FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

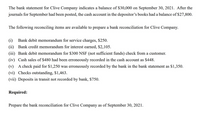

Transcribed Image Text:The bank statement for Clive Company indicates a balance of $30,000 on September 30, 2021. After the

journals for September had been posted, the cash account in the depositor's books had a balance of $27,800.

The following reconciling items are available to prepare a bank reconciliation for Clive Company.

(i)

Bank debit memorandum for service charges, $250.

(ii) Bank credit memorandum for interest earned, $2,105.

(iii) Bank debit memorandum for $300 NSF (not sufficient funds) check from a customer.

(iv) Cash sales of $480 had been erroneously recorded in the cash account as $448.

(v) A check paid for $1,250 was erroneously recorded by the bank in the bank statement as $1,350.

(vi) Checks outstanding, $1,463.

(vii) Deposits in transit not recorded by bank, $750.

Required:

Prepare the bank reconciliation for Clive Company as of September 30, 2021.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Shown below is the information needed to prepare a bank reconciliation for Alpha Communications at December 31, 2018: At December 31, cash per bank statement was $16,200; cash per the company’s records was $17,225. Two debit memoranda accompanied the bank statement: services charges for December of $25, and a $775 check drawn by Jane Jones marked “NSF”. Cash receipts of $9,000 on December 31 were deposited at the bank by end of day but were not shown in the bank statement until January 4. The following checks had been issued (written) in December but were not included among the paid checks returned by the bank: check no. 410 for $8,000 and check no. 425 for $2,500. Included in the bank statement was a check withdrawn (written) for an amount of $5,300 (rent expense) that was erroneously recorded for $3,500 in Alpha's records. The bank statement shows a credit (memorandum) interest of $75. Instructions Prepare a bank reconciliation at December 31, 2018. Prepare the…arrow_forward1) Prepare a bank reconciliation dated December 31, 2020, for Welcome Inc. based on the following information. Balance per bank statement is $21,200.68. Balance per books is $20,559.40. The December bank statement indicated a service charge of $35. Cheque #1169 for $410.50 and cheque #1183 for $2,150.00 were not returned with the bank statement. The bank had not received a deposit in transit of $3,443.22 when the bank statement was generated. A bank debit memo indicated an NSF cheque written by Bill Broke to Welcome Inc. on December 11, 2020, for $169. A bank credit memo indicated a bank collection of $1,700 and interest revenue of $28 on December 15, 2020.arrow_forwardThe Cash account of Ranger Security Systems reported a balance of $2,550 at December 31, 2025. There were outstanding checks totaling $800 and a December 31 deposit in transit of $100. The bank statement, which came from Tri Cities Bank, listed the December 31 balance of $3,910. Included in the bank balance was a collection of $670 on account from Sally Jones, a Ranger Security Systems customer who pays the bank directly. The bank statement also shows a $20 service charge and $10 of interest revenue that Ranger Security System earned on its bank balance. Prepare Ranger Security System's bank reconciliation at December 31. Ranger Security Systems Bank Reconciliation Bank: Balance, December 31, 2025 ADD: Deposit in transit December 31, 2025 LESS: Outstanding checks Adjusted bank balance, December 31, 2025 Book: Balance, December 31, 2025 ADD: LESS: Service charge Adjusted book balance, December 31, 2025arrow_forward

- Coasters Co. issued a note receivable to a customer. The customer made payment directly to the Coaster’s bank. The payment appeared on the month-end bank statement. How would this payment be adjusted in the bank reconciliation? Add to company records (book side) Subtract from company records (book side) Subtract from bank statement (bank side) Add to bank statement (bank side)arrow_forwardPlease help me fill out this bank reconciliation showing the true cash balance.arrow_forwardPlease review the attached files. Thank youarrow_forward

