FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

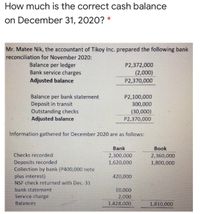

Transcribed Image Text:How much is the correct cash balance

on December 31, 2020? *

Mr. Matee Nik, the accountant of Tikoy Inc. prepared the following bank

reconciliation for November 2020:

Balance per ledger

Bank service charges

P2,372,000

(2,000)

Adjusted balance

P2,370,000

Balance per bank statement

P2,100,000

Deposit in transit

300,000

Outstanding checks

Adjusted balance

(30,000)

P2,370,000

Information gathered for December 2020 are as follows:

Bank

Book

Checks recorded

2,300,000

2,360,000

Deposits recorded

Collection by bank (P400,000 note

plus interest)

NSF check returned with Dec. 31

1,620,000

1,800,000

420,000

bank statement

10,000

Service charge

2,000

Balances

1,828,000

1,810,000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Epto Ergo's bank statement from Crypto Bank at July 31, 2020, gives the following information. $18,400 Balance, July 1 August deposits Checks cleared in July Bank debit memorandum: $ Safety deposit box fee Service charge Balance, July 31 71,000 25 68,678 50 Bank credit memorandum: 20,692 Interest earned 45 A summary of the Cash account in the ledger for July shows the following: balance, July 1, $18,700; receipts $74,000; disbursements $73,570; and balance, July 31, $19,130. Analysis reveals that the only reconciling items on the June 30 bank reconciliation were a deposit in transit for $4,800 and outstanding checks of $4,500. In addition, you determine that there was an error involving a company check drawn in July: A check for $400 to a creditor on account that cleared the bank in July was journalized and posted for $4. Instructions a) Determine deposits in transit. b) Determine outstanding checks. (Hint: You need to correct disbursements for the check error.) c) Prepare a bank…arrow_forwardThe cash account of Sheffield Co. showed a ledger balance of $7,088.13 on June 30, 2020. The bank statement as of that date showed a balance of $7,470. Upon comparing the statement with the cash records, the following facts were determined. 1. 2. 3. 4. 5. 6. 7. (a) There were bank service charges for June of $45. A bank memo stated that Bao Dai's note for $2,160 and interest of $64.80 had been collected on June 29, and the bank had made a charge of $9.90 on the collection. (No entry had been made on Sheffield's books when Bao Dai's note was sent to the bank for collection.) Receipts for June 30 for $6,102 were not deposited until July 2. Checks outstanding on June 30 totaled $3,844.89. The bank had charged the Sheffield Co.'s account for a customer's uncollectible check amounting to $455.76 on June 29. A customer's check for $162 (as payment on the customer's Accounts Receivable) had been entered as $108 in the cash receipts journal by Sheffield on June 15. Check no. 742 in the amount…arrow_forwardASSESSMENT Prepare a bank reconciliation statement for Juan Company for the month of April 2020, using the following information: • The bank statement for Juan Company shows a balance per bank of P15,907.45 on April 30,2020. On this date the balance of cash per books is P11,589.45 • Additional information are provided below: o Deposits in transit: April 30 deposits (received by the bank on May 1) P2,201.40 o Outstanding checks: No.453 – P3,000.00 No.457 - P1,401.30 No.460 – P1,502.70 Errors: Juan wrote check no.443 for P1,226.00 and the bank correctly paid the amount. However, he recorded the check as P1,262.00. Bank me da: Debit - NSF check from Pedro P425.60 Debit - Charge for printing company checks P30.00 Credit – Collection of notes receivable for P1,000.00 plus interest earned of P50.00, less bank collection fee of P15.00arrow_forward

