FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

PLEASE HELP I NEED THESE ANSWERED WITHIN AN HOUR

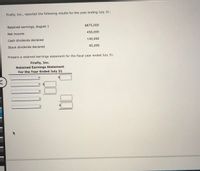

Transcribed Image Text:Firefly, Inc., reported the following results for the year ending July 31:

Retained earnings, August 1

$875,000

Net income

450,000

Cash dividends declared

140,000

Stock dividends declared

60,000

Prepare a retained earnings statement for the fiscal year ended July 31.

Firefly, Inc.

Retained Earnings Statement

For the Year Ended July 31

Transcribed Image Text:On May 10, a company issued for cash 1,000 shares of no-par common stock (with a stated value of $4) at $18, and on May 15, it issued for cash 6,000 shares of $17

par preferred stock at $62.

Journalize the entries for May 10 and 15, assuming that the common stock is to be credited with the stated value. If an amount box does not require an entry, leave it

blank.

May 10

May 15

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- What is the interest rate, monthly deposits, time amount, target Amount, actual Amount and different? And what is the final answer to the question? I'm really lost right now. I was told to use the (saving formula for this)arrow_forwardPlease answer 1,2,3,4.it would be a great help. upvote confirmarrow_forwardsolve using the appropriate formulas show full workings and find the answer. DONT USE EXCEL TO SOLVE ANYTHING ONLY USE RELEVANT FORMULAS TO SOLVE AND SHOW ALL WORKINGS 5. You have $33,556.25 in a brokerage account, and you plan to deposit an additional $5,000 at the end of every future year until your account totals $220,000. You expect to earn 12% annually on the account. How many years will it take to reach your goal?arrow_forward

- Can someone show me how to solve this problem manually without using excel or financial calarrow_forwardYou are looking for a bank in which to open a checking account for your new part-time business. You estimate that in the first year, you will be writing 30 checks per month and will make three debit transactions per month. Your average daily balance is estimated to be $900 for the first six months and $2,400 for the next six months. Use the following information to solve the problem. Bank Monthly Fees and Conditions Bank 1 $16.00 with $1,000 min. daily balance-or-$25.00 under $1,000 min. daily balance Bank 2 $4.50 plus $0.40 per check over 10 checks monthly$1.00 per debit transaction Bank 3 $5 plus $0.25 per check$2.00 per debit transaction Bank 4 $8 plus $0.15 per check$1.50 per debit transaction (a) Calculate the cost (in $) of doing business with each bank for a year. Bank 1 Bank 2 Bank 3 Bank 4 (b) Which bank should you choose for your checking account? Bank 1 Bank 2 Bank 3 Bank 4arrow_forwardhelp please answer in text form with proper workings and explanation for each and every part and steps with concept and introduction no AI no copy paste remember answer must be in proper format with all workingarrow_forward

- Hel Check my work mode : This shows what is correct or incorrect for the work you have completed so far. It does not indicate completion. Baker's Financial Planners purchased nine new computers for $910 each. It received a 20% discount because it purchased more than four and an additional 5% discount because it took immediate delivery. Terms of payment were 5/10, n/30. Baker's pays the bill within the cash discount period. How much should the check be? (Do not round intermediate calculations. Round your final answer to the nearest cent.) Amount $ 5835.38 8 10 of 10arrow_forwardSolve the question in one hour and solve only by hand . I need handwritten soloution only( not on excel etc) . I need handwritten soloution only. Plz solve this now in one hour and take a thumb up plz . I need a perfect handwritten soloution plzarrow_forwardAny crypto currency’s callouts I should know of in the next week?arrow_forward

- Fast pls solve this question correctly in 5 min pls I will give u like for sure Savitr Prudencia has to make two payments of 2,000 each, within 6 and 9 months, to deal with some extraordinary repairs from the community of neighbors. Calculate how much money Doña Prudencia must place today in an account that offers 6% annual interest, to meet these payments.arrow_forwardSolve the following problems without using any software, do everything in digital format, explain the formulas, substitutions and result 3. A person has available the amount of $ 1,250,000 he wants to use to ensure a fixed monthly income for the next three years. For this purpose, deposit that amount in a revolving bank account every 30 days and a monthly interest rate of 0.8% (9.6% per year). Assuming the interest rate was held constant, what amount should you withdraw each month so that by the end of the three years the amount initially deposited would have been completely used up?arrow_forwardI need the answer as soon as possiblearrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education