Quickbooks Online Accounting

3rd Edition

ISBN: 9780357391693

Author: Owen

Publisher: Cengage

expand_more

expand_more

format_list_bulleted

Question

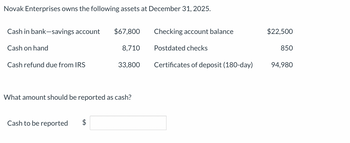

Transcribed Image Text:Novak Enterprises owns the following assets at December 31, 2025.

Cash in bank-savings account $67,800

Cash on hand

Cash refund due from IRS

8,710

Cash to be reported $

33,800

What amount should be reported as cash?

Checking account balance

Postdated checks

Certificates of deposit (180-day)

$22,500

850

94,980

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Cash Receipts from Customers Singleton Inc. had accounts receivable of $22,150 at January 1, 2019, and $26,850 at December 31, 2019. Net income for 2019 was $125,300 and sales revenue was $1,240,000. Required: Compute the amount of cash collected from customers using the direct method.arrow_forwardComprehensive Receivables Problem Blackmon Corporations December 31, 2018, balance sheet disclosed the following information relating to its receivables: The company has a recourse liability of 700 related to a note receivable sold to a bank. During 2019, credit sales (terms, n/EOM) totaled 2,200,000, and collections on accounts receivable (unassigned) amounted to 1,900,000. Uncollectible accounts totaling 18,000 from several customers were written off, and a 1,350 accounts receivable previously written off was collected. Additionally, the following transactions relating to Blackmons receivables occurred during the year: On December 31, 2019, an aging of the accounts receivable balance indicated the following: Required: 1. Prepare the journal entries to record the preceding receivable transactions during 2019 and the necessary adjusting entry on December 31, 2019. Assume a 360-day year for interest calculations and round calculations to the nearest dollar. 2. Prepare the receivables portion of Blackmons December 31, 2019, balance sheet. 3. Next Level Compute Blackmons accounts receivable turnover in days, assuming a 360-day business year. What is your evaluation of its collection policies? 4. If Blackmon uses IFRS, what might be the heading of the section for the receivables reported in Requirement 2?arrow_forwardSage Enterprises owns the following assets at December 31, 2020. Cash in bank-savings account 69,300 Checking account balance 18,600 Cash on hand 8,820 Postdated checks 860 Cash refund due from IRS 41,200 Certificates of deposit (180-day) 90,960 What amount should be reported as cash? Cash to be reported $4arrow_forward

- Kraft Enterprises owns the following assets at December 31, 2020. Cash in bank—savings account 68,000 Checking account balance 17,000 Cash on hand 9,300 Postdated checks 750 Cash refund due from IRS 31,400 Certificates of deposit (180-day) 90,000 What amount should be reported as cash?arrow_forwardOn December 31, 2022, the cash account of AA Company shows the following composition: Petty cash fund, P180,000; Cash in bank (payroll fund). P2,000,000, Interest and dividend fund, P250,000; Tax fund, P120,000; Cash in bank (current account). P3,000,000; Certificate of deposit (terms 90 days), P1,000,000; Certificate of deposit (terms 180 days). P1.500,000; Cash in foreign bank-restricted, P500.000; Money market fund, (60 days), P500,000; Money market funds (6 months), P900,000; Customer's check dated February 15, 2021, P60,000: Customer's check dated December 30, 2020 returned for lack of funds, P40,000: A 30-day BSP treasury bill, P1,000,000; A 3-year BSP treasury bill acquired three months prior to maturity, P1 200,000; Sinking fund cash, P800,000,Contingent fund, P900,000 Fund for the acquisition of fixed asset, P500,000, Travelers checks, P60,000, and Cashiers' checks, What is the correct cash and cash equivalents balance to be reported by AA Company on P100,000. December…arrow_forwardThanks in advancearrow_forward

- What is the bank statement balance at June 30, 2023?a. P70,564.40b. P78,314.60c. P83,109.60d.. P87,904.60arrow_forwardOn December 31, 2021, the cash account of Roel Company showed the following details: wwww Undeposited collections Cash in bank- PCIB checking account 60,000 500,000 Cash in bank- PNB overdraft (50.000) Undeposited NSF check received from customer dated December 1, 2021 Undeposited check from a customer dated January 15, 2022 Cash in bank- PCIB (fund for payroll) Cash in bank- PCIB savings deposit Cash in bank- PCIB money market instrument, 90 days Cash in foreign bank (restricted) IOUS from officers Sinking fund cash Listed shares held as trading investment 15,000 25,000 150,000 100,000 2,000,000 100,000 30,000 450,000 120,000 What amount should be reported as cash and cash equivalents on December 31, 2021?arrow_forwardGood morningarrow_forward

- An entity provided the following data on December 31, 2020: Checkbook balance P5,000,000 Bank statement balance 4,000,000 Check drawn on entity’s account, payable to supplier, dated and recorded on December 31, 2020 but not mailed until January 31, 2021 1,000,000 Cash in sinking fund 1,500,000 Treasury bills, purchased November 1, 2020 and maturing January 31, 2021 2,500,000 Time deposit, purchased October 1, 2020 and maturing January 31, 2021 2,000,000 What amount should be reported as cash and cash equivalents on December 31, 2020?arrow_forwardPlease answer asaparrow_forwardBE6.1 (LO 1) Kraft Enterprises owns the following assets at December 31, 2025. Cash in bank savings account $68,000 Cash on hand 9,300 Cash refund due from IRS 31,400 Certificates of deposit (180-day) What amount should be reported as cash? Checking account balance Postdated checks $17,000 750 90,000arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning, Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Cengage Learning

College Accounting, Chapters 1-27

Accounting

ISBN:9781337794756

Author:HEINTZ, James A.

Publisher:Cengage Learning,

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:Cengage Learning