FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

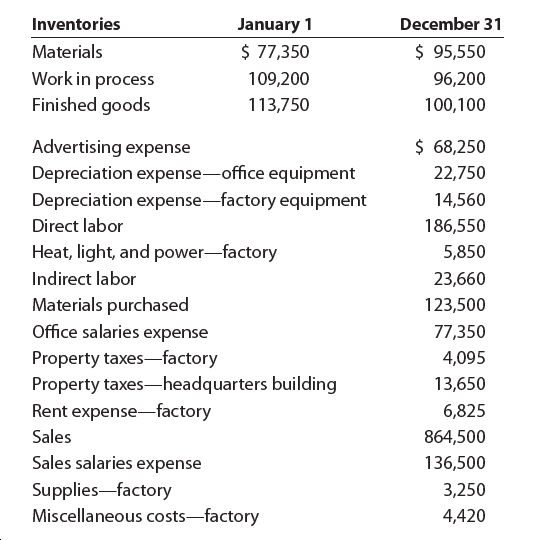

The following information is available for Shanika Company for 20Y6:

Please see the attachment

Instructions

1. Prepare the statement of cost of goods manufactured.

2. Prepare the income statement.

Transcribed Image Text:Inventories

December 31

January 1

$ 77,350

$ 95,550

Materials

Work in process

Finished goods

109,200

96,200

113,750

100,100

$ 68,250

Advertising expense

Depreciation expense-office equipment

Depreciation expense-factory equipment

22,750

14,560

Direct labor

186,550

Heat, light, and power-factory

5,850

Indirect labor

23,660

Materials purchased

123,500

Office salaries expense

77,350

Property taxes-factory

Property taxes-headquarters building

Rent expense-factory

4,095

13,650

6,825

Sales

864,500

Sales salaries expense

136,500

Supplies-factory

Miscellaneous costs-factory

3,250

4,420

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 3 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- A manufacturer reports the information below. Finished goods inventory, beginning Finished goods inventory, ending Depreciation on factory equipment Direct labor Indirect labor Factory utilities Selling expenses Direct materials used Indirect materials used Office rent expense Work in process inventory, beginning Work in process inventory, ending Complete this question by entering your answers in the tabs below. Required A Required B Compute cost of goods sold for the period. Goods available for sale Cost of goods sold $ 8,200 9,140 4,800 84,000 36,700 3,200 750 55,900 700 1,200 1,600 2,400 $ 0arrow_forwardCalculate necessary data where you have a ? in the tablearrow_forwardVaiarrow_forward

- bh.2arrow_forwardPlease help me with required 1 and 2.arrow_forwardThe following transactions pertain to Year 1, the first-year operations of Rooney Company. All inventory was started and completed during Year 1. Assume that all transactions are cash transactions. 1. Acquired $4,900 cash by issuing common stock. 2. Paid $660 for materials used to produce inventory. 3. Paid $1,900 to production workers. 4. Paid $1,078 rental fee for production equipment. 5. Paid $90 to administrative employees. 6. Paid $106 rental fee for administrative office equipment. 7. Produced 340 units of inventory of which 190 units were sold at a price of $13 each. Required Prepare an income statement and a balance sheet in accordance with GAAP.arrow_forward

- 5. Cost of goods sold A only appears on merchandising companies' income statements b. only appears on manufacturing companies' income statements. C. appears on both manufacturing and merchandising companies income statements. d. is caloulated exactly the same for merchandising and manufacturing companies.arrow_forwarda. Prepare a schedule of cost of goods manufactured. b. Prepare an income statement.arrow_forwardPlease do not give solution in image format thankuarrow_forward

- MusicMagic specializes in sound equipment. Company records indicate the following data for a line of speakers: (Click the icon to view the data.) Read the requirements. Co Requirement 1. Determine the amounts that MusicMagic should report for cost of goods sold and ending inventory two ways: a. FIFO and b. LIFO. (MusicMagic uses a perpetual inventory system.) Start by determining the amounts that MusicMagic should report for cost of goods sold and ending inventory under a. FIFO. FIFO method cost of goods sold = FIFO method ending inventory = Data table Date Mar 1 Mar 2 Mar 7 Mar 13 Item Balance Purchase Sale Sale Print Quantity 14 5 7 6 Unit Cost $ Done 41 48 Sale Price $ 109 102 Xarrow_forwardSLO-5.1. for a merchandising business is determined by subtracting the Cost of Goods Sold from the Sale Income account. OOperating Income ONet Income OGross Profit OMerchandise Available for Salearrow_forwardHellow tutor provide Answer with calculation and explanationarrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education