- Egrane, Incorporated's monthly bank statement showed the ending balance of cash of $19,500. The bank reconciliation for the period showed an adjustment for a deposit in transit of $2,000, outstanding checks of $3,000, an NSF check of $1,700, bank service charges of $80 and the EFT from a customer in payment of the customer's account of $2,500. What is the up-to-date ending Cash balance? Multiple Choice $18,500 O $17,780 $20,500 $22,620arrow_forwardUsing the following, prepare a bank reconciliation for Samtani Co. for August 31, 2020, including a proper three-line heading (please use Figure 8.6 in the text as your guide): a) The bank statement balance is $4,010 b) The cash account balance is $4,207 c) Outstanding checks amounted to $507 d) Deposits in transit are $633 e) The bank service charge is $35 f) A check for $84 for supplies was recorded as $48 in the ledger (an error in recording)arrow_forwardOn July 31, 2022, Metlock Company had a cash balance per books of $6,280.00. The statement from Dakota State Bank on that date showed a balance of $7,830.80. A comparison of the bank statement with the Cash account revealed the following facts. 1. The bank service charge for July was $22.00. 2. The bank collected $1,660.00 for Metlock through electronic funds transfer. 3. The July 31 cash receipts of $1,336.30 were not included in the bank statement for July. These receipts were deposited by the company in a night deposit vault on July 31. 4. 5. Company check No. 2480 issued to L. Taylor, a creditor, for $364.00 that cleared the bank in July was incorrectly recorded as a cash payment on July 10 for $346.00. Checks outstanding on July 31 totaled $1,982.10. 6. On July 31, the bank statement showed an NSF charge of $715.00 for a check received by the company from W. Krueger, a customer, on account.arrow_forward

- Can you please show your work on how you came up with the balance per bank and the balance per book on the reconciliation statement? Branson Co. received its bank statement for the month ending May 31, 2019, and reconciled the statement balance to the May 31, 2019, balance in the Cash account. The reconciled balance was determined to be $36,400. The reconciliation recognized the following items: A deposit made on May 31 for $22,700 was included in the Cash account balance but not in the bank statement balance. Checks issued but not returned with the bank statement were No. 673 for $4,550 and No. 687 for $9,700. Bank service charges shown as a deduction on the bank statement were $110. Interest credited to Branson Co.'s account but not recorded on the company's books amounted to $88. Returned with the bank statement was a "debit memo" stating that a customer's check for $3,240 that had been deposited on May 23 had been returned because the customer's account was overdrawn. During a…arrow_forwardWinson Company reported the following information related to its 31 August 2019 bank statement: i) The bank statement's balance is $3267. ii) The cash account balance is $3193. iii) The outstanding checks total $612. iv) The deposits in transit amount to $1415. v)The bank service charge is $27. vi) Winson's accountant issued a check for $153 (inpayment on an account payable) that was erroneously recorded in the ledger as $135. vii)Bank debit memorandum for$138 NSF (not sufficient funds)check from one of its customers. viii) The bank collected an account receivable in the amount of $1060 on. behalf if Winson Company. Required; Prepare Winson Company's bank reconciliation on 31 August 2019.arrow_forwardSmith Company started its business on november 1,2020,below is the information needed to prepare a bank reconciliation for the business as at November 30,2020: i) Balance per bank statement was $34100. ii)$1300 check drawn by a customer johnson had been marked "NSF"in November and the company received this notice at the beginning of december 2020. iii)Cash receipts of $8000 recorded on November 2020 were not deposited to bank unti; december 1. iv)Bank service charge for November 2020 amounted $38 was sent to the company together with the bank statement. v)Check #620 for $4000 had been issued in November but was npt presented to the bank for payment. vi)Check #643 for electricity expense cleared the bank for $268 but was erroneously recorded in our books as $240. vii) A $486 deposit by Easy Co.was erroneously credited to our account by the bank. viii)the bank statement showed $30 interest earned on the bank for the month of November 2020. Requieed: Prepare a bank reconciliation…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education