Excel Applications for Accounting Principles

4th Edition

ISBN: 9781111581565

Author: Gaylord N. Smith

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Question

Give me step by step solution and explanation.

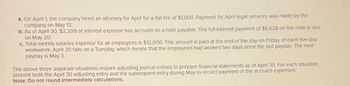

Transcribed Image Text:a. On April 1, the company hired an attorney for April for a flat fee of $1,000. Payment for April legal services was made by the

company on May 12

b. As of April 30, $2,209 of Interest expense has accrued on a note payable. The full interest payment of $6,628 on the note is due

on May 20

c. Total weekly salaries expense for all employees is $12,000. This amount is paid at the end of the day on Friday of each five-day

workweek. April 30 falls on a Tuesday, which means that the employees had worked two days since the last payday. The next

payday is May 3.

The above three separate situations require adjusting journal entries to prepare financial statements as of April 30. For each situation,

present both the April 30 adjusting entry and the subsequent entry during May to record payment of the accrued expenses.

Note: Do not round Intermediate calculations.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Adams, Inc., pays its employees weekly wages in cash. A supplementary payroll sheet that lists the employees names and their earnings for a certain week is shown below. Complete the payroll sheet by calculating the total amount of payroll and indicating the least possible number of denominations that can be used in paying each employee. However, no employees are to be given bills in denominations greater than 20.arrow_forwardOn December 1 of the current year, Jordan Inc. assigns 125,000 of its accounts receivable to McLaughlin Company for cash. McLaughlin Company charges a 750 service fee, advances 85% of Jordans accounts receivable, and charges an annual interest rate of 9% on any outstanding loan balance. Prepare the related journal entries for Jordan.arrow_forwardIn the space provided below, prepare the journal entry to record the November payroll for all employees assuming that the payroll is paid on November 30 and that Joness cumulative gross pay (cell I13) is 85,000.arrow_forward

- On December 1 of the current year, Jordan Inc. assigns 125,000 of its accounts receivable to McLaughlin Company for cash. McLaughlin Company charges a 750 service fee, advances 85% of Jordans accounts receivable, and charges an annual interest rate of 9% on any outstanding loan balance. Prepare the related journal entries for Jordan. Refer to RE6-10. On December 31, Jordan Inc. received 50,000 on assigned accounts. Prepare Jordans journal entries to record the cash receipt and the payment to McLaughlin.arrow_forwardWallace Corporation summarizes the following information from its weekly payroll records during April. Prepare the two journal entries to record the payment of the payroll and the accrual of its payroll taxes for April. Assume an 8% FICA rate for both employees and the employer. Also assume a 5.4% state unemployment tax rate, a 0.6% federal unemployment tax rate, and that all wages are subject to all payroll taxes. Round to the nearest dollar.arrow_forwardIrina Company pays its employees weekly. The last pay period for 20-1 was on December 28. From December 28 through December 31, the employees earned 1,754, so the following adjusting entry was made: The first pay period in 20-2 was on Januar)-4. The totals line from Irina Companys payroll register for the week ended Januar)-4, 20-2, was as follows: REQUIRED 1. Prepare the journal entry for the payment of the payroll on January 4, 20-2. 2. Prepare T accounts for Wages and Salaries Expense and Wages and Salaries Payable showing the beginning balance, January 4, 20-2, entry, and aiding balance as of January 4, 20-2.arrow_forward

