FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

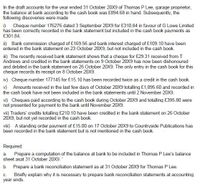

Transcribed Image Text:In the draft accounts for the year ended 31 October 20X9 of Thomas P Lee, garage proprietor,

the balance at bank according to the cash book was £894.68 in hand. Subsequently, the

following discoveries were made

i) Cheque number 176276 dated 3 September 20X9 for £310.84 in favour of G Lowe Limited

has been correctly recorded in the bank statement but included in the cash book payments as

£301.84.

ii) Bank commission charged of £169.56 and bank interest charged of £109.10 have been

entered in the bank statement on 23 October 20X9, but not included in the cash book.

m) The recently received bank statement shows that a cheque for £29.31 received from T

Andrews and credited in the bank statements on 9 October 20X9 has now been dishonoured

and debited in the bank statement on 26 October 20X9. The only entry in the cash book for this

cheque records its receipt on 8 October 20X9.

iv) Cheque number 177145 for £15.10 has been recorded twice as a credit in the cash book.

v) Amounts received in the last few days of October 20X9 totalling £1,895.60 and recorded in

the cash book have not been included in the bank statements until 2 November 20X9.

vi) Cheques paid according to the cash book during October 20X9 and totalling £395.80 were

not presented for payment to the bank until November 20X9.

vii) Traders' credits totalling £210.10 have been credited in the bank statement on 26 October

20X9, but not yet recorded in the cash book.

viii) A standing order payment of £15.00 on 17 October 20X9 to Countryside Publications has

been recorded in the bank statement but is not mentioned in the cash book.

Required:

a. Prepare a computation of the balance at bank to be included in Thomas P Lee's balance

sheet asat 31 October 20X9.

b. Prepare a bank reconciliation statement as at 31 October 20X9 for Thomas P Lee.

Briefly explain why it is necessary to prepare bank reconciliation statements at accounting

C.

year ends.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Using the following information: The bank statement balance is $3,093. The cash account balance is $3,305. Outstanding checks amounted to $767. Deposits in transit are $815. The bank service charge is $155. A check for $40 for supplies was recorded as $31 in the ledger. Prepare a bank reconciliation for Miller Co. for August 31. Miller Co.Bank ReconciliationAugust 31 Cash balance according to bank statement $fill in the blank 1 Adjustments: $- Select - - Select - Total adjustments fill in the blank 6 Adjusted balance $fill in the blank 7 Cash balance according to company's records $fill in the blank 8 Adjustments: $- Select - - Select - Total adjustments fill in the blank 13 Adjusted balance $fill in the blank 14arrow_forwardAt November 30, One Day Cleaners has available the following data concerning its bank checking account: PROBLEM 7A-2 Preparing a Bank Reconcil- 1 At November 30, cash per the bank statement was $37,758; per the accounting records, $42,500. lation 2 The cash receipts of $6,244 on November 30 were deposited on December 1. 3 Included on the bank statement was a credit for $167 interest earned on this checking account during November. 4 Two checks were outstanding at November 30: no. 921 for $964 and no. 925 for $1,085. 5 Enclosed with the bank statement were two debit memoranda for the following items: service charge for November, $14; and a $700 check of customer Tanya Miller, marked "NSF." INSTRUCTIONS a Prepare a bank reconciliation at November 30. b Prepare adjusting entries (in general journal form) based on the bank reconcili- ation.arrow_forwardPrepare a bank reconciliation from the following information:a. Balance per bank statement as of May 31, $17,755.44b. Balance per books as of May 31, $12,211.94c. Deposits in transit, $2,254.81d. Outstanding checks, $7,819.16e. Bank service charge, $20.85arrow_forward

- The following information has been extracted from the accounting records a bank statement of ABCJM Ltd as at 31 January 2019: Closing Balance shown on the Bank Statement Cash Receipts of 31 January which deposited on 30 January did not appear on the bank statement Cheques recorded in the cash payments but not yet presented For payment to the Bank Prepare a bank reconciliation statement as at 31 January. $11 450 CR 5,500 3 550arrow_forwardA deposit of $25,000 made by Federal Trading appeared on the bank statement of Fidel Trading. hello, i am working on a Cash Book and did this as the entry for the statement above. would that be correct? if so can you explain how? cashbook DATE ACCOUNT TITLE DEBIT DATE ACCOUNT TITLE CREDIT 30-November-10 Accounts receivable $25000arrow_forwardThe following information has been extracted from the accounting records of the Simplicity Corporation: a. Cash on hand ( undeposited collections) P1,020 b. Certificates of deposit 25,000 c. Customer’s notes receivable 1,000 d. Reconciled balance in Uno Bank checking account (350) e. Reconciled balance in Trese Bank payroll account 9,350 f. Balance in Rural bank savings account 8,560 g. Customer’s postdated checks 1,350 h. Employee travel advances 1,600 i. Cash in bond sinking fund 1,200 j. Bond sinking fund investments 8,090 k. Postage stamps 430 Required:a. What is the adjusted cash balance?b. Discuss the treatment of the items not included as cash.arrow_forward

- Using the following information, prepare a bank reconciliation for Cullumber Company for July 31, 2022. a. The bank statement balance is $3,700. b. The cash account balance is $4,100. C. Outstanding checks totaled $1,260. d. Deposits in transit are $1,620. e. The bank service charge is $31. f. A check for $87 for supplies was recorded as $78 in the ledger.arrow_forwardThe bank statement for Clive Company indicates a balance of $30,000 on September 30, 2021. After the journals for September had been posted, the cash account in the depositor's books had a balance of $27,800. The following reconciling items are available to prepare a bank reconciliation for Clive Company. (i) Bank debit memorandum for service charges, $250. (ii) Bank credit memorandum for interest earned, $2,105. (iii) Bank debit memorandum for $300 NSF (not sufficient funds) check from a customer. (iv) Cash sales of $480 had been erroneously recorded in the cash account as $448. (v) A check paid for $1,250 was erroneously recorded by the bank in the bank statement as $1,350. (vi) Checks outstanding, $1,463. (vii) Deposits in transit not recorded by bank, $750. Required: Prepare the bank reconciliation for Clive Company as of September 30, 2021.arrow_forwardProvide solution on the following requirements.arrow_forward

- The bank statement for Jeffrey Co. indicates a balance of $8,785 on October 31. After the journals for October had been posted, the cash account had a balance of $8,998. a. Cash sales of $945 had been erroneously recorded in the cash receipts journal as $495. b. Deposits in transit not recorded by bank, $778. c. Bank debit memo for service charges, $40. d. Bank credit memo for note collected by bank, $23,985 plus $885 interest. e. Bank debit memo for $756 NSF (not sufficient funds) check from Calin Sams, a customer. f. Checks outstanding, $1,860. Record the appropriate journal entries that would be necessary for Jeffrey Co. Record the entry that increases cash first. If an amount box does not require an entry, leave it blank.arrow_forwardI need help with correct solutionarrow_forwardNonearrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education