FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

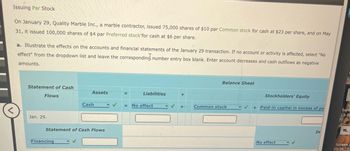

Transcribed Image Text:Issuing Par Stock

On January 29, Quality Marble Inc., a marble contractor, issued 75,000 shares of $10 par Common stock for cash at $23 per share, and on May

31, it issued 100,000 shares of $4 par Preferred stock for cash at $6 per share.

a. Illustrate the effects on the accounts and financial statements of the January 29 transaction. If no account or activity is affected, select "No

effect" from the dropdown list and leave the corresponding number entry box blank. Enter account decreases and cash outflows as negative

amounts.

Statement of Cash

Flows

Jan. 29.

Assets

Financing

Cash

Statement of Cash Flows

=

Liabilities

= No effect

- ✓

+

+

Balance Sheet

Common stock

Stockholders' Equity

+ Paid-in capital in excess of pa

No effect

In

Scre

23-11

P

Screen S

23-11...27

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Similar questions

- Please help with all answersarrow_forwardPlease fill in the blanks with blue arrows to the table above, the one you submitted back to me in response does not look like the same one I submittedarrow_forwardOn October 31, Legacy Rocks Inc., a marble contractor, issued for cash 74,600 shares of $10 par common stock at $12, and on November 19, it issued for cash 15,640 shares of preferred stock, $40 par at $56. Required: A. Journalize the entries for October 31 and November 19. Refer to the Chart of Accounts for exact wording of account titles. B. What is the total amount invested (total paid-in capital) by all stockholders as of November 19? CHART OF ACCOUNTSLegacy Rocks Inc.General Ledger ASSETS 110 Cash 120 Accounts Receivable 131 Notes Receivable 132 Interest Receivable 141 Merchandise Inventory 145 Office Supplies 151 Prepaid Insurance 181 Land 193 Equipment 194 Accumulated Depreciation-Equipment LIABILITIES 210 Accounts Payable 221 Notes Payable 226 Interest Payable 231 Cash Dividends Payable 236 Stock Dividends Distributable 241 Salaries Payable 261 Mortgage Note Payable EQUITY 311 Common Stock 312 Paid-In…arrow_forward

- Prearrow_forwardOn June 1, Teal Mountain Inc. issues 3,000 shares of no-par common stock at a cash price of $5 per share. Journalize the issuance of the shares. (Credit account titles are automatically indented when amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter O for the amounts.) Date Account Titles and Explanation June 1 Debit Creditarrow_forwardOn May 15, Helena Carpet Inc., a carpet wholesaler, issued for cash 120,000 shares of no-par common stock (with a stated value of $3) at $12, and on June 30, it issued for cash 15,000 shares of preferred stock, $65 par at $72.a. Journalize the entries for May 15 and June 30, assuming that the common stock is to be credited with the stated value. If an amount box does not require an entry, leave it blank.May 15 June 30 b. What is the total amount invested (total paid-in capital) by all stockholders as of June 30?$arrow_forward

- On May 10, a company issued for cash 2,000 shares of no-par common stock (with a stated value of $5) at $14, and on May 15, it issued for cash 2,000 shares of $18 par preferred stock at $58. Journalize the entries for May 10 and 15, assuming that the common stock is to be credited with the stated value. If an amount box does not require an entry, leave it blank. May 10 May 15arrow_forwardOn May 10, a company issued for cash 1,600 shares of no-par common stock (with a stated value of $4) at $17, and on May 15, it issued for cash 2,000 shares of $17 par preferred stock at $61. Journalize the entries for May 10 and 15, assuming that the common stock is to be credited with the stated value. If an amount box does not require an entry, leave it blank.arrow_forward(.IS Lily Corporation has 43,500 shares of $13 par value common stock outstanding. It declares a 15% stock dividend on December 1 when the market price per share is $17. The dividend shares are issued on December 31. Prepare the entries for the declaration and issuance of the stock dividend. (Record journal entries in the order presented in the problem. Credit account titles are automatically indented when amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter O for the amounts.) Date く Account Titles and Explanation Debit Creditarrow_forward

- Windsor, Inc. issues 8,500 shares of $105 par value preferred stock for cash at $114 per share. Journalize the issuance of the preferred stock. (Credit account titles are automatically indented when amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter 0 for the amounts.) Account Titles and Explanation Debit Creditarrow_forwardSage Hill Inc. issues 9,000 shares of $105 par value preferred stock for cash at $119 per share. Journalize the issuance of the preferred stock. (Credit account titles are automatically indented when amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter O for the amounts.) Account Titles and Explanation Debit Creditarrow_forwardNote:- Do not provide handwritten solution. Maintain accuracy and quality in your answer. Take care of plagiarism. Answer completely. You will get up vote for sure.arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education