FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

thumb_up100%

Please give me true answer this financial accounting question

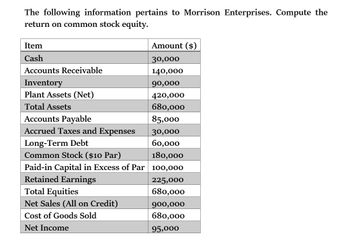

Transcribed Image Text:The following information pertains to Morrison Enterprises. Compute the

return on common stock equity.

Item

Amount ($)

Cash

30,000

Accounts Receivable

140,000

Inventory

90,000

Plant Assets (Net)

420,000

Total Assets

680,000

Accounts Payable

85,000

Accrued Taxes and Expenses

30,000

Long-Term Debt

60,000

Common Stock ($10 Par)

180,000

Paid-in Capital in Excess of Par 100,000

Retained Earnings

225,000

Total Equities

680,000

Net Sales (All on Credit)

900,000

Cost of Goods Sold

680,000

Net Income

95,000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- The following information pertains to Sunland Company. Assume that all balance sheet amounts represent average balance figures. Total assets Stockholders' equity-common Total stockholders' equity Sales revenue Net income Number of shares of common stock Common dividends Preferred dividends What is Sunland's payout ratio? O 24.6%. O 9.6%. O 17.9%. O 37.9%. $355000 235000 294000 97000 21100 6000 5200 8500arrow_forwardWhat is Wayne Co.'s total stockholders' equity based on the following account balances? Common Stock Paid-In Capital in Excess of Par Retained Earnings Treasury Stock O $975,000. O $1,150,000. O $1,000,000. O $800,000. $950,000 50,000 175,000 25,000arrow_forwardSW Company provides the Equity & Liability Information below for analysis. SW Company had net income of $365,700 in 2023 and $352,900 in 2022. Equity and Liabilities Share capital-common (132,300 shares issued) Retained earnings (Note 1) Accrued liabilities Notes payable (current) Accounts payable Total equity and liabilities Return on equity Note 1: Cash dividends were paid at the rate of $1 per share in 2022 and $2 per share in 2023. Required: 1. Calculate the return on common share equity for 2022 and 2023. (Assume total equity was $1,364,100 at December 31, 2021.) (Round your answers to 1 decimal place.) 2022 Book value per share % 2022 2023 2023 2022 $1,282,500 $1,282,500 % 2023 382,200 10,000 72,000 60,800 $1,807,500 2. Calculate the book value per shares for 2022 and 2023. (Round your answers to 2 decimal places.) 308,500 6,000 66,100 177, 200 $1,840,300arrow_forward

- SW Company provides the Equity & Liability information below for analysis. SW Company had net income of $424,100 in 2023 and $373,500 in 2022. Equity and Liabilities. Share capital-common (141,800 shares issued) Retained earnings (Note 1) Accrued liabilities. Notes payable (current) Accounts payable Total equity and liabilities Return on equity 2022 Book value per share Note 1: Cash dividends were paid at the rate of $1 per share in 2022 and $2 per share in 2023. Required: 1. Calculate the return on common share equity for 2022 and 2023. (Assume total equity was $1,618,900 at December 31, 2021.) (Round your answers to 1 decimal place.) 2023 2022 2023 2022 $1,228,500 $1,228,500 274,500 6,600 56, 600 171,900 $1,797,000 $1,738,100 2023 429,500 8,500 2. Calculate the book value per shares for 2022 and 2023. (Round your answers to 2 decimal places.) 69,700 60,800arrow_forwardSW Company provides the Equity & Liability information below for analysis. SW Company had net and $335,800 in 2022. Equity and Liabilities Share capital-common (136,400 shares issued) Retained earnings (Note 1) Accrued liabilities Notes payable (current) Accounts payable Total equity and liabilities Note 1: Cash dividends were paid at the rate of $1 per share in 2022 and $2 per share in 2023. Required: 1. Calculate the return on common share equity for 2022 and 2023. (Assume total equity was $1,439,00 (Round your answers to 1 decimal place.) Return on equity 2022 23.3 % 2023 26.0 % Prox 5 2023 2022 $1,242,000 $1,242,000 417,700 300,000 9,100 6,100 76,600 66,700 63,300 182,500 $1,808,700 $1,797,300 ‒‒‒ - Nextarrow_forwardBlossom Company has the following items: common stock, $1583000; treasury stock, $216000; deferred income taxes, $241000 and Retained Earnings, $790000. What total amount should Blossom Company report as stockholders' equity? O $2589000 O $1367000 $2398000 O $2157000arrow_forward

