FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

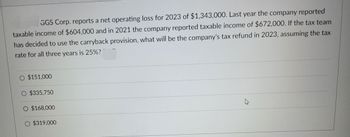

Transcribed Image Text:GGS Corp. reports a net operating loss for 2023 of $1,343,000. Last year the company reported

taxable income of $604,000 and in 2021 the company reported taxable income of $672,000. If the tax team

has decided to use the carryback provision, what will be the company's tax refund in 2023, assuming the tax

rate for all three years is 25%?

O $151,000

O $335,750

O $168,000

O $319,000

K

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- ess Your answer is incorrect. During 2020, Coronado Inc. had sales revenue $1368000, gross profit $730300, operating expenses $497000, cash dividends $92300, other expenses and losses $41200. Its corporate tax rate is 30%. What was Coronado's income tax expense for the year? O $57630 O $497000 O $186900 O $62300 Save for Later Last saved 30 seconds ago. Attempts: 2 of 4 used Submit Answer Saved work will be auto-submitted on the due date. Auto- submission can take up to 10 minutes. MacBook Proarrow_forwardThe Accrual Basis of Accounting-Expense? For each of the following separate situations, determine the amount of expense each company should recognize in December (using accrual basis accounting). a. Chipotle has monthly wages expense of $3,200 that has been incurred but not paid as of December 31. b. United Airlines purchases a 24-month insurance policy for $48,000 on December 1 for immediate coverage. c. On December 15, Pfizer prepays $20,000 for hotel rooms for its January sales meeting. Explain your answer. a. b. C. 1arrow_forwardZYX Inc has average gross receipts of $40 million per year over the last several years. In the current year, ZYX has $2,000,000 of taxable income before considering interest.ZYX has $150,000 of business interest income, S1, 200,000 of interest expense, and no floor plan financing. How much interest expense can ZYX deduct?arrow_forward

- You have calculated the adjusted profit for the company to be $2,000,000. Capital Allowance was $20,000. The tax rate is 25%.Estimated tax paid during the year is $750,000. Employment Tax Credit available (which is nonrefundable)is $700,000. The tax refundable for this company is.a. $950,000b. $500,000c. $250,000d. $200,000arrow_forwardWynn Farms reported a net operating loss of $180,000 for financial reporting and tax purposes in 2021. The enacted tax rate is 25%. Taxable income, tax rates, and income taxes paid in Wynn's first four years of operation were as follows: 2017 2018 Taxable Tax Income Rates $ 80,000 20% 90,000 20 Income Taxes Paid $16,000 18,000 2019 160,000 25 2020 80,000 35 40,000 28,000 Required: 1. Prepare the journal entry to recognize the income tax benefit of the net operating loss. NOL carrybacks are not allowed for most companies, except for property and casualty insurance companies as well as some farm-related businesses. Assume Wynn is one of those businesses. 2. Show the lower portion of the 2021 income statement that reports the income tax benefit of the net operating loss. Complete this question by entering your answers in the tabs below. Required 1 Required 2 Prepare the journal entry to recognize the income tax benefit of the net operating loss. NOL carrybacks are not allowed for most…arrow_forwardNeed Help with this Questionarrow_forward

- a. b Below are the taxable profits and losses for the past few years along with the tax rates on income reported for Olive Company. 2025 2026 2027 Income ($275,000) $70,000 $260,000 Tax Rate 20% 20% 20% Olive elects to use the carry forward procedures with no valuation allowance and strongly anticipates future profits to recover losses. Record the tax effect of the above for 2025 Show the income tax section and loss section of the income statement for 2025arrow_forwardIn 2020, Compton Ltd (Compton) incurred a loss of $1,260,000 for tax purposes, when the tax rate was 30%. Because the company had no prior taxable profit, it carried the entire loss forward. Considering the size of the tax loss, Compton management expected to recover only three-quarters of the tax loss by applying the tax loss to future taxable profit. On 1 January 2021, the income tax rate increased from 30% to 32%. In 2022, it expects that the reminder of the tax loss created in 2020 can fully recover by future taxable profits. Compton has a year end of 31 December. Required: Which of the following statement is considered not true in accordance with HKAS 12 ‘Income Taxes’? A. Deferred tax assets should be adjusted upward to $94,500 in 2022 B. Deferred tax assets and liabilities as at start of 2021 should be adjusted upward C. Deferred tax assets in January 2021 should be increased by $18,900 D. 75% of the tax loss in 2020 will be recognized as deferred…arrow_forwardAt the end of 2021, Schrutte Inc. in its first year of operations, had pretax financial income of $650,000. The company had extra depreciation taken for tax purposes in the amount of $975,000. Estimated expenses that were deducted for financial income but not yet paid amounted to $425,000. It is estimated that the expenses will be paid in 2022. The tax rate for all years is 25% In the journal entry at the end of the year that records income tax expense, deferred taxes and income taxes payable, what is the entry to the Income Tax Payable account? Question 19 options: a) credit Income Tax Payable account by $162,500 b) credit Income Tax Payable account by $300,000. c) credit to Income Tax Payable account by $25,000. d) credit Income Tax Payable account by $512,500.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education