FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

What is the adjustment balance of cash in bank of Mickey Mouse Corporation in November 2020?

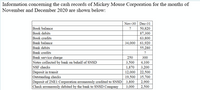

Transcribed Image Text:Information concerning the cash records of Mickey Mouse Corporation for the months of

November and December 2020 are shown below:

Nov-30 Dec-31

Book balance

Book debits

Book credits

Bank balance

Bank debits

Bank credits

Bank service charge

Notes collected by bank on behalf of SNSD

NSF checks

Deposit in transit

Outstanding checks

Deposit of 2NE1 Corporation erroneously credited to SNSD 3,800

|Check erroneously debited by the bank to SNSD Company

?

50,820

87,300

63,800

34,000 61,920

55,280

?

250

300

4,100

3,200

12,000 22,500

19,500 35,700

2,900

2,500

3,500

1,870

3,000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Novak Enterprises owns the following assets at December 31, 2025. Cash in bank-savings account $67,800 Cash on hand Cash refund due from IRS 8,710 Cash to be reported $ 33,800 What amount should be reported as cash? Checking account balance Postdated checks Certificates of deposit (180-day) $22,500 850 94,980arrow_forwardCurrent Attempt in Progress At August 31, 2025, Sage Hill Nail Bar has this bank information: cash balance per bank $10,790; outstanding checks $840; deposits in transit $1,800; and a bank service charge $30. Determine the adjusted cash balance per bank at August 31, 2025. Adjusted cash balance per bank Touthook and Modla $arrow_forwardCan you add the information to the table below. Accounts Receivable Beginning balance Ending Balance 0 What is the net increase or decrease in the Cash account for year 2021?arrow_forward

- please answerarrow_forwardThe following information is produced by comparing the cash deposits and withdrawals recorded by the M&N Windows Ltd for the month with their most recent bank statement received at 30 June 2019:a. M&N Windows Ltd’ cash at bank ledger at 30 June 2019 is: $75,864b. Credit balance as per bank statement as at 30 June 2019 is: $101,160c. Bank statement shows an electronic transfer from a customer of $3,864d. Deposits in transit, $12,540e. Interest earned on bank account, $75f. Unpresented cheques, $37,407g. Service charge included in bank statement, $150h. Cheque for insurance expense, $5,370 incorrectly recorded in books as $5,910i. A dishonoured cheque written by a client Jim Smith, $3,900The entity doesn’t use special journals for record keeping. The entity prepares bank reconciliation statement at the end of each month.Required:a) Prepare a bank reconciliation statement for M&N Windows Ltd at 30 June 2019. b) Discuss why a bank reconciliation is still necessary even most of…arrow_forwardHow much is the correct cash balance on December 31, 2020? * Mr. Matee Nik, the accountant of Tikoy Inc. prepared the following bank reconciliation for November 2020: Balance per ledger Bank service charges P2,372,000 (2,000) Adjusted balance P2,370,000 Balance per bank statement P2,100,000 Deposit in transit 300,000 Outstanding checks Adjusted balance (30,000) P2,370,000 Information gathered for December 2020 are as follows: Bank Book Checks recorded 2,300,000 2,360,000 Deposits recorded Collection by bank (P400,000 note plus interest) NSF check returned with Dec. 31 1,620,000 1,800,000 420,000 bank statement 10,000 Service charge 2,000 Balances 1,828,000 1,810,000arrow_forward

- May you please help me determine the true cash balance for February 28, 2020?arrow_forwardWhat amount should be reported as cash on december 31, 2022 Huston’s company had a checkbook balance on December 31, 2022, of P820,000 and held back the following terms: I. Check payable to Huston dated January 4, 2023, included in the December 31 checkbook balance, P90,000.II. Check payable to Huston dated December 28, 2022, and included in the December 31 balance, it was returned by the bank on December on December 30 marked NSF. The check was redeposited on January 3, 2023 and is cleared January 5, 2023, P80,000. III. Check payable to Regina Mills, a supplier, dated January 3, 2023, was delivered on December 29, 2022, P65,000. This was excluded in the December 31 balance.arrow_forwardRequired information [The following information applies to the questions displayed below.] The cash records and bank statement for the month of July for Glover Incorporated are shown below. GLOVER INCORPORATED Cash Account Records July 1, 2021, to July 31, 2021 Cash Balance Cash Balance July 1, 2021 + Cash Receipts − Cash Disbursements = July 31, 2021 $7,390 $8,630 $10,140 $5,880 Cash Receipts Cash Disbursements Date Desc. Amount Date Check# Desc. Amount 7/9 Sales $ 2,630 7/7 531 Rent $ 1,570 7/21 Sales 3,210 7/12 532 Salaries 2,030 7/31 Sales 2,790 7/19 533 Equipment 4,200 7/22 534 Utilities 970 7/30 535 Advertising 1,370 $ 8,630 $ 10,140 P.O. Box 123878 FIDELITY UNION Member FDIC Gotebo,…arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education