ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Question

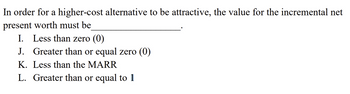

Transcribed Image Text:In order for a higher-cost alternative to be attractive, the value for the incremental net

present worth must be

I. Less than zero (0)

J. Greater than or equal zero (0)

K. Less than the MARR

L. Greater than or equal to 1

SAVE

AI-Generated Solution

info

AI-generated content may present inaccurate or offensive content that does not represent bartleby’s views.

Unlock instant AI solutions

Tap the button

to generate a solution

to generate a solution

Click the button to generate

a solution

a solution

Knowledge Booster

Similar questions

- Three different plans were presented to the Ahbhalet Corporation for operating an identity-theft scanning system. Plan A involves renewable 1-year contracts with payments of $1.1 million at the beginning of each year. Plan B is a 2-year contract that requires four payments of $360,000 each, with the first one made now and the other three at 6-month intervals. Plan C is a 3-year contract that entails payment of $3.5 million now and the second payment of $0.5 million 2 years from now. Assuming that the company could renew any of the plans under the same payment conditions, determine which plan is best on the basis of a PW analysis at a MARR of 6% per year compounded semiannually. The present worth of plan A is $ The best plan on the basis of the present worth analysis is plan B the present worth of plan B is $ and the present worth of plan C is $arrow_forwardhelp please answer in text form with proper workings and explanation for each and every part and steps with concept and introduction no AI no copy paste remember answer must be in proper format with all workingarrow_forwardNadine Chelesvig has patented her invention. She is offering a potential manufacturer two contracts for the exclusive right to manufacture and market her product. Plan A calls for an immediate single lump sum payment to her of $175,000. Plan B calls for an annual payment of $14,000 plus a royalty of $3.90 per unit sold. The remaining life of the patent is 10 years. Nadine uses a MARR of 10%/year. What must be the uniform annual sales volume of the product for Nadine to be indifferent between the contracts, based on an units annual worth analysis? Carry all interim calculations to 5 decimal places and then round your final answer to the nearest unit. The tolerance is ±10.arrow_forward

- Answer please and take likearrow_forwardRequired information Spectra Scientific of Santa Clara, California, manufactures Q-switched solid-state industrial lasers for LED substrate scribing and silicon wafer dicing. The company got a $72 million loan, amortized over a 7-year period at 8% per year interest. NOTE: This is a multi-part question. Once an answer is submitted, you will be unable to return to this part. What is the amount of the unrecovered balance immediately before the payment is made at the end of year 1. (Enter your answer in dollars and not in millions.) The amount of the unrecovered balance is $ 63930787.10arrow_forwardWhat is the PW of all design?arrow_forward

- The prospective exploration for oil in the outer continental shelf by a small, independent drilling company has produced a rather curious pattern of cash flows as follows: EOY Net Cash Flow -$520,000 1-10 $200,000 10 -$1,500,000 The $1,500,000 expenses at EOY 10 will be incurred by the company in dismantling the drilling rig. Customarily, the company expects to earn at least 20% per year on invested capital before taxes. Complete the compounding factors below to determine the ERR. (-520000-1500000( ,20%, 10) ,i%, 10) = 200000(F/ ,20%,10)) (arrow_forwardMitchell Manufacturing purchased new material handling equipment for $28,000,000. The annual maintenance cost for the equipment will be $1,500,000. Mitchell Mfg. expects to generate extra annual revenue of $5,000,000 per year. The payback period to make a return of 8% per year is closest to: O 6 years O 11 years 13 years O 7 years O 9 yearsarrow_forwardThree mutually exclusive electric-vehicle battery systems are being investigated by a large automobile manufacturer. Pertinent data are given below: Solve, a. Use the PW method to select the best battery system. The MARR is 15% per year, and the system chosen must provide service for 10 years. Assume repeatability. b. Confirm your recommendation in Part (a) using the IRR method.arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education