FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

thumb_up100%

On January 31, Wilderness Resorts Inc. reacquired 24,300 shares of its common stock at $31 per share. On April 20, Wilderness Resorts sold 14,900 of the reacquired shares at $41 per share. On October 4, Wilderness Resorts sold the remaining shares at $29 per share.

Journalize the transactions of January 31, April 20, and October 4. Refer to the Chart of Accounts for exact wording of account titles.

CHART OF ACCOUNTS Wilderness Resorts Inc.General Ledger

| ASSETS | |

| 110 | Cash |

| 120 | |

| 131 | Notes Receivable |

| 132 | Interest Receivable |

| 141 | Merchandise Inventory |

| 145 | Office Supplies |

| 151 | Prepaid Insurance |

| 181 | Land |

| 193 | Equipment |

| 194 |

| LIABILITIES | |

| 210 | Accounts Payable |

| 221 | Notes Payable |

| 226 | Interest Payable |

| 231 | Cash Dividends Payable |

| 236 | Stock Dividends Distributable |

| 241 | Salaries Payable |

| 261 | Mortgage Note Payable |

| EQUITY | |

| 311 | Common Stock |

| 312 | Paid-In Capital in Excess of Par-Common Stock |

| 315 | |

| 321 | |

| 322 | Paid-In Capital in Excess of Par-Preferred Stock |

| 331 | Paid-In Capital from Sale of Treasury Stock |

| 340 | |

| 351 | Cash Dividends |

| 352 | Stock Dividends |

| 390 | Income Summary |

| REVENUE | |

| 410 | Sales |

| 610 | Interest Revenue |

| EXPENSES | |

| 510 | Cost of Merchandise Sold |

| 515 | Credit Card Expense |

| 520 | Salaries Expense |

| 531 | Advertising Expense |

| 532 | Delivery Expense |

| 533 | Selling Expenses |

| 534 | Rent Expense |

| 535 | Insurance Expense |

| 536 | Office Supplies Expense |

| 537 | Organizational Expenses |

| 562 | Depreciation Expense-Equipment |

| 590 | Miscellaneous Expense |

| 710 | Interest Expense |

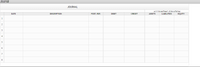

Transcribed Image Text:Journal

JOURNAL

ACCOUNTING FOUATION

ASSETS

DATE

DESCRIPTION

POST, REF.

DEBIT

CREDIT

LIABILITIES

EQUITY

1

2

3

4

5

7

8

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- On March 15, American eagle declares a quarterly cash dividend of $0.035 per-share payable on April 13 to all stockholders of record on March 30. Record American Eagle‘s declaration and payment of cash dividends for its 228 million shares. (If no entry is required for a transaction/event, select “ no journal entry required” in the first account field enter your answer in dollars not in millions)arrow_forwardMystic Lake Inc. bottles and distributes spring water. On July 9 of the current year, Mystic Lake reacquired 80,000 shares of its common stock at $44 per share. On September 22, Mystic Lake sold 55,000 of the reacquired shares at $52 per share. The remaining 25,000 shares were sold at $40 per share on November 23. Question Content Areaa. Journalize the transactions of July 9, September 22, and November 23. If an amount box does not require an entry, leave it blank.b. What is the balance in Paid-In Capital from Sale of Treasury Stock on December 31 of the current year?fill in the blank 1 of 1$c.For what reasons might Mystic Lake Inc. have purchased the treasury stock?arrow_forwardMystic Lake Inc. bottles and distributes spring water. On July 9 of the current year, Mystic Lake reacquired 39,300 shares of its common stock at $42 per share. On September 22, Mystic Lake sold 30,100 of the reacquired shares at $49 per share. The remaining 9,200 shares were sold at $41 per share on November 23. Required: a. Journalize the transactions of July 9, September 22, and November 23. Refer to the Chart of Accounts for exact wording of account titles. b. What is the balance in Paid-In Capital from Sale of Treasury Stock on December 31 of the current year? c. For what reasons might Mystic Lake Inc. have purchased the treasury stock?arrow_forward

