FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

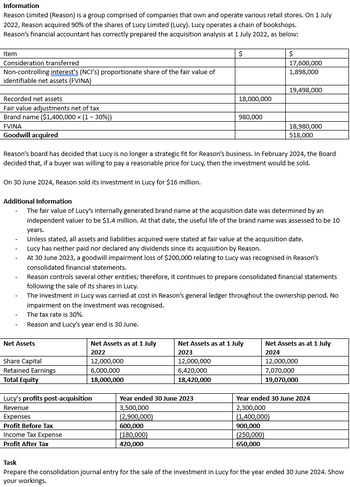

Transcribed Image Text:Information

Reason Limited (Reason) is a group comprised of companies that own and operate various retail stores. On 1 July

2022, Reason acquired 90% of the shares of Lucy Limited (Lucy). Lucy operates a chain of bookshops.

Reason's financial accountant has correctly prepared the acquisition analysis at 1 July 2022, as below:

Item

$

Consideration transferred

Non-controlling interest's (NCI's) proportionate share of the fair value of

identifiable net assets (FVINA)

Recorded net assets

Fair value adjustments net of tax

Brand name ($1,400,000 × (1 - 30%))

$

17,600,000

1,898,000

19,498,000

18,000,000

980,000

18,980,000

518,000

FVINA

Goodwill acquired

Reason's board has decided that Lucy is no longer a strategic fit for Reason's business. In February 2024, the Board

decided that, if a buyer was willing to pay a reasonable price for Lucy, then the investment would be sold.

On 30 June 2024, Reason sold its investment in Lucy for $16 million.

Additional Information

- The fair value of Lucy's internally generated brand name at the acquisition date was determined by an

independent valuer to be $1.4 million. At that date, the useful life of the brand name was assessed to be 10

years.

-

Unless stated, all assets and liabilities acquired were stated at fair value at the acquisition date.

Lucy has neither paid nor declared any dividends since its acquisition by Reason.

At 30 June 2023, a goodwill impairment loss of $200,000 relating to Lucy was recognised in Reason's

consolidated financial statements.

Reason controls several other entities; therefore, it continues to prepare consolidated financial statements

following the sale of its shares in Lucy.

The investment in Lucy was carried at cost in Reason's general ledger throughout the ownership period. No

impairment on the investment was recognised.

The tax rate is 30%.

Reason and Lucy's year end is 30 June.

Net Assets

Share Capital

Retained Earnings

Total Equity

Lucy's profits post-acquisition

Revenue

Expenses

Profit Before Tax

Income Tax Expense

Net Assets as at 1 July

2022

Net Assets as at 1 July

2023

Net Assets as at 1 July

2024

12,000,000

12,000,000

6,000,000

6,420,000

12,000,000

7,070,000

18,000,000

18,420,000

19,070,000

Year ended 30 June 2023

3,500,000

(2,900,000)

600,000

(180,000)

420,000

Year ended 30 June 2024

2,300,000

(1,400,000)

900,000

(250,000)

650,000

Profit After Tax

Task

Prepare the consolidation journal entry for the sale of the investment in Lucy for the year ended 30 June 2024. Show

your workings.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Please help mearrow_forwardDEF company acquired the assets and assumed liabilities of GHI Company on January 1, 2022 by paying P3,000,000 and issuing its own ordinary shares. The comparison of the acquirer’s balance sheet before and after business combination transaction is as follows: Balance sheet before Acquisition Balance Sheet after Acquisition Total Assets 13,545,000 17,595,000 Total Liabilities 3,760,000 ? Total SHE 9,785,000 ? The fair value of the identifiable net asset of the acquiree is P4,835,000 and the book value of acquiree’s liabilities amounting to P1,300,000 is lower compared to its fair value by P350,000. DEF company paid acquisition related costs amounting to P50,000. What is the fair market value of the ordinary shares issued by the acquirer? a. 2,500,000 b. 2,400,000 c. 2,480,000 d. 2,450,000arrow_forwardOn 1 July 2019, Christina Ltd acquired all the issued shares of Adeline Ltd, paying $120 000 cash and transferring 100 000 of its own shares to Adeline Ltd’s former shareholders. At that date, the financial statements of Adeline Ltd showed the following information. Share Capital $100000 General Reserve 50000 Retained Earnings 150000 All the assets and liabilities of Adeline Ltd were recorded at amounts equal to their fair values at the acquisition date. The fair value of Christina Ltd’s shares at acquisition date was $2 per share. Christina Ltd incurred $30 000 in acquisition‐related costs that included $5000 as share issue costs. Required Prepare the acquisition analysis at 1 July 2019. Prepare the journal entries for Christina Ltd to recognise the investment in Adeline Ltd at 1 July 2019. Prepare the consolidation worksheet entries for…arrow_forward

