. Round your answer to the nearest whole number. days Calculate the average balances in accounts receivable, accounts payable, and inventory. Round your answers to the nearest dollar. Accounts receivable: $ Accounts payable: $ Inventory: $arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education