............$14.40 plus 15% of excess over $195 $645 $1,482...................$81.90 plus 25% of excess over $645 $1,482 $3,131...................$2

|

Use the table below for the next few questions

Table for Single Taxpayers |

|

|

Over |

But not over |

|

$51 |

$195......................10% of excess over $51 |

|

$195 |

$645......................$14.40 plus 15% of excess over $195 |

|

$645 |

$1,482...................$81.90 plus 25% of excess over $645 |

|

$1,482 |

$3,131...................$291.15 plus 28% of excess over $1,482 |

|

$3,131 |

$6,763...................$752.87 plus 33% of excess over $3,131 |

|

$6,763...........................................$1,951.43 plus 35% of excess over $6,763 |

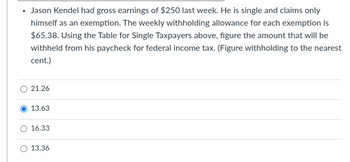

Herb Becker had gross earnings of $465 last week. He is single and claims a withholding allowance for himself only. The amount of each weekly withholding allowance is $65.38. Using the Table for Single Taxpayers above, compute the amount that will be withheld from his paycheck for federal income tax. (Figure withholding to the nearest cent.)

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

|

Use the table below for the next few questions

Table for Single Taxpayers |

|

|

Over |

But not over |

|

$51 |

$195......................10% of excess over $51 |

|

$195 |

$645......................$14.40 plus 15% of excess over $195 |

|

$645 |

$1,482...................$81.90 plus 25% of excess over $645 |

|

$1,482 |

$3,131...................$291.15 plus 28% of excess over $1,482 |

|

$3,131 |

$6,763...................$752.87 plus 33% of excess over $3,131 |

|

$6,763...........................................$1,951.43 plus 35% of excess over $6,763 |