FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

I need help with correct solution

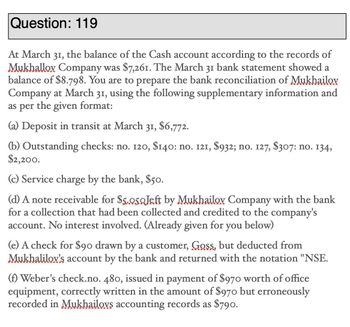

Transcribed Image Text:Question: 119

At March 31, the balance of the Cash account according to the records of

Mukhalloy Company was $7,261. The March 31 bank statement showed a

balance of $8.798. You are to prepare the bank reconciliation of Mukhailov

Company at March 31, using the following supplementary information and

as per the given format:

(a) Deposit in transit at March 31, $6,772.

(b) Outstanding checks: no. 120, $140: no. 121, $932; no. 127, $307: no. 134,

$2,200.

(c) Service charge by the bank, $50.

(d) A note receivable for $5.050 Jeft by Mukhailov Company with the bank

for a collection that had been collected and credited to the company's

account. No interest involved. (Already given for you below)

(e) A check for $90 drawn by a customer, Goss, but deducted from

Mukhalilov's account by the bank and returned with the notation "NSE.

(f) Weber's check.no. 480, issued in payment of $970 worth of office

equipment, correctly written in the amount of $970 but erroneously

recorded in Mukhailovs accounting records as $790.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- help please, the answers I put are not correctarrow_forwardWhat are the strengths and weaknesses that you see in the system and ways that you would improve any weaknesses identified.arrow_forwardCompany B Consolidated Statement of Income (000) Year Ending May 31 1996 1997 1998 1999 2000 Revenues $3,930,984 $3,789,668 $4,760,834 $6,470,625 $9,186,539 Cost and Expenses Cost of sales $2,386,993 $2,301,423 $2,865,280 $3,906,746 $5,502,993 Selling & Administrative $922,261 $974,099 $1,209,760 $1,588,612 $2,303,704 Interest expense $25,739 $15,282 $24,208 $39,498 $52,343 Other income/expense $1,475 $8,270 $11,722 $36,679 $32,277 $3,336,468 $3,299,074 $4,110,970 $5,571,535 $7,891,317 Income before income taxes $594,516 $490,594 $649,864 $899,090 $1,295,222 Income taxes $229,500 $191,800 $250,200 $345,900 $499,400 Net income $365,016 $298,794 $399,664 $553,190 $795,822 Company B Consolidatd Balance Sheets (000) Year Ending May 31+A2:G25 1996 1997 1998 1999 2000 Assets Current Assets Cash…arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education