- On 1 July 2022, Dean Ltd acquired the remaining 80% of the issued shares of Lewis Ltd for shares in Dean Ltd with a fair value of $1 000 000. At that date, the financial statements of Lewis Ltd showed the following information. All the assets and liabilities of Lewis Ltd were recorded at amounts equal to their fair values at the acquisition date, except some equipment recorded at $50 000 below its fair value with a related accumulated depreciation of $80 000. Assume the equipment has not been revalued in the subsidiaries accounts. Also, Dean Ltd identified at acquisition date a contingent liability related to a lawsuit where Lewis Ltd was sued by a former supplier and attached a fair value of $40 000 to that liability. The previous held interest by Dean Ltd in Lewis Ltd (ie 20% of the issued shares) was recognised by in Dean Ltd.’s accounts at the fair value at acquisition date of $250 000. Dean Ltd incurred $15 000 in acquisition related costs including $10 000 in share issue costs.…arrow_forwardE Company Ltd, a reporting entity, purchases all the issued shares of D Company Pty Ltd for $2,100,000. The net assets of D Company Pty Ltd at the date of acquisition consist of land $2,500,000 and a liability of $400,000 with these values representing their respective fair values. E Company Ltd will record the acquisition in its separate accounting records as follows: O a. Dr. Investment in D Company Pty Ltd $2,100,000 Cr. Issued Capital $2,100,000 O b. None of these options is correct O. Dr. Investment in D Company Pty Ltd $2,100,000 Cr. Cash $2,100,000 O d. Dr. Land $2,500.000 Cr. Liability $400,000 Cr. Cash $2,100,000arrow_forwardMadari Ltd purchased 100% of the shares of Concerto Ltd on 1 July 2020 for $70,000. On the date of acquisition, the equity of the two entities was as follows: Madari Ltd($) Concerto Ltd ($) General Reserve 25,000 5,500 Retained Earnings 4,500 3,300 Share Capital 60,000 38,000 At 1 July 2020, all of the identifiable assets and liabilities of Concerto Ltd were recorded at fair value except for the following: Carrying Amount ($) Fair Value ($) Inventory 3,000 4,500 Plant and Equipment 60,000 65,000 The plant and equipment had a further 5-year useful life. Any valuation adjustments are made on…arrow_forward

- Madari Ltd purchased 100% of the shares of Concerto Ltd on 1 July 2020 for $70,000. On the date of acquisition, the equity of the two entities was as follows: Madari Ltd($) Concerto Ltd ($) General Reserve 25,000 5,500 Retained Earnings 4,500 3,300 Share Capital 60,000 38,000 At 1 July 2020, all of the identifiable assets and liabilities of Concerto Ltd were recorded at fair value except for the following: Carrying Amount ($) Fair Value ($) Inventory 3,000 4,500 Plant and Equipment 60,000 65,000 The plant and equipment had a further 5-year useful life. Any valuation adjustments are made on…arrow_forwardOn January 1, 2020, Albay Company acquired a 30% interest in Bataan Company for P2,430,000. On this date, Bataan Company’s shareholders’ equity was P5,000,000. At acquisition date, the carrying amount of Bataan Company’s identifiable net assets approximated their fair values, except for the following: Page 2of 2Excess of Fair Value Over Carrying ValueLandP2,000,000Inventory600,000 Machinery500,000All of the inventories that are undervalued onJanuary 1, 2020 was sold during the year. The machinery is being depreciated using the straight-line method and had a remaining useful life of 4 years onJanuary 1, 2020. For the year 2020, Bataan Company reported profit of P1,520,000 and paid its shareholders dividends of P650,000.Required: What is the carrying amount of the investment in associates onDecember 31, 2020?arrow_forward1.County Street Ltd acquired 60% of the shares of Trilogy Ltd in 2021 for R896 000 when Trilogy Ltd had retained earnings amounting to R392 000. At this date, all the identifiable assets and liabilities of Trilogy Ltd were fairly valued. 2.Non - controlling interest is measured at their share of net identifiable assets. 3.At the beginning of the current financial year, County Street Ltd became the sole supplier of inventory for Trilogy Ltd, selling inventory to Trilogy Ltd at a mark — up of 10% on cost. Trilogy Ltd held closing inventory of R89 600 at year end. 4.on 1 March 2023 Trilogy Ltd purchased a machine with a carrying amount of R400 000 from County Street Ltd for R700 000. It is the policy of the group to depreciate machinery using the straight - line method. The remaining useful life of the machinery was 4 years on 1 March 2023 5.SA normal tax rate is 27% . 6.Goodwill is not considered to be impaired at year end Prepare the pro-forma consolidation journal entries of the…arrow_forward

- Company X acquired 100% of the voting shares of Company Y for $137,500 on 1/1/2022. The fair value of the net assets of Company Y at the date of acquisition was $150,000. This is an example of a(n): Select one: O O FELIC a. revaluation adjustment b. bargain purchase c. extraordinary loss d. positive differential idarrow_forwardOn January 2, 2021, ABC Co. acquired 80% of XYZ Co. ordinary shares for P810,000. An amount of P37,500 of the excess is attributable to goodwill and the balance to a depreciable assets with an economic life of ten years. NCI is measured at fair value on the date of acquisition. On the date of acquisition, shareholder's equity accounts of the two entities were as follows: АВС Ordinary Shares - 1,312,500 Retained Earnings - 1,950,000 XYZ Ordinary Shares - 300,000 Retained Earnings - 525,000 On December 31, 2021, XYZ reported net income of 131,250 and paid dividends of P172,500. Goodwill have been impaired and should be reported at P7,500 on December 31, 2021. #6. What is the non-controlling interest in profit of XYZ on December 31, 2021? Select the correct response: 26,250.00 17,250.00 23,250.00 23,437.50arrow_forwardAccounting at acquisition date by the acquirer On 1 July 2019, Brad Ltd acquired all of the assets and liabilities of Pitt Ltd. In exchange for these assets and liabilities, Brad Ltd issued 100 000 shares that at date of issue had a fair value of $5.20 per share. Costs of issuing these shares amounted to $1000. Legal costs associated with the acquisition of Pitt Ltd amounted to $1200. The asset and liabilities of Pitt Ltd at 1 July 2019 were as follows: Carrying amount Fair value Assets Cash $2000 $2000 Accounts receivable 10000 10000 Inventories…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education