FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

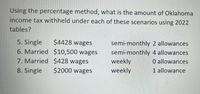

Transcribed Image Text:Using the percentage method, what is the amount of Oklahoma

income tax withheld under each of these scenarios using 2022

tables?

5. Single

6. Married $10,500 wages

7. Married $428 wages

$4428 wages

semi-monthly 2 allowances

semi-monthly 4 allowances

weekly

O allowances

8. Single

$2000 wages

weekly

1 allowance

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps with 3 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Use table to calculate Ed Robinsons income tax due on his $450,000 income, assuming that he files as a single taxpayers. Use table to calculate Ed Robinsons income tax due on his $450,000 income, assuming that he files as a single taxpayers. Use table to calculate Ed Robinsons income tax due on his $450,000 income, assuming that he files as a single taxpayers.arrow_forwardData: Alice is single and self-employed in 2020. Her net business profit on her Schedule C for the year is $200,000. Question: What is her self-employment tax liability and additional Medicare tax liability for 2020? Thx, Stephaniearrow_forwardDetermine from the tax table the amount of the income tax for each of the following taxpayers for 2020: Taxpayer(s) Filing Status Taxable Income Income Tax Allen Single $ 30,000 $______________________ Boyd MFS 34,545 $______________________ Caldwell MFJ 55,784 $______________________ Dell H of H 67,450 $______________________ Evans Single 75,000 $______________________arrow_forward

- Suppose you made $85,776 of income from wages and $830 of taxable interest. You also made contributions of $3700 to a tax deferred retirement account. You have 2 dependents and file as single. The standard deduction is 11900 and the exemption amount is 3100 per exemption. What is your Adjusted Gross Income? Answer to the nearest dollar.arrow_forwardComputing Federal Income Tax Using the table (Refer to Figure 8-4 in the text.), determine the amount of federal income tax an employer should withhold weekly for employees with the following marital status, earnings, and withholding allowances: Marital Status Total Weekly Earnings Number of Allowances Amount of Withholding (a) S $364.80 2 (b) S 445.80 1 (c) M 493.40 3 (d) S 493.60 0 (e) M 702.70 5arrow_forward13. Pat generated self-employment income in 2019 of $76,000. The self-employment tax is: a. b. C. d. $0. $5,369.23. $10,738.46. $11,628.00.arrow_forward

- Accounting Below are the 2021 tax brackets for single American taxpayers: Marginal Tax Rate For Single Individuals For Married Individuals Filing Joint Returns 10% $0 to $9,950 $0 to $19,900 12% $9,951 to $40,525 $19,901 to $81,050 22% $40,526 to $86,375 $81,051 to $172,750 24% $86,376 to $164,925 $172,751 to $329,850 32% $164,926 to $209,425 $329,851 to $418,850 35% $209,426 to $523,600 $418,851 to $628,300 37% $523,601 or more $628,301 or more a) Build this table in Excel. Have the user plug in their salary in a cell. In another cell, use a lookup function to determine and output the marginal tax rate, assuming the person is single. Note: the marginal tax rate is defined as the tax rate that applies to the last unit of the tax base. For example, if your income was $25,000, your marginal tax rate is 12%. Your lookup function should be flexible enough to output the correct answer for a multitude of different salaries. b) Do the same but this time assume the person is married filing…arrow_forwardDarius' net income from self-employment reported on Schedule C is $25,000. Calculate his self-employment tax. Group of answer choices $1,766 $23,088 $3,825 $3,532arrow_forwardA single person has taxable income of $85,000 per year. She earns $1,800 in interest from a certificate of deposit. How much federal income tax expense will be calculated on these earnings? Tax year 2019. Deduction amount 12,200. Tax rate 24%arrow_forward

- Nonearrow_forwardDd.4.arrow_forwardDuela Dent is single and had $182,400 in taxable income. Using the rates from Table 2.3, calculate her income taxes. What is the average tax rate? What is the marginal tax rate? Note: Do not round intermediate calculations and round your income tax answer to 2 decimal places, e.g., 32.16. Enter the average and marginal tax rate answers as a percent, rounded 2 decimal places, e.g., 32.16. Income taxes Average tax rate Marginal tax rate % %arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education