FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

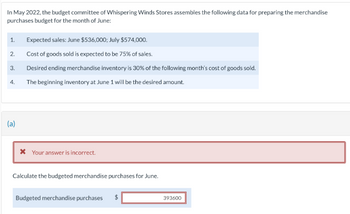

Transcribed Image Text:In May 2022, the budget committee of Whispering Winds Stores assembles the following data for preparing the merchandise

purchases budget for the month of June:

1. Expected sales: June $536,000; July $574,000.

2.

Cost of goods sold is expected to be 75% of sales.

3.

Desired ending merchandise inventory is 30% of the following month's cost of goods sold.

4.

The beginning inventory at June 1 will be the desired amount.

(a)

* Your answer is incorrect.

Calculate the budgeted merchandise purchases for June.

Budgeted merchandise purchases

$

393600

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Boris detergents expects to have a cash balance of P46,000 on January 1, 2020. These are the relevant monthly budget data for the first two months of 2017. 1. Collections from customers: January P71,000, February P146,000. 2. Payments to suppliers: January P40,000, February P75,000. 3. Wages: January P30,000, February P40,000. Wages are paid in the month they are incurred. 4. Administrative expenses: January P21,000, February P24,000. These costs include depreciation of P1,000 per month. All other costs are paid as incurred. 5. Selling expenses: January P15,000, February P20,000. These costs are exclusive of depreciation. They are paid as incurred. 6. Sales of short-term investments in January are expected to realize P12,000 in cash. The Company has a line of credit at a local bank that enables it to borrow up to P25,000. The company wants to maintain a minimum monthly cash balance of P20,000. Prepare a cash budget for January and February.arrow_forwardBased on the preceding projections and budget requirements for Thingone and Thingtwo, prepare the following budgets for 2017: * Revenues budget (in dollars)arrow_forwardLA Vaughn Wholesalers is preparing its merchandise purchases budget. Budgeted sales are $400,000 for April and $500,000 for May. Cost of goods sold is expected to be 62% of sales. The company's desired ending inventory is 21% of the following month's cost of goods sold. Calculate the required purchases for April. VAUGHN WHOLESALERS Merchandise Purchases Budget For the Month of April, 2022 LAarrow_forward

- Use the information provided below to calculate the number of units of Product Blue that must be produced for September and October 2023. The estimated sales volume of Product Blue is 25 000 units for August, 21 000 units for September, 30 000 units for 0ctober and 36 000 units for November. The management policy maintains an ending finished goods inventory each month equalling to 20% of the current month’s budgeted sales and 30% of the following month’s budgeted sales.arrow_forwardHayma Company's sales budget for 2022 in units for the next five months is as follows: January 20,000. February 26,000, March 32,000, April 40,000 and May 42,000. The Company's ending finished goods inventory policy is set for 25% of the following month's sales. January 1 beginning inventory is 2,800 units. How many units will be produced in February? O a. 24,700 O b. None of the given answers. O c. 40,500 O d. 27,500 О е. 34,000 O f. 24,500 ere to search 11:42 ADA dx ENG 22-05-2021 hp 40 141 bet sc delete home end +backspace lock T. 8 A home K enter 5 0 pause t shift SS end ctriarrow_forwardThe SK Industries, Inc. manufactures and sells two products, Accel Active and Accel Regular. In September 2018, SK Industries Budget Department gathered the following data in order to prepare budgets for 2019: 2019 Projected Sales Product Accel Active 45,000|s225 |Units Price Accel Regular 75,000 S1s5 Expected Target Inventories Product January 1, 2019 December 31, 2019 Accel Active 9,000 12,000 Accel Regular 17,000 25,000 The following direct materials are expected to be used in the two products: Material Used per Unit Direct Material Unit Accel Active Accel Regular pound One 6. Two pound 4 2 Three pound Projected data for 2019 with respect to direct materials are as follows: Direct Material Expected Purchase PriceExpected Inventories Target Inventories (January 1, 2019) (December 31, 2019) One $15 27,000 lb 35,000 lb Two S7 30,000 lb 35,000 lb Three $4 4,000 lb 7,000 lb Projected direct labor requirements and rates for 2019 are as follows: Product Hours Per Unit Rate Per Hour Accel…arrow_forward

- Waterways Corporation is preparing its budget for the coming year, 2020. The first step is to plan for the first quarter of that coming year. The company has gathered information from its managers in preparation of the budgeting process. Sales Unit sales for November 2019 111,000 Unit sales for December 2019 101,000 Expected unit sales for January 2020 113,000 Expected unit sales for February 2020 113,000 Expected unit sales for March 2020 118,000 Expected unit sales for April 2020 124,000 Expected unit sales for May 2020 137,000 Unit selling price $12 Waterways likes to keep 10% of the next month’s unit sales in ending inventory. All sales are on account. 85% of the Accounts Receivable are collected in the month of sale, and 15% of the Accounts Receivable are collected in the month after sale. Accounts receivable on December 31, 2019, totaled $181,800.Direct MaterialsDirect materials cost 80 cents per pound. Two pounds of direct materials…arrow_forwardScannell, Inc. sells tire rims. Its sales budget for the nine months ended September 30, 2024, and additional information follow: (Click the icon to view the budget.) (Click the icon to view additional information.) Prepare an inventory, purchases, and cost of goods sold budget for each of the first three quarters of the year. Compute cost of goods sold for the entire nine-month period. Plus: Less: More info Scannell, Inc. Inventory, Purchases, and Cost of Goods Sold Budget Nine Months Ended September 30, 2024 Quarter Ended March 31 In the past, cost of goods sold has been 40% of total sales. The director of marketing and the financial vice president agree that each quarter's ending inventory should not be below $15,000 plus 10% of cost of goods sold for the following quarter. The marketing director expects sales of $200,000 during the fourth quarter. The January 1 inv ory was $19,000. Print Done X Data table Cash sales, 30% Credit sales, 70% Total sales $ $ Quarter Ended June 30…arrow_forwardOn January 1, 2022, the Bramble Company budget committee has reached agreement on the following data for the 6 months ending June 30, 2022. Sales units: Ending raw materials inventory: Ending finished goods inventory: Third-quarter production: First quarter 5,800; second quarter 6,960; third quarter 8,120. 40% of the next quarter's production requirements. 25% of the next quarter's expected sales units. 8,470 units. The ending raw materials and finished goods inventories at December 31, 2021, follow the same percentage relationships to production and sales that occur in 2022. Three pounds of raw materials are required to make each unit of finished goods. Raw materials purchased are expected to cost $4 per pound. Prepare a production budget by quarters for the 6-month period ended June 30, 2022. BRAMBLE COMPANY Production Budget 1 Quarter 2arrow_forward

- hello, help pleasearrow_forwardAssuming the current ratio equals 2, which of the following would cause the current ratio to increase? O Accrual for payroll. Declaration of cash dividend. O Payment for inventory purchased on account. O Inventory purchased on account.arrow_forwardSales budget data for Paige Company are given in BE9.2. Management desires to have an ending finished goods inventory equal to 25% of the next quarter’s expected unit sales. Prepare a production budget by quarters for the first 6 months of 2020.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education