- During the third calendar quarter of 20--, the Beechtree Inn, owned by Dawn Smedley, employed the persons listed below. Also given are the employees salaries or wages and the amount of tips reported to the owner. The tips were reported by the 10th of each month. The federal income tax and FICA tax to be withheld from the tips were estimated by the owner and withheld equally over the 13 weekly pay periods. The employers portion of FICA tax on the tips was estimated as the same amount. Employees are paid weekly on Friday. The following paydays occurred during this quarter: Taxes withheld for the 13 paydays in the third quarter follow: Based on the information given, complete Form 941 on the following pages for Dawn Smedley. Phone number: (901) 555-7959 Date filed: October 31, 20--arrow_forwardA weekly payroll summary made from labor time records shows the following data for Pima Company: Overtime is payable at one-and-a-half times the regular rate of pay and is distributed to all jobs worked on during the period. a. Determine the net pay of each employee. The income taxes withheld for each employee amount to 15% of the gross wages. b. Prepare journal entries for the following: 1. Recording the payroll. 2. Paying the payroll. 3. Distributing the payroll. (Assume that the overtime premium will be charged to all jobs worked on during the period.) 4. The employers payroll taxes. (Assume that none of the employees has achieved the maximum wage bases for FICA and unemployment taxes.)arrow_forwardAccounting for bonus and vacation pay Cathy Muench a factory worker, earns 1,000 each week. In addition, she will receive a 4,000 bonus at year-end and a four-week paid vacation. Prepare the entry to record the weekly payroll and the costs and liabilities related to the bonus and the vacation pay, assuming that Muench is the only employee.arrow_forward

- On January 21, the column totals of the payroll register for Great Products Company showed that its sales employees had earned 14,960, its truck driver employees had earned 10,692, and its office employees had earned 8,670. Social Security taxes were withheld at an assumed rate of 6.2 percent, and Medicare taxes were withheld at an assumed rate of 1.45 percent. Other deductions consisted of federal income tax, 3,975, and union dues, 560. Determine the amount of Social Security and Medicare taxes withheld and record the general journal entry for the payroll, crediting Salaries Payable for the net pay. All earnings were taxable. Round amounts to the nearest penny.arrow_forwardAn analysis of the payroll for the month of November for CinMar Inc. reveals the information shown: All regular time Andrews, Lomax, and Herzog are production workers, and Dimmick is the plant manager. Hendrick is in charge of the office. Cumulative earnings paid (before deductions) in this calendar year prior to the payroll period ending November 8 were as follows: Andrews, 21,200; Lomax, 6,800; Herzog, 11,500; Dimmick, 116,200; and Hendrick, 32,800. The solution to this problem requires the following forms, using the indicated column headings: 1. Prepare an employee earnings record for each of the five employees. 2. Prepare a payroll record for each of the four weeks. 3. Prepare a labor cost summary for the month. 4. Prepare journal entries to record the following: a. The payroll for each of the four weeks. b. The payment of wages for each of the four payrolls. c. The distribution of the monthly labor costs per the labor cost summary. d. The company's payroll taxes covering the four payroll periods.arrow_forwardOn September 30, Cody Companys selected account balances are as follows: In general journal form, prepare the entries to record the following: Oct. 15Payment of liabilities for FICA taxes and the federal income tax. 31Payment of liability for state unemployment tax. 31Payment of liability for federal unemployment tax.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Excel Applications for Accounting PrinciplesAccountingISBN:9781111581565Author:Gaylord N. SmithPublisher:Cengage Learning

Excel Applications for Accounting PrinciplesAccountingISBN:9781111581565Author:Gaylord N. SmithPublisher:Cengage Learning Financial AccountingAccountingISBN:9781305088436Author:Carl Warren, Jim Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781305088436Author:Carl Warren, Jim Reeve, Jonathan DuchacPublisher:Cengage Learning College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College Pub

College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College Pub

College Accounting (Book Only): A Career ApproachAccountingISBN:9781305084087Author:Cathy J. ScottPublisher:Cengage Learning

College Accounting (Book Only): A Career ApproachAccountingISBN:9781305084087Author:Cathy J. ScottPublisher:Cengage Learning Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Excel Applications for Accounting Principles

Accounting

ISBN:9781111581565

Author:Gaylord N. Smith

Publisher:Cengage Learning

Financial Accounting

Accounting

ISBN:9781305088436

Author:Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:Cengage Learning

College Accounting (Book Only): A Career Approach

Accounting

ISBN:9781337280570

Author:Scott, Cathy J.

Publisher:South-Western College Pub

College Accounting (Book Only): A Career Approach

Accounting

ISBN:9781305084087

Author:Cathy J. Scott

Publisher:Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:Cengage Learning