- Biscayne Bay Water Inc. bottles and distributes spring water. On May 14 of the current year, Biscayne Bay Water Inc. reacquired 2,700 shares of its common stock at $53 per share. On September 6, Biscayne Bay Water Inc. sold 2,100 of the reacquired shares at $57 per share. The remaining 600 shares were sold at $50 per share on November 30. a. Journalize the transactions of May 14, September 6, and November 30. If an amount box does not require an entry, leave it blank. May 14 fill in the blank 5100910d601a073_2 fill in the blank 5100910d601a073_3 fill in the blank 5100910d601a073_5 fill in the blank 5100910d601a073_6 Sept. 6 Cash fill in the blank 5100910d601a073_8 fill in the blank 5100910d601a073_9 fill in the blank 5100910d601a073_11 fill in the blank 5100910d601a073_12 fill in the blank 5100910d601a073_14 fill in the blank 5100910d601a073_15 Nov. 30 fill in the blank 5100910d601a073_17 fill in the blank 5100910d601a073_18 fill in the…arrow_forwardMystic Lake Inc. bottles and distributes spring water. On July 9 of the current year, Mystic Lake reacquired 5,200 shares of its common stock at $77 per share. On September 22, Mystic Lake sold 3,600 of the reacquired shares at $85 per share. The remaining 1,600 shares were sold at $74 per share on November 23. a. Journalize the transactions of July 9, September 22, and November 23. If an amount box does not require an entry, leave it blank. July 9 Treasury Stock fill in the blank 10c23a02efe4076_2 fill in the blank 10c23a02efe4076_3 Cash fill in the blank 10c23a02efe4076_5 fill in the blank 10c23a02efe4076_6 Sept. 22 Cash fill in the blank 10c23a02efe4076_8 fill in the blank 10c23a02efe4076_9 Treasury Stock fill in the blank 10c23a02efe4076_11 fill in the blank 10c23a02efe4076_12 Paid-In Capital from Sale of Treasury Stock fill in the blank 10c23a02efe4076_14 fill in the blank 10c23a02efe4076_15 Nov. 23 Cash fill in the blank 10c23a02efe4076_17 fill in…arrow_forwardOn February 14, Marine Company reacquired 7,500 shares of its common stock at $30 per share. On March 15, Marine sold 4,500 of the reacquired shares at $34 per share. On June 2, Marine sold the remaining shares at $28 per share. Required: Journalize the transactions of Februaryl4, March 5, and June 2.arrow_forward

- Sprinkle Inc. has outstanding 10,000 shares of $10 par value common stock. On July 1, 2025, Sprinkle reacquired 100 shares at $87 per share. On September 1, Sprinkle reissued 60 shares at $90 per share. On November 1, Sprinkle reissued 40 shares at $83 per share. Prepare Sprinkle's journal entries to record these transactions using the cost method.arrow_forwardAlanae Inc issues 500 common shares to the organizers of its corporation to pay for their services valued at $5,000. What is included in the journal entry to record this transaction? O a. O b. C. O d. A debit to an asset account A credit to an expense account A credit to a liability account A credit to an equity accountarrow_forwardMarigold Inc. has outstanding 10,600 shares of $10 par value common stock. On July 1, 2020, Marigold reacquired 105 shares at $87 per share. On September 1, Marigold reissued 62 shares at $91 per share. On November 1, Marigold reissued 43 shares at $84 per share. Prepare Marigold's journal entries to record these transactions using the cost method. (Credit account titles are automatically indented when amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter O for the amounts.) Date Account Titles and Explanation Debit Credit 11/1/20arrow_forward

- Lawn Spray Inc. develops and produces spraying equipment for lawn maintenance and industrial uses. On January 31 of the current year, Lawn Spray Inc. reacquired 19,100 shares of its common stock at $20 per share. On June 14, 13,700 of the reacquired shares were sold at $25 per share, and on November 23, 4,000 of the reacquired shares were sold at $21. Required: A. Journalize the transactions of January 31, June 14, and November 23. Refer to the Chart of Accounts for exact wording of account titles. B. What is the balance in Paid-In Capital from Sale of Treasury Stock on December 31 of the current year? C. What is the balance in Treasury Stock on December 31 of the current year? D. How will the balance in Treasury Stock be reported on the balance sheet? CHART OF ACCOUNTSLawn Spray Inc.General Ledger ASSETS 110 Cash 120 Accounts Receivable 131 Notes Receivable 132 Interest Receivable 141 Merchandise Inventory 145 Office Supplies 151 Prepaid Insurance…arrow_forwardInstructions On January 31, Wilderness Resorts Inc. reacquired 23,900 shares of its common stock at $31 per share. On April 20, Wilderness Resorts sold 14,000 of the reacquired shares at $40 per share. On October 4, Wilderness Resorts sold the remaining shares at $29 per share. Journalize the transactions of January 31, April 20, and October 4. Refer to the Chart of Accounts for exact wording of account titles. Journal JOURNAL DESCRIPTION POST. REF. DEBIT CREDIT 1 2 B DATE ASarrow_forwardIvanhoe Inc. has outstanding 11,500 shares of $10 par value common stock. On July 1, 2020, Ivanhoe reacquired 111 shares at $87 per share. On September 1, Ivanhoe reissued 60 shares at $95 per share. On November 1, Ivanhoe reissued 51 shares at $85 per share.Prepare Ivanhoe’s journal entries to record these transactions using the cost method. (Credit account titles are automatically indented when amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter 0 for the amounts.)arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education