SWFT Essntl Tax Individ/Bus Entities 2020

23rd Edition

ISBN: 9780357391266

Author: Nellen

Publisher: Cengage

expand_more

expand_more

format_list_bulleted

Question

ll.1

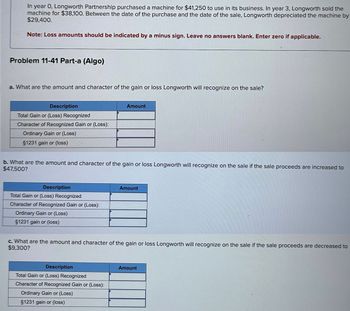

Transcribed Image Text:In year 0, Longworth Partnership purchased a machine for $41,250 to use in its business. In year 3, Longworth sold the

machine for $38,100. Between the date of the purchase and the date of the sale, Longworth depreciated the machine by

$29,400.

Note: Loss amounts should be indicated by a minus sign. Leave no answers blank. Enter zero if applicable.

Problem 11-41 Part-a (Algo)

a. What are the amount and character of the gain or loss Longworth will recognize on the sale?

Description

Total Gain or (Loss) Recognized

Character of Recognized Gain or (Loss):

Ordinary Gain or (Loss)

§1231 gain or (loss)

Amount

b. What are the amount and character of the gain or loss Longworth will recognize on the sale if the sale proceeds are increased to

$47,500?

Description

Total Gain or (Loss) Recognized

Character of Recognized Gain or (Loss):

Ordinary Gain or (Loss)

§1231 gain or (loss)

Amount

c. What are the amount and character of the gain or loss Longworth will recognize on the sale if the sale proceeds are decreased to

$9,300?

Description

Total Gain or (Loss) Recognized

Character of Recognized Gain or (Loss):

Ordinary Gain or (Loss)

§1231 gain or (loss)

Amount

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- In year 0, Longworth Partnership purchased a machine for $53,000 to use in its business. In year 3, Longworth sold the machine for $42,400. Between the date of the purchase and the date of the sale, Longworth depreciated the machine by $22,800. Note: Loss amounts should be indicated by a minus sign. Leave no answer blank. Enter zero if applicable. Problem 3-41 Part-a (Algo) a. What are the amount and character of the gain or loss Longworth will recognize on the sale? b. What are the amount and character of the gain or loss Longworth will recognize on the sale if the sale proceeds are increased to $61,750?arrow_forwardS ! Required information [The following information applies to the questions displayed below.] In year O, Longworth Partnership purchased a machine for $50,500 to use in its business. In year 3, Longworth sold the machine for $35,200. Between the date of the purchase and the date of the sale, Longworth depreciated the machine by $26,600. Note: Loss amounts should be indicated by a minus sign. Leave no answers blank. Enter zero if applicable. c. What are the amount and character of the gain or loss Longworth will recognize on the sale if the sale proceeds are decreased to $16,100? Description Total Gain or (Loss) Recognized Character of Recognized Gain or (Loss): Ordinary Gain or (Loss) §1231 gain or (loss) Amountarrow_forwardiarrow_forward

- Required information Problem 11-41 (LO 11-3, LO 11-4) (Static) [The following information applies to the questions displayed below.] In year 0, Longworth Partnership purchased a machine for $40,000 to use in its business. In year 3, Longworth sold the machine for $35,000. Between the date of the purchase and the date of the sale, Longworth depreciated the machine by $22,000. Note: Loss amounts should be indicated by a minus sign. Leave no answers blank. Enter zero if applicable. Problem 11-41 Part-b (Static) b. What are the amount and character of the gain or loss Longworth will recognize on the sale if the sale proceeds are increased to $45,000? Answer is complete but not entirely correct. Description Total Gain or (Loss) Recognized Character of Recognized Gain or (Loss): Ordinary Gain or (Loss) $1231 gain or (loss) Amount $ 27,000 $(27,000) X $ (27,000)arrow_forwardRequired information Problem 11-42 (LO 11-3, LO 11-4) (Algo) [The following information applies to the questions displayed below.] On August 1 of year 0, Dirksen purchased a machine for $28,750 to use in its business. On December 4 of year 0, Dirksen sold the machine for $28,000. Use MACRS Table. Note: Loss amounts should be indicated by a minus sign. Do not round percentages used for calculations. Round other intermediate computations to the nearest whole dollar amount. Leave no answers blank. Enter zero if applicable. Problem 11-42 Part-b (Algo) b. Dirksen depreciated the machinery using MACRS (seven-year recovery period). What are the amount and character of the gain or loss Dirksen will recognize on the sale if the machine is sold on January 15 of year 1 instead? Description Total Gain or (Loss) Recognized Character of Recognized Gain or (Loss): Ordinary Gain or (Loss) 51231 gain or (loss) $ Amount 0arrow_forwardYour answerarrow_forward

- On August 1 of year 0, Dirksen purchased a machine for $20,000 to use in its business. On December 4 of year 0, Dirksen sold the machine for $18,000. Use MACRS Table. Note: Loss amounts should be indicated by a minus sign. Do not round percentages used for calculations. Leave no answers blank. Enter zero if applicable. Problem 11-42 Part-b (Static) b. Dirksen depreciated the machinery using MACRS (seven-year recovery period). What are the amount and character of the gain or oss Dirksen will recognize on the sale if the machine is sold on January 15 of year 1 instead? Note: Round other intermediate computations to the nearest whole dollar amount. X Answer is complete but not entirely correct. Description Total Gain or (Loss) Recognized Character of Recognized Gain or (Loss): Ordinary Gain or (Loss) §1231 gain or (loss) $ $ Amount 4,119 X 4,119 X 0arrow_forward3. In year 0, Canon purchased a machine to use in its business for $56,000. In year 3, Canon sold the machine for $42,000. Between the date of the purchase and the date of the sale, Canon depreciated the machine by $32,000. (Loss amounts should be indicated by a minus sign. Leave no answer blank. Enter zero if applicable.) b. What are the amount and character of the gain or loss Canon will recognize on the sale, assuming that it is a corporation? Total Gain/Loss Recognized? Ordinary Gain/Loss? 1231 Gain/Loss?arrow_forwardUrmilaarrow_forward

- Dogarrow_forwardn year 0, Canon purchased a machine to use in its business for $56,000. In year 3, Canon sold the machine for $42,000. Between the date of the purchase and the date of the sale, Canon depreciated the machine by $32,000. (Loss amounts should be indicated by a minus sign. Leave no answer blank. Enter zero if applicable.) d. What are the amount and character of the gain or loss Canon will recognize on the sale, assuming that it is a corporation and the sale proceeds were decreased to $20,000?arrow_forward5. In year 0, Canon purchased a machine to use in its business for $56,000. In year 3, Canon sold the machine for $42,000. Between the date of the purchase and the date of the sale, Canon depreciated the machine by $32,000. (Loss amounts should be indicated by a minus sign. Leave no answer blank. Enter zero if applicable.) d. What are the amount and character of the gain or loss Canon will recognize on the sale, assuming that it is a corporation and the sale proceeds were decreased to $20,000? Total Gain/Loss Recognized? Ordinary Gain/Loss? 1231 Gain/Loss?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you