College Accounting, Chapters 1-27

23rd Edition

ISBN: 9781337794756

Author: HEINTZ, James A.

Publisher: Cengage Learning,

expand_more

expand_more

format_list_bulleted

Question

thumb_up100%

Use table Info & answer me

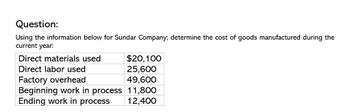

Transcribed Image Text:Question:

Using the information below for Sundar Company; determine the cost of goods manufactured during the

current year:

Direct materials used

$20,100

Direct labor used

25,600

Factory overhead

49,600

Beginning work in process 11,800

Ending work in process

12,400

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- SCHEDULE OF COST OF GOODS MANUFACTURED The following information is supplied for Sanchez Welding and Manufacturing Company. Prepare a schedule of cost of goods manufactured for the year ended December 31, 20--. Assume that all materials inventory items are direct materials. Work in process, January 1 20,500 Materials inventory, January 1 11,000 Materials purchases 12,000 Materials inventory, December 31 13,000 Direct labor 9,500 Overhead 5,500 Work in process, December 31 10,500arrow_forwardDuring the year, a company purchased raw materials of $77,321, and incurred direct labor costs of $125,900. Overhead is applied at the rate of 75% of the direct labor cost. These are the inventory balances: Compute the cost of materials used in production, the cost of goods manufactured, and the cost of goods sold.arrow_forwardCushing, Inc., costs products using a normal costing system. The following data are available for last year: Overhead is applied on the basis of direct labor hours. What was last years per unit product cost? a. 1.39 b. 4.40 c. 4.43 d. 3.01arrow_forward

- Selected information from Hernandez Corporation shows the following: Prepare journal entries to record the following: raw material purchased direct labor incurred depreciation expense (hint: this is part of manufacturing overhead) raw materials used overhead applied on the basis of $0.50 per machine hour the transfer from department 1 to department 2arrow_forwardSelected information from Skylar Studios shows the following: Prepare journal entries to record the following: raw material purchased direct labor incurred depreciation expense (hint: this is part of manufacturing overhead) raw materials used overhead applied on the basis of $0.50 per machine hour the transfer from department 1 to department 2arrow_forwardThe following product costs are available for Kellee Company on the production of eyeglass frames: direct materials, $32,125; direct labor, $23.50; manufacturing overhead, applied at 225% of direct labor cost; selling expenses, $22,225; and administrative expenses, $31,125. The direct labor hours worked for the month are 3,200 hours. A. What are the prime costs? B. What are the conversion costs? C. What is the total product cost? D. What is the total period cost? E. If 6.425 equivalent units are produced, what is the equivalent material cost per unit? F. What is the equivalent conversion cost per unit?arrow_forward

- Ripley, Inc., costs products using a normal costing system. The following data are available for last year: Overhead is applied on the basis of direct labor hours. Required: 1. What was the predetermined overhead rate? 2. What was the applied overhead for last year? 3. Was overhead over- or underapplied, and by how much? 4. What was the total cost per unit produced (carry your answer to four significant digits)?arrow_forwardThe records of Burris Inc. reflect the following data: Work in process, beginning of month2,000 units one-half completed at a cost of 1,250 for materials, 675 for labor, and 950 for overhead. Production costs for the monthmaterials, 99,150; labor, 54,925; factory overhead, 75,050. Units completed and transferred to stock38,500. Work in process, end of month3,000 units, one-half completed. Compute the months unit cost for each element of manufacturing cost and the total per unit cost.arrow_forwardCost of Direct Materials, Cost of Goods Manufactured, Cost of Goods Sold Bisby Company manufactures fishing rods. At the beginning of July, the following information was supplied by its accountant: During July, the direct labor cost was 43,500, raw materials purchases were 64,000, and the total overhead cost was 108,750. The inventories at the end of July were: Required: 1. What is the cost of the direct materials used in production during July? 2. What is the cost of goods manufactured for July? 3. What is the cost of goods sold for July?arrow_forward

- Cost Classification Loring Company incurred the following costs last year: Required: 1. Classify each of the costs using the following table format. Be sure to total the amounts in each column. Example: Direct materials, 216,000. 2. What was the total product cost for last year? 3. What was the total period cost for last year? 4. If 30,000 units were produced last year, what was the unit product cost?arrow_forwardA company calculated the predetermined overhead based on an estimated overhead of $70.000, and the activity for the cost driver was estimated as 2,500 hours. If product A utilized 1,350 hours and product 8 utilized 1,100 hours, what was the total amount of overhead assigned to the products? A. $35000 B. $30.800 C. $37,800 D. $68,600arrow_forwardDuring the year, a company purchased raw materials of $77,321 and incurred direct labor costs of $125,900. Overhead Is applied at the rate of 75% of the direct labor cost. These are the inventory balances: Compute the cost of materials used in production, the cost of goods manufactured, and the cost of goods sold.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,Principles of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,Principles of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

College Accounting, Chapters 1-27

Accounting

ISBN:9781337794756

Author:HEINTZ, James A.

Publisher:Cengage Learning,

Principles of Accounting Volume 2

Accounting

ISBN:9781947172609

Author:OpenStax

Publisher:OpenStax College

Cornerstones of Cost Management (Cornerstones Ser...

Accounting

ISBN:9781305970663

Author:Don R. Hansen, Maryanne M. Mowen

Publisher:Cengage Learning

Principles of Cost Accounting

Accounting

ISBN:9781305087408

Author:Edward J. Vanderbeck, Maria R. Mitchell

Publisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...

Accounting

ISBN:9781337115773

Author:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:Cengage Learning

Managerial Accounting

Accounting

ISBN:9781337912020

Author:Carl Warren, Ph.d. Cma William B. Tayler

Publisher:South-Western College Pub