FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

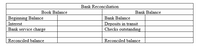

Complete a Bank Reconciliation for the following: On March 31st the checkbook balance of Dust Bunnies Cleaning Co. was $2,568. The bank statement was $3,254.50. Checks outstanding were $2,788. The statement revealed a deposit in transit of $2,125 as well as a bank service charge of $11.50. The company earned interest income of $35.00. Complete a bank reconciliation for Dust Bunnies Cleaning Co.

Transcribed Image Text:Bank Reconciliation

Book Balance

Bank Balance

Beginning Balance

Bank Balance

Deposits in transit

Checks outstanding

Interest

Bank service charge

Reconciled balance

Reconciled balance

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- XYZ Inc is preparing the October month-end Bank Reconciliation. The balance in the cash ledger on October 31 was $1,900. Some adjustments to this cash ledger balance were recorded on the Bank Reconciliation Report, as follows: • Bank service charge $55 NSF cheque: $375 • Cheque # 40 was correctly written and processed for $3,030 however the XYZ bookkeeper recorded the cheque amount for $3,300. What is the adjusted cash balance for October 31, for the Bank Reconciliation Report? Show your basic math.arrow_forwardUsing the following information: a. The bank statement balance is $2,622. b. The cash account balance is $3,032. c. Outstanding checks amounted to $555. d. Deposits in transit are $835. e. The bank service charge is $121. f. A check for $52 for supplies was recorded as $43 in the ledger. Prepare a bank reconciliation for Miller Co. for August 31. Miller Co. Bank Reconciliation August 31 Cash balance according to bank statement Adjustments: Total adjustments Adjusted balance Cash balance according to company's records Adjustments: A || A %24arrow_forwardShown below is the information needed to prepare a bank reconciliation for Alpha Communications at December 31, 2018: At December 31, cash per bank statement was $16,200; cash per the company’s records was $17,225. Two debit memoranda accompanied the bank statement: services charges for December of $25, and a $775 check drawn by Jane Jones marked “NSF”. Cash receipts of $9,000 on December 31 were deposited at the bank by end of day but were not shown in the bank statement until January 4. The following checks had been issued (written) in December but were not included among the paid checks returned by the bank: check no. 410 for $8,000 and check no. 425 for $2,500. Included in the bank statement was a check withdrawn (written) for an amount of $5,300 (rent expense) that was erroneously recorded for $3,500 in Alpha's records. The bank statement shows a credit (memorandum) interest of $75. Instructions Prepare a bank reconciliation at December 31, 2018. Prepare the…arrow_forward

- The accountant at Terry Farm Stores prepares a monthly bank reconciliation. On 31 August she received a bank statement from QBE Bank, which had a credit balance of $8 950. Terry Farm Stores' cash at bank account per the general ledger showed a debit balance of $15 050. A comparison of the bank statement with the cash payments and cash receipts journals revealed the following information: (1) Outstanding EFTs at 31 August totaled $1 550 (2) QBE bank mistakenly included a cheque payment on Terry Farm Stores' bank statement that related to Tolga Ltd. The cheque amount was for $2 180. The mistake will be corrected in September. (3) The bank statement included bank charges of $20. (4) In reviewing the cheque payments, a mistake was discovered on cheque no. 574 for the payment of rent expense. The amount of the cheque was for $5 510 but was recorded in the cash payments journal as $5 150. (5) Cash receipts recorded in the cash receipts journal on 30 August of $4 300 were not on the bank…arrow_forwardThe following data were gathered to use in reconciling the bank account of Photo Op: Balance per bank... $14,500 Balance per company records.... .13,875 Bank service charges.. 75 Deposit in transit... .3,750 NSF check... 800 Outstanding checks... .5,250 What is the adjusted balance on the bank reconciliation?arrow_forwardUsing the following information, prepare the journal entries to reconcile the bank statement. Bank balance: $6,988 Book balance: $8,923 Deposits in transit: $1,875 Outstanding checks: $569 and $1,423 Bank service charges: $75 Bank incorrectly charged the account $75. The bank will correct the error next month. Check number 2456 correctly cleared the bank in the amount of $123 but posted in the accounting records as $213. This check was expensed to Utilities Expense. If an amount box does not require an entry, leave it blank.arrow_forward

- Sal's Surf Shop deposits all receipts in the bank and makes all payments by check. On July 31 the cash account had a balance of $6,105.42. The bank statement on July 31 reported a balance of $4,146.46. Upon comparing the bank statement to the books, the following items were found.arrow_forwardOn March 31, Sigment Company had a $44,547.60 checkbook balance. The bank statement showed a balance on that date of $46,574.10, and the following information on the bank statement had not been entered in the checkbook: $24.75 Service charge $68.85 NSF charge A review of the company’s bank statement and checkbook showed a deposit in transit of $3,919.44 and outstanding checks as follows: Number 234 for $281.34 Number 236 for $445.12 Number 237 for $2,901.60 Number 238 for $2,411.48 Prepare a bank reconciliation in proper format. List and total the outstanding checks at the bottom of the bank reconciliation.arrow_forwardUsing the following information, prepare the journal entries to reconcile the bank statement. Bank balance: $6,988 • Book balance: $8,866 • Deposits in transit: $1,832 Outstanding checks: $589 and $1,623 • Bank service charges: $50 • Bank incorrectly charged the account $50. The bank will correct the error next month. • Check number 2456 correctly cleared the bank in the amount of $417 but posted in the accounting records as $471. This check was expensed to Utilities Expense. If an amount box does not require an entry, leave it blank.arrow_forward

- On December 10, you receive your bank statement showing a balance of $2,981.97. Your checkbook shows a balance of $2,782.86. Outstanding checks are $387.86 and $175.56. The account earned $122.85. Deposits in transit amount to $479.16, and there is a service charge of $8.00. Calculate the reconciled balance. O $199.11 $2,668.01 $2,897.71 O $4,024.55arrow_forwardUsing the following information, prepare a bank reconciliation. Bank balance: $6,788 Book balance: $6,228 Deposits in transit: $1,712 Outstanding checks: $569 and $1,623 Bank charges: $50 Bank incorrectly charged the account $50. The bank will correct the error next month. Check number 2456 correctly cleared the bank in the amount of $137 but posted in the accounting records as $317. This check was expensed to Utilities Expense. Bank Reconciliation Bank Statement Balance at (date) Add: Less: Adjusted Bank Balance Book Balance at (date) Add: Less: Adjusted Book Balancearrow_forwardUsing the following information: The bank statement balance is $5,289. The cash account balance is $5,764. Outstanding checks amounted to $751. Deposits in transit are $1,174. The bank service charge is $43. A check for $71 for supplies was recorded as $62 in the ledger. Prepare a bank reconciliation for Candace Co. for May 31. Candace Co.Bank ReconciliationMay 31 Cash balance according to bank statement $fill in the blank 1 Adjustments: $fill in the blank 3 fill in the blank 5 Total adjustments fill in the blank 6 Adjusted balance $fill in the blank 7 Cash balance according to company's records $fill in the blank 8 Adjustments: $fill in the blank 10 fill in the blank 12 Total adjustments fill in the blank 13 Adjusted balance $fill in the blank 14arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education