FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

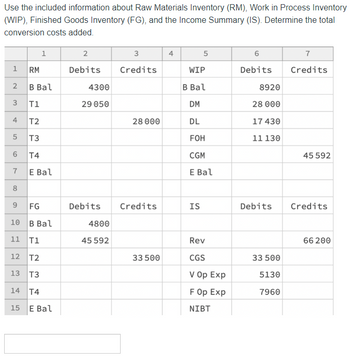

Transcribed Image Text:Use the included information about Raw Materials Inventory (RM), Work in Process Inventory

(WIP), Finished Goods Inventory (FG), and the Income Summary (IS). Determine the total

conversion costs added.

1

2

3

4

5

6

7

1

00

RM

B Bal

T1

T2

T3

T4

E Bal

8

9 FG

10 B Bal

11 T1

12 T2

13 T3

14 T4

15 E Bal

2

Debits

4300

29 050

Debits

4800

45 592

3

Credits

28 000

Credits

33 500

4

5

WIP

B Bal

DM

DL

FOH

CGM

E Bal

IS

Rev

CGS

V Op Exp

F Op Exp

NIBT

6

Debits

8920

28 000

17 430

11 130

Debits

33 500

5130

7960

7

Credits

45 592

Credits

66 200

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Trying to figure out how to calculate manufacturer compute cost of goods manufactured and cost of goodssoldarrow_forwardPrimare Corporation provided the following data for last month's manufacturing operations. Purchases of raw materials Indirect materials used in production Direct labor $ 30,000 $4,930 $ 60,000 $7,500 $ 4,130 Manufacturing overhead applied to work in process Underapplied overhead Rav materials Work in process Finished goods Beginning $ 11,900 $ 54,100 $34,900 Required: 1 Prepare a schedule of cost of goods manufactured. 2. Prepare a schedule of cost of goods sold. Assume the underapplied or overapplied overhead is closed to Cost of Goods Sold. Complete this question by entering your answers in the tabs below. Direct materials Required 1 Required 2 Prepare a schedule of cost of goods manufactured. Inding $19,500 $ 67,000 $ 43,200 Total raw materials available Pamare Corporation Schedule of Cost of Goods Manufactured Raw materials used in production Direct materials used in productionarrow_forwardIn the cost reconciliation report under the weighted-average method, the "Costs to be accounted for" section contains which of the following items? Question 27 options: Cost of ending work in process inventory Cost of units transferred out Cost of ending finished goods inventory Cost of beginning work in process inventory Previous PageNext Pagearrow_forward

- Equivalent Units of Production and Related Costs The charges to Work in Process-Assembly Department for a period, together with information concerning production, are as follows. All direct materials are placed in process at the beginning of production. Work in Process-Assembly Department Bal., 6,000 units, 25% completed Direct materials, 141,000 units @ $2.1 Direct labor 15,300 To Finished Goods, 138,000 units 296,100 194,700 75,765 ? Factory overhead Bal. 2 units, 65% completed Determine the following: a. The number of units in work in process inventory at the end of the period. units b. Equivalent units of production for direct materials and conversion. If an amount box does not require an entry, leave it blank. Work in Process-Assembly Department Equivalent Units of Production for Direct Materials and Conversion Costs Fquivalentarrow_forwardPlease do not give solution in image format thankuarrow_forwardquestion is in image. Required: Prepare a schedule of cost of goods manufactured. Prepare a schedule of cost of goods sold. Prepare an income statement. Build a spreadsheet: Construct an Excel spreadsheet to solve all of the preceding requirements. Show how both cost schedules and the income statement will change if the following data change: direct labor is $390,000 and utilities cost $35,000.arrow_forward

- Please do not give solution in image format thankuarrow_forwardUse the information to prepare a schedule of cost of goods manufactured and an income statement. Assume no indirect materials are used and all amounts are shown in millions.arrow_forwardWindsor Company reports the following costs and expenses in May. Factory utilities Depreciation on factory equipment Depreciation on delivery trucks Indirect factory labor Indirect materials Direct materials used Factory manager's salary From the information: (a) Manufacturing overhead $ LA $18,700 15,370 5,140 60,120 98,240 168,880 10,600 Office supplies used Determine the total amount of manufacturing overhead. Direct labor Sales salaries Property taxes on factory building Repairs to office equipment Factory repairs Advertising $84,680 56,020 3,050 1,670 2,440 18,300 3,160arrow_forward

- Determine the missing amount for each separate situation involving work in process cost flows. Total manufacturing costs Work in process inventory, beginning Work in process inventory, ending Cost of goods manufactured $ (1) 105,200 84,200 200,200 $ (2) 150,200 $ 22,200 $ 138,200 (3) 217,200 32,200 $ 237,200arrow_forwardPlease Answer 1-10arrow_forward1. Compute the amount of (a) production costs transferred from Cutting to Stitching, (b) production costs transferred from Stitching to finished goods, and (c) cost of goods sold. Hint: Compute the total production costs in each department and then subtract the ending inventory to get the amount transferred out of each department.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education