ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Question

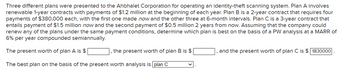

Transcribed Image Text:Three different plans were presented to the Ahbhalet Corporation for operating an identity-theft scanning system. Plan A involves

renewable 1-year contracts with payments of $1.2 million at the beginning of each year. Plan B is a 2-year contract that requires four

payments of $380,000 each, with the first one made now and the other three at 6-month intervals. Plan C is a 3-year contract that

entails payment of $1.5 million now and the second payment of $0.5 million 2 years from now. Assuming that the company could

renew any of the plans under the same payment conditions, determine which plan is best on the basis of a PW analysis at a MARR of

6% per year compounded semiannually.

The present worth of plan A is $

The best plan on the basis of the present worth analysis is plan C

the present worth of plan B is $

and the present worth of plan C is $1830000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 6 steps with 7 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Similar questions

- Concurris Prototyping is committed to using the newest and finest equipment in its labs. Accordingly, Wilma, a senior engineer, has recommended that a 2-year-old piece of precision measurement equipment be replaced immediately. She believes it can be demonstrated that the proposed equipment is economically advantageous at a 15%-per year return and a planning horizon of 5 years. Perform the replacement analysis using the annual worth method, a 5-year study period, and the estimates below. Was Wilma correct? Equipment Original purchase price, $ Current market value, $ Remaining life, years Estimated value in 5 years, $ Salvage value after 15 years, $ AOC, $ per year Current -30,000 15,000 5 7,000 -11,000 The AW of the defender is $- challenger is $- Wilma ((Click to select)) correct. Proposed -40,000 -- 15 10,000 5,000 -3,000 and the AW of thearrow_forwardAnswer it ASAP with step by step solutionarrow_forwardhelp please answer in text form with proper workings and explanation for each and every part and steps with concept and introduction no AI no copy paste remember answer must be in proper format with all workingarrow_forward

- Nadine Chelesvig has patented her invention. She is offering a potential manufacturer two contracts for the exclusive right to manufacture and market her product. Plan A calls for an immediate single lump sum payment to her of $175,000. Plan B calls for an annual payment of $14,000 plus a royalty of $3.90 per unit sold. The remaining life of the patent is 10 years. Nadine uses a MARR of 10%/year. What must be the uniform annual sales volume of the product for Nadine to be indifferent between the contracts, based on an units annual worth analysis? Carry all interim calculations to 5 decimal places and then round your final answer to the nearest unit. The tolerance is ±10.arrow_forwardFuture worth and annual cash flow analysis often require far less computation than rate of return analysis Select one: True Falsearrow_forwardNeighboring parishes in Louisiana have agreed to pool road tax resources already designated for bridge refurbishment. At a recent meeting, the engineers estimated that a total of $500,000 will be deposited at the end of next year into an account for the repair of old and safety-questionable bridges throughout the area. Further, they estimate that the deposits will increase by $100,000 per year for only 9 years thereafter, then cease. Determine the equivalent (a) present worth and (b) annual series amounts, if public funds earn at a rate of 5% per year. Draw the cash flow diagram and show complete solution. Make it clear tyarrow_forward

- If the APR is 14%, what is the annual effective rate (%)?arrow_forwardConcurris Prototyping is committed to using the newest and finest equipment in its labs. Accordingly, Wilma, a senior engineer, has recommended that a 2-year-old piece of precision measurement equipment be replaced immediately. She believes it can be demonstrated that the proposed equipment is economically advantageous at a 15%-per year return and a planning horizon of 5 years. Perform the replacement analysis using the annual worth method, a 5-year study period, and the estimates below. Was Wilma correct Equipment Current Proposed Original purchase price, $ Current market value, $ -30,000 -42,000 15,000 Remaining life, years 5 15 Estimated value in 5 years, $ 7,000 10,000 5,000 -3,000 Salvage value after 15 years, $ AOC, $ per year The AW of the defender is $- Wilma (Click to select) correct. -14,000 and the AW of the challenger is $-arrow_forwardCosta Rica Savings Bank issues 100,000 bonds as a response to the Costa Rica Central Bank's initiatives to increase domestic saving. The bonds have a face value of $40,000, a bond interest rate of 8% per year payable annually and a maturity date of 14 years. What is the current price one should pay for this bond, if the market interest rate is 9% per year, compounded annually? Requires to answer these questions using EXCEL spreadsheets. I am clueless went it comes to this subject and using EXCEL formulas so it would help if you provided which formula to use and how to enter it into EXCEL to get the correct answer. Don't just post values it will not help I need Excel formulas to enter in Excel. Thank you!arrow_forward

- A company has approved a car plan for its six senior officers in which the companywill shoulder 25% of the cost and the difference payable by each officer to a financingcompany in 48 equal end of the month installments at an interest rate of 1.5% per month. If the cost of each car is P350,000, determine the amount each officer has to pay the financing company per month? PLEASE DO NOT USE EXCEL. PLEASE EXPLAIN USING FORMULAS OPTIONS A. P7,523.90 B. P7,619.22 C. P7,190.00 D. P7,710.94arrow_forwardThe prospective exploration for oil in the outer continental shelf by a small, independent drilling company has produced a rather curious pattern of cash flows as follows: EOY Net Cash Flow -$520,000 1-10 $200,000 10 -$1,500,000 The $1,500,000 expenses at EOY 10 will be incurred by the company in dismantling the drilling rig. Customarily, the company expects to earn at least 20% per year on invested capital before taxes. Complete the compounding factors below to determine the ERR. (-520000-1500000( ,20%, 10) ,i%, 10) = 200000(F/ ,20%,10)) (arrow_forwardThe sign of various amounts at different points in time in a cash flow diagram is to be decided based on the type of the decision problem Select one O True O Falsearrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education