Quickbooks Online Accounting

3rd Edition

ISBN: 9780357391693

Author: Owen

Publisher: Cengage

expand_more

expand_more

format_list_bulleted

Question

Transcribed Image Text:5:30 PM

←

+91 94972 95529

Today, 2:25 pm

*

lll88

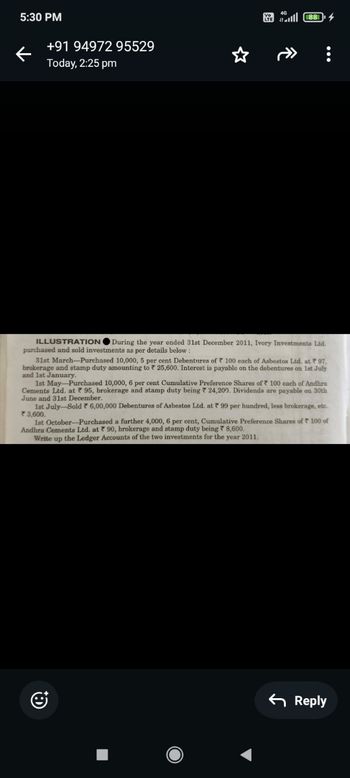

ILLUSTRATION

During the year ended 31st December 2011, Ivory Investments Ltd.

purchased and sold investments as per details below:

31st March-Purchased 10,000, 5 per cent Debentures of 100 each of Asbestos Ltd. at 97,

brokerage and stamp duty amounting to 25,600. Interest is payable on the debentures on 1st July

and 1st January.

1st May-Purchased 10,000, 6 per cent Cumulative Preference Shares of 100 each of Andhra

Cements Ltd. at 95, brokerage and stamp duty being 24,200. Dividends are payable on 30th

June and 31st December.

1st July-Sold * 6,00,000 Debentures of Asbestos Ltd. at 99 per hundred, less brokerage, etc.

3,600.

1st October-Purchased a further 4,000, 6 per cent, Cumulative Preference Shares of 100 of

Andhra Cements Ltd. at 90, brokerage and stamp duty being 8,600.

Write up the Ledger Accounts of the two investments for the year 2011.

J

Reply

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- cam Acc III-June 23 1 O:22:27 C Mc Graw Hill Monkey Mortgage Inc. engaged in the following non-strategic investment transactions during 2023, all with intent to hold to maturity: 2023 1 Purchased for $427,057 a 7.0%, $420,000 Jaguar Corp. bond that matures in five years when the market interest rate was 6.6%. There was a $$125 transaction fee included in the above-noted payment amount. Interest is paid semiannually beginning June 30, 2023. Monkey Mortgage Inc. plans to hold this investment until maturity. 1 Bought 8,000 shares of Mule Corp., paying $34.50 per share. There was a $125 transaction fee included in the above-noted payment amount. May 7 Received dividends of $2.90 per share on the Mule Corp. shares. June 1 Paid $336,000 for 22,000 shares of Zebra common shares. There was a $$125 transaction fee included in the above-noted payment. June 30 Received interest on the Jaguar bond.. Jan. Mar. Aug. 1 Sold the Mule Corp. shares for $34.75 per share. Dec. 31 Received interest on the…arrow_forwardA1arrow_forwarda7arrow_forward

- How do you solve 15-4 letter B. What steps are taken?arrow_forwardparesharrow_forwardOn October 1, Year 1 Hernandez Company loaned $60,000 cash to Acosta Company. The one-year note carried a 6% rate of interest. Which of the following shows how the December 31, Year 1 recognition of accrued interest will affect Hernandez's financial statements? Assets A. 900 B. 900 C. 2,700 D. 2,700 Balance Sheet Liabilities + ΝΑ ΝΑ ΝΑ ΝΑ Multiple Choice Option A Option C Option D Option B Stockholders' Equity 900 900 2,700 2,700 Income Statement Revenue Expense = 900 ΝΑ 900 2,700 ΝΑ ΝΑ 2,700 ΝΑ Net Income 900 900 2,700 2,700 Statement of Cash Flows 900 IA ΝΑ 2,700 IA ΝΑarrow_forward

- Sh7arrow_forwardQ7- Khalid Corporation had the following transactions relating to debt investments: Jan. 1 Purchased 50, $1,000, 12% Naved Company bonds for $50,000 plus broker's fees of $1,500. Interest is payable semiannually on January 1 and July 1. July 1 Received semiannual interest from Naved Company bonds. July 1 Sold 30 Naved Company bonds for $30,000, less $800 broker's fees. Instructions (a). Journalize the transactions, and (b). prepare the adjusting entry for the accrual of interest on December 31.arrow_forwardInstructions Stuart Corp. purchased $80,000 of Durmb Co, bonds and $120,000 of Silly Inc. bonds. Both investments are classified as trading. As of December 31, the Dumb Co. bonds are selling for $90,000 and the Silly Inc, bonds are selling for $140,000 per share. Stuart had net income of $150,000 before reporting the impact of investment transactions. Required: a. Record the December 31 adjusting entries for investments. b. What is Stuart Corp.'s net income after adjusting for investments? c. What is the appropriate balance sheet presentation for these investments?arrow_forward

- 1.Prepare Hertog Company’s journal entries to record the following transactions for the current year. May 7 Purchases Kraft bonds as a short-term investment in trading securities at a cost of $10,830. June 6 Sells its entire investment in Kraft bonds for $11,330 casharrow_forwardShow the solution in good accounting formarrow_forwardWhirlie Inc. issued $300,000 face value, 10% paid annually, 10-year bonds for $319,251 when the market of interest was 9%. The company uses the effective-interest method of amortization. At the end of the year, the company will record ________. A. a credit to cash for $28,733 B. a debit to interest expense for $31,267 C. a debit to Discount on Bonds Payable for $1,267 D. a debit to Premium on Bonds Payable for $1.267arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage LearningPrinciples of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage LearningPrinciples of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

Financial Accounting: The Impact on Decision Make...

Accounting

ISBN:9781305654174

Author:Gary A. Porter, Curtis L. Norton

Publisher:Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:9781947172685

Author:OpenStax

Publisher:OpenStax College