ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Question

thumb_up100%

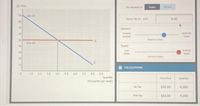

Transcribed Image Text:($) Price

Tax imposed on:

Supply

Demand

90

$90.00

Excise Tax (0- $20)

0,00

80

70

Demand

60

Perfectly

Relabively

Inelastic

Elastic

Relatively Elastic

50

$50.00

40

Supply

Less

Perfectly

30

Elastic

Elastic

Perfectly Elaste

20

10

CALCULATIONS

1.0

2.0

3.0

4.0

5.0

6.0

7.0

8.0

9.0

Quantity

(thousands per week)

Price Paid

Quantity

No Tax

$50.00

4,000

With Tax

$50.00

4,000

Transcribed Image Text:Instructions: Adjust the sliders so that the vertical intercept of the supply curve is $22.00 and the vertical intercept is $66.00 for the

demand curve. Assume there is initially no tax, and that a $12.50 tax is being proposed by policymakers.

Report all answvers to two decimal places

a) Calculate the total amount of surplus that consumers would lose if the tax was implemented. $[

b) Calculate the total amount of surplus that producers would lose if the tax was implemented. $

) How much of the total losses for consumers and producers are recovered as government tax revenue? $

d) is there any surplus lost by either consumers or producers that is not recovered as revenue? (Click to select)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 4 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Similar questions

- The demand for tomatoes is Q = 40-4P and the supply of tomatoes is Q = P +10. Answer the following questions. (a) Suppose that $1 per unit tax is levied on the consumers. Who bears the economic incidence of this tax? (b) Calculate the deadweight loss (c) Suppose that stores will pay $1 per unit tax directly. What will happen to the "sticker price" on tomatoes? How will the size of the consumer tax burden change? (d) Suppose that tax is increased to $2 per unit on the consumers. Calculate the deadweight loss. Compare the size of the deadweight loss with (b).arrow_forwardConsumer surplus is a measure of the difference between: a) The price which a consumer has to pay and the cost of producing the good (in a diagram, the area between the market price, and the supply curve). b) The consumer’s willingness to pay, and the cost of production (the area between the demand curve and the supply curve). c) The value which a consumer places on a unit of the good, and the market price (the area between the demand curve and the market price line). d) The marginal revenue from sales and the marginal cost of sales (the area between the marginal revenue and the marginal cost curves).arrow_forwardThe standard measure of consumer surplus is a fair measure of the value of a good to consumers because it gives an equal weight to each individual consumer.” Is this statement true, false, or uncertain?arrow_forward

- The tax authorities of Mabalingwe, an imaginary country, have decided to impose a 99% tax on alcohol sales to reduce domestic abuse cases in the country. The tax is payable to the government on purchase of the product. Describe who bears the cost of this tax and, secondly, explain what drives this outcome. Use bullet points.arrow_forwardA consumer is willing to pay $300 for cricket match. The cost of the ticket is $120. What is consumer surplus ?arrow_forwardThe supply curve for product X is given by QXS = -300 + 10PX .a. Find the inverse supply curve.P = ___ + ___ Qb. How much surplus do producers receive when Qx = 300? When Qx = 800?When QX = 300: $ ___When QX = 800: $ ___arrow_forward

- Consider a market where demand and supply satisfy the following equationsQd = 12 – 2 P,QS = 2P.a)Find the current equilibrium price and quantity. b)What is the total producer surplus if the market is in equilibrium? The government is considering a minimum price policy to increase producer surplus.c)Explain by means of graphs how the introduction of a price floor can increase producer surplus. d)Find the (optimal) price floor that maximizes producer surplus. hi, can you answer part c and part d for this question please, thanksarrow_forwardThe equilibrium price of a good is $13$13. Suppose the government introduces a tax on this good. In this case, the price paid by consumers is 1.51.5 times more than the equilibrium price, and the price received by producers is 1.31.3 times less than the equilibrium price. Calculate the amount of tax per good. Enter your answer in the box below and round to two decimal places if necessary.arrow_forwardThe supply curve for product X is given by QXS = −440 + 20PX .a. Find the inverse supply curve.P = ____+ ____Qb. How much surplus do producers receive when Qx = 420? When Qx = 980?When QX = 420: $ When QX = 980: $arrow_forward

- 3. Find the consumer's and producer's surplus: Supply: p=14.4+ .3g- .001q² Demand: p=160-2q+.005q²arrow_forwardYou are considering buying a monthly metro pass for the subway at $150 or paying $4 per ride. Your monthly demand curve is P = 60 - 2Q where Q is the number of rides per month. Given this information, your consumer surplus will be $750 buying each ride and $900 with the monthly pass. $600 buying each ride and $700 with the monthly pass. $784 buying each ride and $900 with the monthly pass. $784 buying each ride and $750 with the monthly pass.arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education