FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

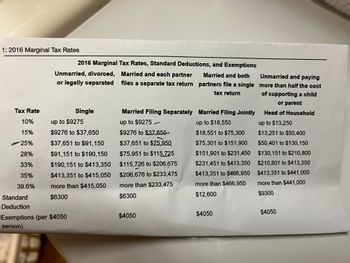

Use the 2016 marginal tax rates to compute the tax owed by a married couple filing jointly with a taxable income of $302,000 and a $8,000 tax credit .

Transcribed Image Text:1: 2016 Marginal Tax Rates

Tax Rate

10%

15%

<-25%

28%

33%

35%

39.6%

Standard

Deduction

2016 Marginal Tax Rates, Standard Deductions, and Exemptions

Married and each partner

files a separate tax return

Unmarried, divorced,

or legally separated

Exemptions (per $4050

person)

Single

up to $9275

$9276 to $37,650

$37,651 to $91,150

$91,151 to $190,150

$190,151 to $413,350

$413,351 to $415,050

more than $415,050

$6300

Married and both

partners file a single

tax return

Married Filing Separately Married Filing Jointly

up to $9275-

$9276 to $37,650-

$37,651 to $75,950

$75,951 to $115,725

$115,726 to $206,675

$206,676 to $233,475

more than $233,475

$6300

up to $18,550

$18,551 to $75,300

$75,301 to $151,900

$151,901 to $231,450

$231,451 to $413,350

$413,351 to $466,950

more than $466,950

$12,600

$4050

$4050

Unmarried and paying

more than half the cost

of supporting a child

or parent

Head of Household

up to $13,250

$13,251 to $50,400

$50,401 to $130,150

$130,151 to $210,800

$210,801 to $413,350

$413,351 to $441,000

more than $441,000

$9300

$4050

Expert Solution

arrow_forward

Step 1

Tax owed refers to the tax liability which is the amount of payment owed through the business, entity or an individual to the tax authorities. In short, it is the tax liability on taxpayer when taxpayer earns income or have profits on selling the investment or asset.

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Determine the amount of the child tax credit in each of the following cases: a. A single parent with modified AGI of $214,800 and one child age 4. b. A single parent with modified AGI of $79,400 and three children ages 7, 9, and 12. c. A married couple, filing jointly, with modified AGI of $409,333 and two children age 14 and 16. d. A married couple, filing jointly, with modified AGI of $133,455 and one child, age 13. Child Tax Credit Allowedarrow_forwardA taxpayer who is married with $200,000 of joint income in 2024 and claiming the standard deduction of $29,200 owe $ 27,726 of total federal income taxes. True Falsearrow_forwardUse the 2015 tax table to find the income tax for a taxpayer with taxable income of $25,156 filing as single. Use the 2015 tax table to find the income tax for a taxpayer with taxable income of $69,633 filing as married filing jointly.arrow_forward

- Haresharrow_forwardDetermine the amount of the child tax credit in each of the following cases: > Answer is complete but not entirely correct. a. A single parent with modified AGI of $214,600 and one child age 4. b. A single parent with modified AGI of $79,200 and three children ages 7, 9, and 12. c. A married couple, filing jointly, with modified AGI of $409,133 and two children age 14 and 16. d. A married couple, filing jointly, with modified AGI of $133,255 and one child, age 13. Child Tax Credit Allowed $ $ $ $ 1,250 ✓✔ 9,600 X 3,544 x 3,000arrow_forwardUse the 2016 FICA tax rates, shown below, to answer the following question. If a taxpayer is not self-employed and earns $137,000, what are the taxpayer's FICA taxes? Employee's Rates Matching Rates Paid by the Employer Self-Employed Rates 7.65% on first $118,500 of income 1.45% of income in excess of $118,500 7.65% on first $118,500 paid in wages 1.45% of wages paid in excess of $118,500 15.3% on first $118,500 of net profits 2.9% of net profits in excess of $118,500 FICA taxes are ?$arrow_forward

- use the marginal tax rates in the table below to compute the tax owed in the following situation. Winona and Jim are married filing jointly, with a taxable income of $288,000. They are entitled to a $6000 tax credit. Solve. The tax owed is $. enter your response here. Tax Rate Married filing jointly 10% up to $18,650 15% up to $75,900 25% up to $153,100 28% up to $233,350 33% up to $416,700 35% up to $470,700 39.6% above $470,700 Standard deduction $12,700 Exemption (per person) $4050arrow_forwardUse the 2016 marginal tax rates to compute the tax owed by a single woman with a taxable income of $64,000.arrow_forwardIn 2021, Lisa and Fred, a married couple, had taxable income of $305,200. If they were to file separate tax returns, Lisa would have reported taxable income of $126,700 and Fred would have reported taxable income of $178,500. Use Tax Rate Schedule for reference. What is the couple’s marriage penalty or benefit?arrow_forward

- The table below shows a certain state's income tax rates for individuals filing a return. Complete parts (A) through (D below. SINGLE, MARRIED FILING SEPERATELY, OR HEAD OF HOUSEHOLD SINGLE, MARRIED FILING SEPERATELY, OR HEAD OF HOUSEHOLD Over $0 $12,500 $50,000 But Not Over $12,500. $50,000 Tax Due Is 4% of taxable income $500.00 plus 6.25% of excess over $12,500 $2843.75 plus 6.5% of excess over $50,000 (A) Write a piecewise definition for T(x), the tax due on a taxable income of x dollars. if 0≤x≤12,500 T(x)= if 12,500 x≤50,000 if 50,000 < x (Use integers or decimals for any numbers in the expressions.)arrow_forwardThe tax liability for a married couple with taxable income of $87,131 is: Use the appropriate Tax tables or Tax rate schedules. Multiple Choice O $14,475. $12,869 $10,015. None of these.arrow_forwardPlease assist. Thank you much.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education