Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN: 9781337788281

Author: James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Question

General accounting question

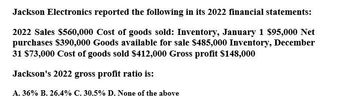

Transcribed Image Text:Jackson Electronics reported the following in its 2022 financial statements:

2022 Sales $560,000 Cost of goods sold: Inventory, January 1 $95,000 Net

purchases $390,000 Goods available for sale $485,000 Inventory, December

31 $73,000 Cost of goods sold $412,000 Gross profit $148,000

Jackson's 2022 gross profit ratio is:

A. 36% B. 26.4% C. 30.5% D. None of the above

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- The following information is available for Cooke Company for the current year: The gross margin is 40% of net sales. What is the cost of goods available for sale? a. 5840,000 b. 960,000 c. 1,200,000 d. 1,220,000arrow_forwardLast year, Nikkola Company had net sales of 2,299,500,000 and cost of goods sold of 1,755,000,000. Nikkola had the following balances: Refer to the information for Nikkola Company above. Required: Note: Round answers to one decimal place. 1. Calculate the average inventory. 2. Calculate the inventory turnover ratio. 3. Calculate the inventory turnover in days. 4. CONCEPTUAL CONNECTION Based on these ratios, does Nikkola appear to be performing well or poorly?arrow_forwardRefer to RE22-2. Assume Heller Company had sales revenue of 510,000 in 2019 and 650,000 in 2020. Prepare Hellers partial income statements (through gross profit) for 2019 and 2020. RE22-2 Heller Company began operations in 2019 and used the LIFO method to compute its 300,000 cost of goods sold for that year. At the beginning of 2020, Heller changed to the FIFO method. Heller determined that its cost of goods sold under FIFO would have been 250,000 in 2019. For 2020, Hellers cost of goods sold under FIFO was 360,000, while it would have been 410,000 under LIFO. Heller is subject to a 21% income tax rate. Compute the cumulative effect of the retrospective adjustment on prior years income (net of taxes) that Heller would report on its retained earnings statement for 2020.arrow_forward

- Comprehensive The following information for 2019 is available for Marino Company: 1. The beginning inventory is 100,000. 2. Purchases returns of 4,000 were made. 3. Purchases of 300,000 were made on terms of 2/10, n/30. Eighty percent of the discounts were taken. 4. At December 31, purchases of 20,000 were in transit, FOB destination, on terms of 2/10, n/30. 5. The company made sales of 640,000. The gross selling price per unit is twice the net cost of each unit sold. 6. Sales allowances of 6,000 were made. 7. The company uses the LIFO periodic method and the gross method for purchase discounts. Required: 1. Compute the cost of the ending inventory before the physical inventory is taken. 2. Compute the amount of the cost of goods sold that came from the purchases of the period and the amount that came from the beginning inventory.arrow_forwardCost of goods sold and related items The following data were extracted from the accounting records of Harkins Company for the year ended April 30, 20Y8: Estimated returns of current year sales 11,600 Inventory, May 1, 20Y7 380,000 Inventory, April 30, 20Y8 415,000 Purchases 3,800,000 Purchases returns and allowances 150,000 Purchases discounts 80,000 Sales 5,850,000 Freight in 16,600 a. Prepare the Cost of goods sold section of the income statement for the year ended April 30, 20Y8, using the periodic inventory system. b. Determine the gross profit to be reported on the income statement for the year ended April 30, 20Y8. c. Would gross profit be different if the perpetual inventory system was used instead of the periodic inventory system?arrow_forwardThe following selected information is taken from the financial statements of Arnn Company for its most recent year of operations: During the year, Arnn had net sales of 2.45 million. The cost of goods sold was 1.3 million. Required: Note: Round all answers to two decimal places. 1. Compute the current ratio. 2. Compute the quick or acid-test ratio. 3. Compute the accounts receivable turnover ratio. 4. Compute the accounts receivable turnover in days. 5. Compute the inventory turnover ratio. 6. Compute the inventory turnover in days.arrow_forward

