Principles of Accounting Volume 2

19th Edition

ISBN: 9781947172609

Author: OpenStax

Publisher: OpenStax College

expand_more

expand_more

format_list_bulleted

Question

Give true answer this accounting question

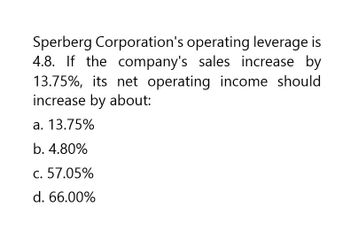

Transcribed Image Text:Sperberg Corporation's operating leverage is

4.8. If the company's sales increase by

13.75%, its net operating income should

increase by about:

a. 13.75%

b. 4.80%

c. 57.05%

d. 66.00%

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Clermont Industries' operating leverage is 4.7. If the company's sales increase by 15%, its net operating income should increase by about: Options-a. 4.7% b. 15.0% c. 70.5% d. 35.3%arrow_forwardits net operating income should increase by about:arrow_forwardNet opreting income should increase?arrow_forward

- Subject:-- general accounarrow_forwardBendel Incorporated has an operating leverage of 7.3. If the company's sales volume increases by 3%, its net operating income should increase by about: Multiple Choice O 7.3% 3.0% 21.9% 243.3%arrow_forwardNet opreting income should increase? Accountingarrow_forward

- Sperberg corporation's operating leveragearrow_forwardWhat is the firm's ROA??arrow_forwardA firm has a profit margin of 15 percent on sales of GHS20,000,000. If the firm has debt of GHS7,500,000, total assets of GHS22,500,000, and an after-tax interest cost on total debt of 5 percent, what is the firm?s ROA? O A. 8.4% B. 10.9% O C. 12.0% D. 13.3% E. 15.1%arrow_forward

- If Gandhi & Co. has a 15% return on assets (ROA) and 25% is the pay-out ratio, what is its internal growth rate. a. 11.22% b. 12.68% c. 3.90% d. 10.12%arrow_forwardA firm has a profit margin of 19 percent on sales of $24,000,000. If the firm has total assets of $23,500,000, and an after-tax interest cost on total debt of 5 percent, what is the firm's ROA? a. 12.9% b. 19.4% c. 12.0% d. 13.3% e. 15.1%arrow_forwardA firm has a profit margin of 19 percent on sales of $24,000,000. If the firm has total assets of $23,500,000, and an after-tax interest cost on total debt of 5 percent, what is the firm's ROA? a. 12.9% b. 19.4% c. 12.0% d. 13.3% e. 15.1%Provide correct answer pleasearrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

- Principles of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

Principles of Accounting Volume 2

Accounting

ISBN:9781947172609

Author:OpenStax

Publisher:OpenStax College

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:9781337514835

Author:MOYER

Publisher:CENGAGE LEARNING - CONSIGNMENT