Century 21 Accounting Multicolumn Journal

11th Edition

ISBN: 9781337679503

Author: Gilbertson

Publisher: Cengage

expand_more

expand_more

format_list_bulleted

Question

Give true answer this accounting question

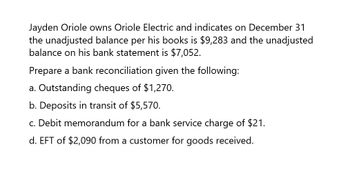

Transcribed Image Text:Jayden Oriole owns Oriole Electric and indicates on December 31

the unadjusted balance per his books is $9,283 and the unadjusted

balance on his bank statement is $7,052.

Prepare a bank reconciliation given the following:

a. Outstanding cheques of $1,270.

b. Deposits

transit of $5,570.

c. Debit memorandum for a bank service charge of $21.

d. EFT of $2,090 from a customer for goods received.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Using the following information, prepare a bank reconciliation. Bank balance: $4,587 Book balance: $5,577 Deposits in transit: $1,546 Outstanding checks: $956 Interest income: $56 NSF check: $456arrow_forwardThe bank reconciliation shows the following adjustments: Deposits in transit: $852 Notes receivable collected by bank: $1,000; interest: $20 Outstanding checks: $569 Error by bank: $300 Bank charges: $30 Prepare the correcting journal entry.arrow_forwardJayden Carla Vista owns Carla Vista Electric and indicates on December 31 the unadjusted balance per his books is $7,882 and the unadjusted balance on his bank statement is $5,988. Prepare a bank reconciliation given the following: (a) Outstanding cheques of $1,080 (b) Deposits in transit of $4.730 (c) Debit memorandum for bank service charge of $14 (d) EFT of $1,770 from a customer for goods received. (List items that increase balance as per bank & books first.) Carla Vista Electric Bank Reconciliationarrow_forward

- Provide this question general accounting solutionsarrow_forwardThe bank statement for Betty Company indicates a balance of $20,000 on September 30, 2021. After thejournals for September had been posted, the cash account in the depositor's books had a balance of $19,800.The following reconciling items are available to prepare a bank reconciliation for Betty Company.(1)Bank debit memorandum for service charges, $60.() Bank credit memorandum for interest earned, $374.(in) Bank debit memorandum for $170 NSF (not sufficient funds) check from a customer.(iv) Cash sales of $450 had been erroneously recorded in the cash account as $324.(v)A check paid for $980 was erroneously recorded by the bank in the bank statement as $1,530.(vi) Checks outstanding, $1,180.(vi) Deposits in transit not recorded by bank, $700.Required:Prepare the bank reconciliation for Betty Company as of September 30, 2021arrow_forwardThe bank statement balance is $3,500 and shows a service charge of $24 , interest earned of $3, and an NSF cheque for $100. Deposits in transit total $1,400; outstanding cheques are $450. The bookkeeper mistakenly recorded as $158 a cheque of $132 in payment of an account payable. Prepare Bank Reconciliation Statement Prepare Adjusting Entries.arrow_forward

- On December 31st, the cheque book balance of Bob's Burgers Ltd. was $1,301.31. The bank statement balance was $1,670.26. Cheques outstanding were $3,152.88. The statement revealed a deposit in transit of $2,815.35 as well as a bank service charge of $112.88. The company earned interest income of $44.30. Complete a bank reconciliation for Bob's Burgers Ltd. $1,332.73 $1,968.23 $1.514.04 $1,345.61 $1,414.19 $1,896.66 $1.269.89 $2.454.19arrow_forwardThe bank statement balance is $3,500 and shows a service charge of $24 , interest earned of $3, and an NSF cheque for $100. Deposits in transit total $1,400; outstanding cheques are $450. The bookkeeper mistakenly recorded as $158 a cheque of $132 in payment of an account payable. 1. Prepare Bank Reconciliation 2. Prepare the adjusting entryarrow_forwardThe accountant of ABC Company is preparing a bank reconciliation statement for the month of October. The bank statement shows a balance of $9,719 while the ledger balance is $7,261. He compiles the following information: Description Check #3119 recorded at $1,830 Amount $1,380 a b NSF checks $500 EFT for insurance deducted $336 d EFT for rent collected $775 Service charge deducted Outstanding checks Deposit in transit Notes collected by bank e $15 f $4,036| g $3,402 h $1,450 Compute the adjusted bank balance for the month of October. а. $10,520 b. $9,070 с. $9,085 d. $8,749arrow_forward

