FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

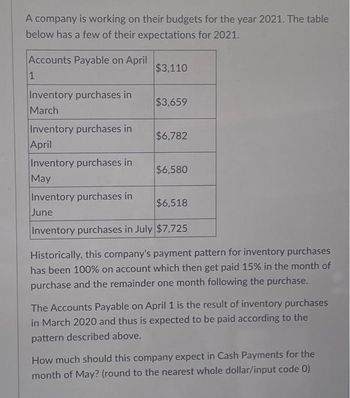

Transcribed Image Text:A company is working on their budgets for the year 2021. The table

below has a few of their expectations for 2021.

Accounts Payable on April

1

Inventory purchases in

March

Inventory purchases in

April

Inventory purchases in

May

$3,110

$3,659

$6,782

$6,580

Inventory purchases in

$6,518

June

Inventory purchases in July $7,725

Historically, this company's payment pattern for inventory purchases

has been 100% on account which then get paid 15% in the month of

purchase and the remainder one month following the purchase.

The Accounts Payable on April 1 is the result of inventory purchases

in March 2020 and thus is expected to be paid according to the

pattern described above.

How much should this company expect in Cash Payments for the

month of May? (round to the nearest whole dollar/input code 0)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Capstone, Inc. is preparing its budget for the coming year, 2020. The first step is to plan for the first quarter of that coming year. Capstone, Inc. gathered the following information from the managers. Sales Unit sales for November 2019 112500 Unit sales for December 2019 104,000 Expected unit sales for January 2020 116,000 Expected unit sales for February 2020 115,500 Expected unit sales for March 2020 117,000 Expected unit sales for April 2020 135,000 Expected unit sales for May 2020 145,000 Unit selling price $13.00 Capstone, Inc. likes to keep 10% of the next month’s unit sales in ending inventory. All sales are on account. 85% of the Accounts Receivable are collected in the month of sale, and 15% of the Accounts Receivable are collected in the month after sale. Accounts receivable on December 31, 2019,…arrow_forwardYou are to create a debtor ageing summary report for the year 2017/2018 for the CEO. Forecasted Sales figure for 2017/18 = 16,971,236 Using the percentages provided – calculate the figures for the report. After you have finished your yearly calculations you will then need to break down equally per quarter. Debtors ageing budget The historical records show that the debtors balance at the end of each quarter is usually about 20% of the quarter’s sales. At any time in the debtor’s balances 1% of the total debtors is overdue 90 days and over, 5% is 60 days overdue, 10% is 30 days overdue and the balance of the total debtors is current. The aged debtors’ budgets are only distributed to the accountant and the accounts receivable clerk. Aged debtors Aged Debtors Budget 2017/2018 Total Yearly Qtr. 1 Qtr. 2 Qtr. 3 Qtr. 4 Sales x,xxx x,xxx x,xxx x,xxx x,xxx % Debtors Sales % % % % Total Debtors % Calculation Calculation Calculation…arrow_forwardThe SK Industries, Inc. manufactures and sells two products, Accel Active and Accel Regular. In September 2018, SK Industries Budget Department gathered the following data in order to prepare budgets for 2019: 2019 Projected Sales Product Accel Active 45,000|s225 |Units Price Accel Regular 75,000 S1s5 Expected Target Inventories Product January 1, 2019 December 31, 2019 Accel Active 9,000 12,000 Accel Regular 17,000 25,000 The following direct materials are expected to be used in the two products: Material Used per Unit Direct Material Unit Accel Active Accel Regular pound One 6. Two pound 4 2 Three pound Projected data for 2019 with respect to direct materials are as follows: Direct Material Expected Purchase PriceExpected Inventories Target Inventories (January 1, 2019) (December 31, 2019) One $15 27,000 lb 35,000 lb Two S7 30,000 lb 35,000 lb Three $4 4,000 lb 7,000 lb Projected direct labor requirements and rates for 2019 are as follows: Product Hours Per Unit Rate Per Hour Accel…arrow_forward

