College Accounting, Chapters 1-27

23rd Edition

ISBN: 9781337794756

Author: HEINTZ, James A.

Publisher: Cengage Learning,

expand_more

expand_more

format_list_bulleted

Question

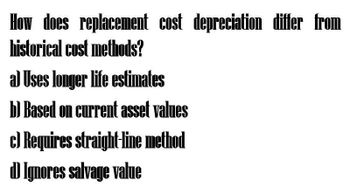

Transcribed Image Text:How does replacement cost depreciation differ from

historical cost methods?

a) Uses longer life estimates

b) Based on current asset values

c) Requires straight-line method

DIgnores salvage value

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- A) What is residual value? Support your answer with an example ( word count 100) B) In practise, would you expect the depreciation expense for a non-current asset to be overestimated or underestimated? Explain why this is the case.arrow_forwardWhich of the following depreciation methods will result in the most depreciation expense over the life of an asset? Select one: a. Double-declining balance method b. All three methods will result in the same amount of depreciation expense. c. Units-of-production method d. Straight-line method e. Cannot be determined from the information given.arrow_forwardWhich of the following is not a factor in computing depreciation for a period? present value residual value method of cost allocation service lifearrow_forward

- Which of the following depreciation methods most closely approximates the method used to deplete the cost of natural resource? a. Straight-line method b. Double-declining-balance method c. Either the cost model or the revaluation model d. The recoverable amount modelarrow_forward1. Depreciation is best described as a method of a. Asset valuation b. Current value allocation Cost allocation C. d. Useful life determination 2. All of the following factors are considered in determining the useful life of an asset, except a. Expected usage of the asset b. Expected physical wear and tear c. Technical obsolescence d. Residual value 3. Technical or commercial obsolescence arises from a. Expected usage of the asset b. c. Expected physical wear and tear Change or improvement in production or change in the market demand for the product output of the asset d. Expiry date of related lease of the asset 4. The production method of depreciation results in a. Constant charge over the useful life of the asset. b. Decreasing charge over the useful life of the asset. c. Increasing charge over the useful life of the asset. d. Variable charge based on the expected use or output of the asset. 5. What factor must be present under the production method of depreciation? a. Total units…arrow_forwardIs residual value deductible when using accelerated method of depreciation>arrow_forward

- When a number of low-cost depreciable assets with similar characteristics, service lives, and residual values is required, which depreciation method should be used? a. Compsite depreciation b. Replacement depreciation c. Group depreciation d. Retirement depreciationarrow_forwardwhat is Intangible Asset ? what is Wasting Assets ? what is Asset Cost ? what is Residual Value? and what are : e) Depreciation Base f) Book Value g) Historical Cost ? and also what is Basket Purchase of Non- Current Operating Assets.?arrow_forwardWhat is a relevant cost? Explain why depreciation on an existing asset is always irrelevant.arrow_forward

- Which of the following answers is the correct formula for determining the historical cost of an asset? Select one: O a. historical cost = original value of the asset - accumulated depreciation. O b. historical cost = the basic purchase price of the asset minus any other costs necessary to prepare the asset ready for use. O c. historical cost = the basic purchase price of the asset plus any other costs necessary to prepare the asset ready for use. O d. historical cost = the basic purchase price of the asset only.arrow_forwardExplain the historical cost concept as it applies to long-term operational assets. Why is the book value of an asset likely to be different from the current market value of the asset?arrow_forwardIn calculating depreciation, both the long-lived asset's cost and useful life are based on estimates. Select one: O True O Falsearrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning, Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning Financial Reporting, Financial Statement Analysis...FinanceISBN:9781285190907Author:James M. Wahlen, Stephen P. Baginski, Mark BradshawPublisher:Cengage Learning

Financial Reporting, Financial Statement Analysis...FinanceISBN:9781285190907Author:James M. Wahlen, Stephen P. Baginski, Mark BradshawPublisher:Cengage Learning

College Accounting, Chapters 1-27

Accounting

ISBN:9781337794756

Author:HEINTZ, James A.

Publisher:Cengage Learning,

Cornerstones of Cost Management (Cornerstones Ser...

Accounting

ISBN:9781305970663

Author:Don R. Hansen, Maryanne M. Mowen

Publisher:Cengage Learning

Financial Reporting, Financial Statement Analysis...

Finance

ISBN:9781285190907

Author:James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:Cengage Learning