FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

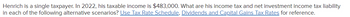

Transcribed Image Text:Henrich is a single taxpayer. In 2022, his taxable income is $483,000. What are his income tax and net investment income tax liability

in each of the following alternative scenarios? Use Tax Rate Schedule, Dividends and Capital Gains Tax Rates for reference.

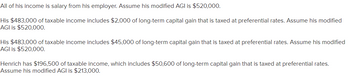

Transcribed Image Text:All of his income is salary from his employer. Assume his modified AGI is $520,000.

His $483,000 of taxable income includes $2,000 of long-term capital gain that is taxed at preferential rates. Assume his modified

AGI is $520,000.

His $483,000 of taxable income includes $45,000 of long-term capital gain that is taxed at preferential rates. Assume his modified

AGI is $520,000.

Henrich has $196,500 of taxable income, which includes $50,600 of long-term capital gain that is taxed at preferential rates.

Assume his modified AGI is $213,000.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 5 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- In 2021, Lisa and Fred, a married couple, had taxable income of $305,200. If they were to file separate tax returns, Lisa would have reported taxable income of $126,700 and Fred would have reported taxable income of $178,500. Use Tax Rate Schedule for reference. What is the couple’s marriage penalty or benefit?arrow_forwardTaylor, a single taxpayer, has $17,400 AGI. Assume the taxable year is 2023. Use Standard Deduction Table. Required: a. Compute taxable income if Taylor's AGI consists entirely of interest income. Taylor is 19 years old and a dependent of his parents for tax purposes. b. Compute taxable income if Taylor's AGI consists entirely of wage income. Taylor is 19 years old and is considered a dependent of his parents for tax purposes. c. Compute taxable income if Taylor's AGI consists entirely of interest income. Taylor is 70 years old and lives with his grown child who provides more than one-half of Taylor's financial support. Complete this question by entering your answers in the tabs below. Required A Required B Required C Compute taxable income if Taylor's AGI consists entirely of interest income. Taylor is 70 years old and lives with his grown child who provides more than one-half of Taylor's financial support. Taxable Income < Required B Required Carrow_forwardA single person with taxable income of $117064 will have the first $9,525 of that income taxed at a different rate than the income between $9,525 and $38,700. The first bracket is taxed at 10%, the second is taxed at 12% Determine the taxes owed on just the second bracket.arrow_forward

- Chuck, a single taxpayer, earns $77,400 in taxable income and $12,600 in interest from an investment in City of Heflin bonds. (Use the U.S. tax rate schedule.) Required: A. If Chuck earns an additional $40,000 of taxable income, what is his marginal tax rate on this income? B. What is his marginal rate if, instead, he had $40,000 of additional deductions? Please I need fast subparts a and b please i give up vote 2arrow_forwardMorgan Cruise earns net self-employment income of $221,600. She works a second job from which she receives FICA taxable earnings of $111,300.00.Self-Employment tax =arrow_forwardTaylor, a single taxpayer, has $15,200 AGI. Assume the taxable year is 2022. Use Standard Deduction Table. Required: a. Compute taxable income if Taylor's AGI consists entirely of interest income. Taylor is 19 years old and a dependent of his parents for tax purposes. b. Compute taxable income if Taylor's AGI consists entirely of wage income. Taylor is 19 years old and is considered a dependent of his parents for tax purposes. c. Compute taxable income if Taylor's AGI consists entirely of interest income. Taylor is 70 years old and lives with his grown child who provides more than one-half of Taylor's financial support. Complete this question by entering your answers in the tabs below. Required A Required B Required C Compute taxable income if Taylor's AGI consists entirely of interest income. Taylor is 19 years old and a dependent of his parents for tax purposes. Taxable Incomearrow_forward

- Hansabenarrow_forwardWhitney received $76,500 of taxable income in 2022. All of the income was salary from her employer. What is her income tax liability in each of the following alternative situations? Use Tax Rate Schedule for reference. Note: Do not round intermediate calculations. Required: She files under the single filing status. She files a joint tax return with her spouse. Together their taxable income is $76,500. She is married but files a separate tax return. Her taxable income is $76,500. She files as a head of household.arrow_forwardFind the gross income, the adjusted gross income, and the taxable income. Base the taxable income on the greater of a standard deduction or an temized deduction A taxpayer earned wages of $94,600, received $560 in interest from a savings account, and contributed $10,800 to a tax-deferred retirement plan She is entitled to a standard deduction of $18,800. The interest on her home mortgage was $6800, she contributed $9640 to charity, and she paid $2825 in state taxes Her gross income is $ (Simplify your answer)arrow_forward

- Domesticarrow_forward3. Fess receives wages totaling $75,700 and has net earnings from self-employment amounting to $61,300. In determining her taxable self-employment income for the OASDI tax, how much of her net self-employment earnings must Fess count?arrow_forwardRamsey Smith receives wages amounting to $93,500. His net earnings from self-employment amount to $68,600. Smith must count ________ of his earnings in determining taxable self-employment income for OASDI taxes.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education