- 16. What is the adjusted cash balance on November 30, 2020?17. What is the adjusted cash balance on December 31, 2020?arrow_forwardWhat is the adjusted CASH IN BANK on December 31, 2020? Love Company reported the following data in relation to cash on Dec. 31, 2020: * Checkbook balance, P4,000,000 * Undeposited collections, P400,000 * A customer check amounting to P200,000 dated January 2, 2021 was included in the December 31, 2020 checkbook balance. * Another customer check for P500,000 included in the checkbook balance but returned by the bank for insufficiency of posited on December 22, 2020 was fund. This check was redeposited on December 26, 2020 and cleared two days later. * A P400,000 check payable to supplier dated and recorded on December 30, 2020 was mailed on January 16, 2021. * A petty cash fund of P50,000 comprised the following on December 31 2020: 5,000 5,000 40,000 50,000 * A check of P40,000 was drawn on December 31, 2020 payable to the petty cash Coins and currencies Refundable deposit for returnable containers Petty cash vouchers Totalarrow_forwardIn connection with your examination, the Caliao Company presented to you the following information regarding its Cash in Bank account for the month of December 2020: A. Balances per bank statements: November 30, P215,600 and December, P230,400. B. Balances of cash in bank account in company's books: November 30, P165,450 and December 31, P226,800. C. Total receipts per book were P2,221,900 of which P12,100 was paid in cash to a creditor on December 24. D. Total charges in the bank statement during December were P2,189,700. E. Undeposited receipts were: November 30, P90 600 and December 31, P101,200. F. Outstanding checks were: November 30, P26,750 and December 31, P19,300, of which a check for P5,000 was certified by the bank on December 26. G. NSF checks returned, recorded as reduction of cash receipts were: Returned by bank on December and recorded also in December P10,400. Returned by bank on December but recorded also in January P8,600. H. Collections by bank not recorded by…arrow_forward

- In connection with your examination, the Caliao Company presented to you the following information regarding its Cash in Bank account for the month of December 2020: A. Balances per bank statements: November 30, P215,600 and December, P230,400. B. Balances of cash in bank account in company’s books: November 30, P165,450 and December 31, P226,800. C. Total receipts per book were P2,221,900 of which P12,100 was paid in cash to a creditor on December 24. D. Total charges in the bank statement during December were P2,189,700. E. Undeposited receipts were: November 30, P90 600 and December 31, P101,200. F. Outstanding checks were: November 30, P26,750 and December 31, P19,300, of which a check for P5,000 was certified by the bank on December 26. G. NSF checks returned, recorded as reduction of cash receipts were: Returned by bank on December and recorded also in December P10,400. Returned by bank on December but recorded also in January P8,600. H. Collections by bank not recorded by…arrow_forwardWhat is the bank statement balance at June 30, 2023?a. P70,564.40b. P78,314.60c. P83,109.60d.. P87,904.60arrow_forwardGeneral Accountingarrow_forward

- The bank columns in the cash book for month of June 2020 and Maybank's bank statement for that month for James Enterprise are as follows: Cash Book Date Particulars Amount Date Particulars Amount (RM) (RM) 2020 2020 1,410 | June 5 62 June 12 75 June 16 224 June 29 582 June 30 June 1 Balance b/d L Holmes 180 J May June 16 T wWilson J Rebus T Silver June 7 519 41 June 28 F Slack Blister Disco 22 June 30 G Baker Balance c/d 1,591 2.353 2.353 Maybank Bank Statement as at 30 June 2020 Date Particulars Withdrawals Deposits Balance (RM) (RM) (RM) June 1 Balance b/d 1,410 Cheque F Lane June 7 62 1,472 June 8 180 1,292 Cheque J Rebus T Silver June 16 75 1,367 June 17 519 848 June 18 41 807 Cheque SLM Standing Order June 30 Flynn: Trader's Credit Bank Charges June 28 224 1,031 June 29 52 979 64 1,043 June 30 43 1,000 | You are required to: (a) Draw up a Bank Reconciliation Statement as at 30 June 2020.arrow_forwardWhat is the cash balance per books at November 30, 2021?arrow_forwardEpto Ergo’s bank statement from Crypto Bank at July 31, 2020, gives thefollowing information.Balance, July 1 $18,400 Bank debit memorandum:August deposits 71,000 Safety deposit box fee $ 25Checks cleared in July 68,678 Service charge 50Bank credit memorandum: Balance, July 31 20,692Interest earned 45A summary of the Cash account in the ledger for July shows the following:balance, July 1, $18,700; receipts $74,000; disbursements $73,570;and balance, July 31, $19,130.Analysis reveals that the only reconciling items on the June 30 bank reconciliation were adeposit in transit for $4,800 and outstanding checks of $4,500. In addition, you determine thatthere was an error involving a company check drawn in July: A check for $400 to a creditor onaccount that cleared the bank in July was journalized and posted for $40.Instructionsa) Determine deposits in transit.b) Determine outstanding checks. (Hint: You need to correct disbursements for thecheck error.)c) Prepare a bank reconciliation at July…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education