- Bonita Industries had the following information in its financial statements for the years ended 2020 and 2021: Cash dividends for the year 2021 $ 9600 Net income for the year ended 2021 97700 Market price of stock, 12/31/20 9 Market price of stock, 12/31/21 11 Common stockholders’ equity, 12/31/20 1001000 Common stockholders’ equity, 12/31/21 1192000 Outstanding shares, 12/31/21 100300 Preferred dividends for the year ended 2021 14300 What is the payout ratio for Bonita Industries for the year ended 2021?arrow_forwardPresented below is information related to Cullumber Corporation: Common Stock, $1 par $10364000 Paid-in Capital in Excess of Par-Common Stock 6542000 Paid-in Capital from Treasury Stock 430000 Retained Earnings 9548000 696000 Treasury Common Stock (at cost) The total stockholders' equity of Cullumber Corporation is O $27580000. $26188000. $27150000. $25328000.arrow_forward27. The shareholders' equity section of Ball Company's comparative balance sheets for the years ended December 31, 2021 and 2020, reported the following data: Common stock, $1 par per share Paid-in capital-excess of par Retained earnings ($ in millions) 2021 A. $28 million B. $718 million C. $130 million D. $118 million $ 61 छत लॅक बैंक 2 34 8 62 2020 $ 60 30 60 0 During 2021, Ball declared and paid cash dividends of $90 million. The company also declared and issued a small stock dividend. No other changes occurred in shares outstanding during 2021. What was Ball's net income for 2021?arrow_forward

- Sheffield Corp. had the following information in its financial statements for the years ended 2020 and 2021: Cash dividends for the year 2021 $ 10500 Net income for the year ended 2021 92600 Market price of stock, 12/31/20 8 Market price of stock, 12/31/21 10 Common stockholders’ equity, 12/31/20 1636000 Common stockholders’ equity, 12/31/21 1981000 Outstanding shares, 12/31/21 166000 Preferred dividends for the year ended 2021 15200 What is the book value per share for Sheffield Corp. for the year ended 2021?arrow_forwardSheffield Corp. had the following information in its financial statements for the year ended 2020 and 2021: Common cash dividends for the year 2021 $ 19700 Net income for the year ended 2021 136000 Market price of stock, 12/31/21 24 Common stockholders’ equity, 12/31/20 2300000 Common stockholders’ equity, 12/31/21 2780000 Outstanding shares, 12/31/21 149300 Preferred dividends for the year ended 2021 30800 What is the payout ratio for Sheffield Corp. for the year ended 2021?arrow_forwardThe following information relates to SE11-8 through SE11-10: Evans & Sons, Inc., disclosed the following information in a recent annual report: Net income Preferred stock dividends. Average common stockholders' equity. Dividend per common share.. Earnings per share. . . . . Market price per common share, year-end. 2018 $ 35,000 3,000 1,000,000 1.90 2.85 19.00 2019 $ 48,000 3,000 1,500,000 2.00 3.20 21.00 SE11-8. Return on Common Stockholders' Equity Calculate the return on common stockholders' equity for Evans & Sons for 2018 and 2019. Did the return improve from 2018 to 2019? SE11-9. Dividend Yield Calculate the dividend yield for Evans & Sons for 2018 and 2019. Did the dividend yield improve from 2018 to 2019? SE11-10. Dividend Payout Ratio Calculate the dividend payout for Evans & Sons for 2018 and 2019. Did the dividend payout increase from 2018 to 2019? SE11-11. Change in Stockholders' Equity Nikron Corporation issued 20,000 shares of $0.50 par value common stock during the year…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education