- The income statement of Pharoah Company is shown below. Pharoah Company Income Statement For the Year Ended December 31, 2025 Sales revenue $6,850,000 Cost of goods sold Beginning inventory $1,880,000 Purchases 4,410,000 Goods available for sale 6,290,000 Ending inventory 1,610,000 Cost of goods sold 4,680,000 Gross profit 2,170,000 Operating expenses Selling expenses 450,000 Administrative expenses 710,000 1,160,000 Net income $1,010,000 Additional information: 1. Accounts receivable decreased $380,000 during the year. 2. Prepaid expenses increased $150,000 during the year. 3. Accounts payable to suppliers of merchandise decreased $260,000 during the year. 4. Accrued expenses payable decreased $110,000 during the year. 5. Administrative expenses include depreciation expense of $50,000. Prepare the operating activities section of the statement of cash flows using the direct method. PHAROAH COMPANY Partial Statement of Cash Flows For the Year Ended December 31, 2025 Cash Flows from…arrow_forwardThe income statement of Pharoah Company is shown below. Pharoah Company Income Statement For the Year Ended December 31, 2025 Sales revenue $6,850,000 Cost of goods sold Beginning inventory $1,880,000 Purchases 4,410,000 Goods available for sale 6,290,000 Ending inventory 1,610,000 Cost of goods sold 4,680,000 Gross profit 2,170,000 Operating expenses Selling expenses 450,000 Administrative expenses 710,000 1,160,000 Net income $1,010,000 Additional information: 1. Accounts receivable decreased $380,000 during the year. 2. Prepaid expenses increased $150,000 during the year. 3. Accounts payable to suppliers of merchandise decreased $260,000 during the year. 4. Accrued expenses payable decreased $110,000 during the year. 5. Administrative expenses include depreciation expense of $50,000. Prepare the operating activities section of the statement of cash flows using the direct method. PHAROAH COMPANY Partial Statement of Cash Flows $arrow_forwardsalamagundi, inc. has the following income statement: For the year ended December 31, 2021 net sales: $160 Cost of goods sold: $100 gross profit: $60 Operating expenses: $40 Net income: $20 Using vertical analysis, what percentage is assigned to operating expenses? a. 25% b. 40% c. 66.7% d. 200%arrow_forward

- Mbi inc. had sales of $900 million for fiscal 2019. Solve this questionarrow_forwardHaharrow_forwardThe income statement of Sweet Company is shown below. SWEET COMPANYINCOME STATEMENTFOR THE YEAR ENDED DECEMBER 31, 2020 Sales revenue $6,960,000 Cost of goods sold Beginning inventory $1,910,000 Purchases 4,380,000 Goods available for sale 6,290,000 Ending inventory 1,610,000 Cost of goods sold 4,680,000 Gross profit 2,280,000 Operating expenses Selling expenses 450,000 Administrative expenses 710,000 1,160,000 Net income $1,120,000 Additional information: 1. Accounts receivable decreased $380,000 during the year. 2. Prepaid expenses increased $190,000 during the year. 3. Accounts payable to suppliers of merchandise decreased $290,000 during the year. 4. Accrued expenses payable decreased $90,000 during the year. 5. Administrative expenses include depreciation expense of $70,000. Prepare…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning

Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning, Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...

Accounting

ISBN:9781337115773

Author:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:Cengage Learning

Financial Accounting: The Impact on Decision Make...

Accounting

ISBN:9781305654174

Author:Gary A. Porter, Curtis L. Norton

Publisher:Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:9781337514835

Author:MOYER

Publisher:CENGAGE LEARNING - CONSIGNMENT

Financial And Managerial Accounting

Accounting

ISBN:9781337902663

Author:WARREN, Carl S.

Publisher:Cengage Learning,

Cornerstones of Financial Accounting

Accounting

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Cengage Learning