- Complete a Bank Reconciliation for the following: On March 31st the checkbook balance of Dust Bunnies Cleaning Co. was $2,568. The bank statement was $3,254.50. Checks outstanding were $2,788. The statement revealed a deposit in transit of $2,125 as well as a bank service charge of $11.50. The company earned interest income of $35.00. Complete a bank reconciliation for Dust Bunnies Cleaning Co.arrow_forwardThe following data represents information necessary to assist in preparing the July 31, 2019 bank reconciliation for Domore Company. On July 31, the bank balance was $5,353. The bank statement indicated a deduction of $20 for all bank service charges. A customer deposited $1,210 directly into the bank account to settle an outstanding accounts receivable bill. Cheque #566 for $800 and cheque #573 for $560 have been recorded in the company ledger but did not appear on the bank statement. A customer paid an amount of $4,570 to Domore Company on July 31 but the deposit did not appear on the bank statement. The accounting clerk made an error and recorded a $150 cheque as $1,500. The cheque was written to pay an outstanding accounts payable account. Cheque #8603 for $170 was deducted from Domore Company's account by the bank. This cheque was not written by Domore Company and needs to be reversed by the bank. The bank included an NSF cheque in the amount of $490 relating to a…arrow_forward5) The following data have been gathered for Rocky Candi Corporation for the month ended September 30, 2020. Prepare a bank reconciliation based on the following information: · The bank statement reveals a balance of $8,936. · The September 30, 2020, book balance was $3,200. · There was an EFT deposit of $1,800 on the bank statement for the monthly rent from a tenant. The bookkeeper had erroneously recorded a $50 cheque as $500. The cheque was to settle an account payable. · The bank statement revealed $50 in service charges. · Cheques #322 and #330 for $260 and $285 were not returmed with the bank statement. · A deposit made on September 29, 2020, for $1,250 did not appear on the bank statement. A deposit of $500 made on September 10 was erroneously credited to Rocky Candi's account by the bank for $5,000. A bank debit memo indicated an NSF cheque for $259.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

- Century 21 Accounting Multicolumn JournalAccountingISBN:9781337679503Author:GilbertsonPublisher:Cengage

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning, Survey of Accounting (Accounting I)AccountingISBN:9781305961883Author:Carl WarrenPublisher:Cengage Learning

Survey of Accounting (Accounting I)AccountingISBN:9781305961883Author:Carl WarrenPublisher:Cengage Learning  Financial AccountingAccountingISBN:9781305088436Author:Carl Warren, Jim Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781305088436Author:Carl Warren, Jim Reeve, Jonathan DuchacPublisher:Cengage Learning College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College Pub

College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College Pub

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:9781337679503

Author:Gilbertson

Publisher:Cengage

Financial And Managerial Accounting

Accounting

ISBN:9781337902663

Author:WARREN, Carl S.

Publisher:Cengage Learning,

Survey of Accounting (Accounting I)

Accounting

ISBN:9781305961883

Author:Carl Warren

Publisher:Cengage Learning

Financial Accounting

Accounting

ISBN:9781305088436

Author:Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:Cengage Learning

College Accounting (Book Only): A Career Approach

Accounting

ISBN:9781337280570

Author:Scott, Cathy J.

Publisher:South-Western College Pub