- please give me answerarrow_forwardCrane Company has accumulated the following budget data for the year 2022. 1. Sales: 31,100 units, unit selling price $85. 2. Cost of one unit of finished goods: direct materials 1 pound at $5 per pound, direct labor 3 hours at $12 per hour, and manufacturing overhead $6 per direct labor hour. 3. Inventories (raw materials only): beginning, 10,100 pounds; ending, 15,100 pounds. 4. Selling and administrative expenses: $170,000; interest expense: $30,000. 5. Income taxes: 20% of income before income taxes.arrow_forwardScannell, Inc. sells tire rims. Its sales budget for the nine months ended September 30, 2024, and additional information follow: (Click the icon to view the budget.) (Click the icon to view additional information.) Prepare an inventory, purchases, and cost of goods sold budget for each of the first three quarters of the year. Compute cost of goods sold for the entire nine-month period. Plus: Less: More info Scannell, Inc. Inventory, Purchases, and Cost of Goods Sold Budget Nine Months Ended September 30, 2024 Quarter Ended March 31 In the past, cost of goods sold has been 40% of total sales. The director of marketing and the financial vice president agree that each quarter's ending inventory should not be below $15,000 plus 10% of cost of goods sold for the following quarter. The marketing director expects sales of $200,000 during the fourth quarter. The January 1 inv ory was $19,000. Print Done X Data table Cash sales, 30% Credit sales, 70% Total sales $ $ Quarter Ended June 30…arrow_forward

- How much should this company expect in cash collections for the month of January? ROUND TO NEAREST WHOLE DOLLARarrow_forwardPaddle Up, a retailer of paddle boards, has provided you with the following information: Budgeted Sales (units) February 2022 150 March 2022 110 April 2022 70 a) Paddle Up sells each board for $400 and purchases each board for $250. b) Paddle Up plans to maintain inventory on hand at the end of each month to be 20% of next month's sales volume. You can assume this to be the situation at the end of January 2022. c) 40% of sales are made on cash basis with the remaining 60% - on credit. All credit sales are collected in the month following the sale. d) 50% of inventory purchases are made on cash basis with the remaining 50% - on credit. All credit purchases are paid in the month following the purchase. e) The following cash expenses are incurred on a monthly basis: Rent ($5,300); Wages ($5,400); Utilities ($2,100); Insurance ($600). The business also recognises $3,000 of depreciation expense each month. f) The monthly drawings by the owner Paddle Up include: $2,000 cash and 1 board for…arrow_forwardThe income statement for the first quarter of 2019 was as follows: Income Statement For the Quarter Ended March 31, 2019 Sales Cost of goods sold Gross profit Operating expenses ales salaries Rent expense Depreciation Utilities Miscellaneous Total operating expenses Net income $52,000 24,000 12,000 3,600 12,800 $720,000 396,000 324,000 104,400 $219,600 Prepare a budgeted quarterly income statement in tabular form for the first quarter of 2020.arrow_forward

- Here are some important figures from the budget of Cornell, Inc., for the second quarter of 2020: April May June Credit sales $ 312,000 $ 292,000 $ 352,000 Credit purchases 120,000 143,000 168,000 Cash disbursements Wages, taxes, and expenses 43,200 10,700 62,200 Interest 10,200 10,200 10,200 Equipment purchases 72,000 134,000 0 The company predicts that 5 percent of its credit sales will never be collected, 40 percent of its sales will be collected in the month of the sale, and the remaining 55 percent will be collected in the following month. Credit purchases will be paid in the month following the purchase. In March 2020, credit sales were $182,000, and credit purchases were $122,000. Using this information, complete the following cash budget. (Do not round intermediate calculations.)arrow_forwardThe Clinton Antique Mall expects to make purchases in the first quarter of 2021 as follows: January $114,000 February 144,000 March 102,000 Purchases in December 2020 are expected to be $109,600. The company expects that 50 percent of a month's purchases will be paid in the month of purchase and 50 percent will be paid in the following month. Estimate cash disbursements related to purchases for each month of the first quarter of 2021. Cash disbursements for purchases Payment of December purchases $ Payment of January purchases Payment of February purchases Payment of March purchases $ January $ $ February $ March Activate Go to Settiarrow_forward3. Cash collection for month of February. SHOW WORK.arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education