FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

thumb_up100%

Please help me brake down the problem. the percentage is correct but i need help setting up the problem.

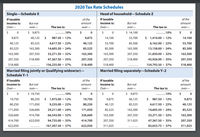

Transcribed Image Text:2020 Tax Rate Schedules

Single-Schedule X

Head of household-Schedule Z

If taxable

of the

If taxable

of the

income is:

But not

атоunt

income is:

But not

amount

Over-

over-

The tax is:

over-

Over-

over-

The tax is:

over-

$ 9,875

10%

$

$ 14,100

10%

9,875

40,125

$

987.50 + 12%

9,875

14,100

53,700

$ 1,410.00 + 12%

14,100

40,125

85,525

4,617.50 + 22%

40,125

53,700

85,500

6,162.00 + 22%

53,700

85,525

163,300

14,605.50 + 24%

85,525

85,500

163,300

13,158.00 + 24%

85,500

163,300

207,350

33,271.50 + 32%

163,300

163,300

207,350

31,830.00 + 32%

163,300

207,350

518,400

47,367.50 + 35%

207,350

207,350

518,400

45,926.00 + 35%

207,350

518,400

156,235.00 + 37%

518,400

518,400

154,793.50 + 37%

518,400

.........

.........

Married filing jointly or Qualifying widow(er)–

Schedule Y-1

Married filing separately-Schedule Y-2

If taxable

of the

If taxable

of the

income is:

But not

атоunt

income is:

But not

amount

Over-

over-

The tax is:

over-

Over-

over-

The tax is:

over-

$ 19,750

.........10%

$

$ 9,875

.........10%

2$

19,750

80,250

$ 1,975.00 + 12%

19,750

9,875

40,125

987,50 + 12%

9,875

80,250

171,050

9,235.00 + 22%

80,250

40,125

85,525

4,617.50 + 22%

40,125

171,050

326,600

29,211.00 + 24%

171,050

85,525

163,300

14,605.50 + 24%

85,525

326,600

414,700

66,543.00 + 32%

326,600

163,300

207,350

33,271.50 + 32%

163,300

414,700

622,050

94,735.00 + 35%

414,700

207,350

311,025

47,367.50 + 35%

207,350

622,050

167,307.50 + 37%

622,050

311,025

83,653.75 + 37%

311,025

........

.........

Transcribed Image Text:Exercise 3-20 (Algorithmic) (LO. 6)

Compute the 2020 tax liability and the marginal and average tax rates for the following taxpayers.

Click here to access the 2020 tax rate schedule. If required, round the tax liability to the nearest dollar. When required,

round the average rates to four decimal places before converting to a percentage (i.e. .67073 would be rounded to .6707 and

entered as 67.07%).

a. Chandler, who files as a single taxpayer, has taxable income of $101,000.

Tax liability:

20,000 x

Marginal rate:

24 V %

Average rate:

18.52 x %

b. Lazare, who files as a head of household, has taxable income of $78,600.

Tax liability:

10,432 x

Marginal rate:

22 v %

Average rate:

14.21 x %

Feedback

V Check My Work

The computation of income tax due (or refund) involves applying the proper set of tax rates to taxable income and then adjusting for available

credits. The basic tax rate structure is progressive, with current rates ranging from 10 percent to 37 percent.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- It keeps coming back incorrect and I can not figure out whYarrow_forwardWhich of the following are typical prevention costs? (Check all that apply.) Multiple select question. Quality circles Statistical process control Depreciation of test equipment Debugging software errorsarrow_forwardCan i have the answers for all in formula steps not excel please. Kind of hard to understand.arrow_forward

- Inspector expenses and other expenses that are designed to ensure quality or uncover defects are examples of prevention costs. ture or falsearrow_forwardIm having an issue with this problem. Thank you!arrow_forwardRegarding accountant's liability, the courts have held accountants liable for their financial statements to which of the following: (multiple answers possible. However marking all will result in an incorrect score.) a. client b. bankers of the client c. future investors in the business of the client d. creditors of the client e. third party vendors that might supply clientarrow_forward

- A Framework for decision making: a. can help reduce the unexpected consequences of our actions. b. is not needed if the activity is legal. c. helps identify who gains the most from a decision.arrow_forwardWhat is underpricing? Why is it used? What evidence do we have to support the belief that underpricing is a regular problem?arrow_forwardMake sure to calculate the NPV correctly! The previous answer was wrong!arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education