FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

a.Prepare the updated

b.Prepare the

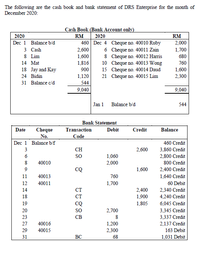

Transcribed Image Text:The following are the cash book and bank statement of DRS Enterprise for the month of

December 2020:

Cash Book (Bank Account only)

RM

2020

2020

RM

460 Dec 4 Cheque no. 40010 Ruby

6 Cheque no. 40011 Zain

8 Cheque no. 40012 Harris

10 Cheque no. 40013 Wong

15 Cheque no. 40014 Daud

21 Cheque no. 40015 Lim

Dec 1 Balance b/d

2,000

3 Cash

8 Lim

2,600

1,600

1,700

680

14 Mat

1,816

760

18 Jay and Kay

900

1,600

2,300

24 Bidin

1,120

31 Balance c/d

544

9,040

9,040

Jan 1 Balance b/d

544

Bank Statement

Debit

Date

Transaction

Cheque

No.

Credit

Balance

Code

Dec 1 Balance b/f

460 Credit

3

CH

2,600

3,860 Credit

6

so

1,060

2,000

2,800 Credit

8

40010

800 Credit

9

CQ

1,600

2,400 Credit

11

40013

760

1,640 Credit

12

40011

1,700

60 Debit

14

CT

2,400

2,340 Credit

4,240 Credit

18

CT

1,900

CQ

so

19

1,805

6,045 Credit

20

2,700

3,345 Credit

3,337 Credit

2,137 Credit

23

CB

8

27

40016

1,200

2,300

29

40015

163 Debit

31

BC

68

1,031 Debit

Transcribed Image Text:Transaction Codes

СВ Сhequebook

BC Bank Charge

CH

Cash

SO

Standing Order

CQ Cheque

CT

Credit Transfer

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Match each description to the appropriate term. Clear All Measures how frequently during the year accounts Net realizable value receivable are being turned into cash Amounts owed by customers Receivables documented by a formal written instrument of credit All money claims against Notes receivable other entities The difference between Accounts receivable accounts receivable and turnover allowance for doubtful accountsarrow_forwardThe following information was available to reconcile A.C. Forrest Company's book cash balance with its bank statement as of June 30, 2020: The June 30 cash balance according to the accounting records was $14,630. Oustanding checks from May's bank reconciliation: Check # 229 $770 Check # 230 540 Below is a record of the cash receipts and cash payments for June: Cash Deposits Cash Payments Date Amount Check# Amount Jun 2 $3,600 231 $1,500 Jun 5 4,210 232 7,510 Jun 11 5,230 233 1,800 Jun 17 4,500 234 3,230 Jun 23 3,350 235 1,100 Jun 27 5,100 236 1,250 Jun 30 5,390 237 6,270 238 1,650 239 820 240 1,430 241 740 242 1,310 243 2,190 244 5,300 Continued…arrow_forwardWhich of the following is not one fo the examples of cash equivalent? a. a bank certificate of deposit maturing within 60 days of the reporting date. b. a newly issued corporate bond. c. a US Treasury Bill d. commerial paperarrow_forward

- Bank Reconciliation and Adjusting Entries (Appendix 6.1) Instructions Chart of Accounts Labels and Amount Descriptions Bank Reconciliation General Journal X Instructions Odum Corporation’s cash account showed a balance of $17,200 on March 31, 2019. The bank statement balance for the same date indicated a balance of $17,916.55. The following additional information is available concerning Odum’s cash balance on March 31: • Undeposited cash on hand on March 31 amounted to $724.50. • A customer’s NSF check for $180.80 was returned with the bank statement. • A note for $2,000 plus interest of $25 was collected for Odum by the bank during March. The bank notified Odum of this collection on the bank statement. • The bank service charge for March was $15. • A deposit of $950.75 mailed to the bank on March 31 did not appear on the bank statement. The following checks mailed to creditors had not been processed by the bank on March…arrow_forwardIndicate with Yes or No whether each of items should be included in the cash balance presented on the balance sheet. If yes is selected for the Included in Cash Balance column for NSF checks, Savings account,Compensating balance,post dated checks,IOU,cash on hand,cash in sinking fund, travel advance, bank draft and prepaid debit card. Include the Classification items excluded?arrow_forwardWhen a company records a bank deposit, it will: O A. credit the Cash account on the company's books. O B. debit the Accounts Receivable account on the company's books. OC. debit the Cash account on the company's books. O D. credit the Accounts Payable account on the company's books.arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education