SWFT Essntl Tax Individ/Bus Entities 2020

23rd Edition

ISBN: 9780357391266

Author: Nellen

Publisher: Cengage

expand_more

expand_more

format_list_bulleted

Question

Christina had a $12,000 gain on the sales solution this accounting questions

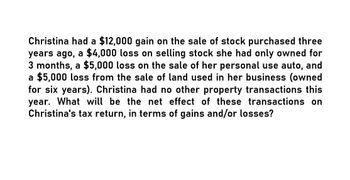

Transcribed Image Text:Christina had a $12,000 gain on the sale of stock purchased three

years ago, a $4,000 loss on selling stock she had only owned for

3 months, a $5,000 loss on the sale of her personal use auto, and

a $5,000 loss from the sale of land used in her business (owned

for six years). Christina had no other property transactions this

year. What will be the net effect of these transactions on

Christina's tax return, in terms of gains and/or losses?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Martha is a self-employed tax accountant who drives her car to visit clients on a regular basis. She drives her car 4,000 miles for business and 10,000 for commuting and other personal use. Assuming Martha uses the standard mileage method, how much is her auto expense for the year? Where in her tax return should Martha claim this deduction? _________________________________________________ _______________________________________________________________________________ _______________________________________________________________________________arrow_forwardChelsea, who is single, purchases land for investment purposes in 2014 at a cost of 22,000. In 2019, she sells the land for 38,000. Chelseas taxable income without considering the land sale is 100,000. What is the effect of the sale of the land on her taxable income, and what is her tax liability?arrow_forwardLast year Aleshia identified 15,000 as a nonbusiness bad debt. In that tax year, before considering the tax implications of the nonbusiness bad debt, Aleshia had 100,000 of taxable income, of which 12,000 consisted of short-term capital gains. This year Aleshia collected 8,000 of the amount she had previously identified as a bad debt. Determine Aleshias tax treatment of the 8,000 received in the current tax year.arrow_forward

- Anh is single, has no dependents, and itemizes deductions. In the current year for regular tax purposes, she records 60,000 of income and 105,000 of deductions and losses, primarily from business activities. Included in the losses are 30,000 of AMT preferences. Given this information, what are Anhs regular tax and alternative tax NOL amounts?arrow_forwardOtto and Monica are married taxpayers who file a joint tax return. For the current tax year, they have AGI of $80,300. They have excess depreciation on real estate of $67,500, which must be added back to AGI to arrive at AMTI. The amount of their mortgage interest expense for the year was $25,000, and they made charitable contributions of $7,500. If Otto and Monica's taxable income for the current year is $47,800 determine the amount of their AMTI. _______________________________________________________________________arrow_forwardSheila, a single taxpayer, is a retired computer executive with a taxable income of 100,000 in the current year. She receives 30,000 per year in tax-exempt municipal bond interest. Adam and Tanya are married and have no children. Adam and Tanyas 100,000 taxable income is comprised solely of wages they earn from their jobs. Calculate and compare the amount of tax Sheila pays with Adam and Tanyas tax. How well does the ability-to-pay concept work in this situation?arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you