FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

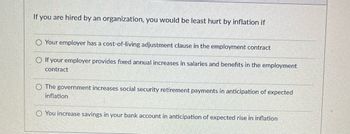

Transcribed Image Text:If you are hired by an organization, you would be least hurt by inflation if

Your employer has a cost-of-living adjustment clause in the employment contract

If your employer provides fixed annual increases in salaries and benefits in the employment

contract

The government increases social security retirement payments in anticipation of expected

inflation

O You increase savings in your bank account in anticipation of expected rise in inflation

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- A taxpayer has a pension income of £3,100 a month and savings income of £1000. What is the personal savings allowance available? £0 £1,000 £500 £5,000arrow_forwardSuppose a wealthy individual approaches you and says, “Because of your outstanding ability to manage money, I am prepared to present you with a tax-free gift of $1,000. If you prefer, however, I will postpone the presentation for a year, at which time I will guarantee that you will receive a tax-free gift of $X.” (For purposes of this example, assume that the guarantee is risk-free.) In other words, you can choose to receive $1,000 today or receive $X 1 year from today. Which would you choose if X equals (1) $1,000, (2) $1,050, (3) $1,100, (4) $1,500, (5) $2,000, (6) $5,000, (7) $10,000, (8) $100,000? Suppose the student is guaranteed to receive $1,100 one year from today, and nothing thereafter, if $1,000 is invested today in a particular venture. What is the return on the student’s investment?arrow_forwardBankrate.com reported on a shocking statistic: only 54% of workers participate in their company's retirement plan. This means that 46% do not. With such an uncertain future for Social Security, this can leave almost 1 in 2 individuals without proper income during retirement. Jill Collins, 20, decided she needs to have $280,000 in her retirement account upon retiring at 60. How much does she need to invest each year at 5% compounded annually to meet her goal? (Please use the following provided Table) (Do not round intermediate calculations. Round your answer to the nearest dollar amount.) i.......... Each year investmentarrow_forward

- Munabhaiarrow_forwardConsider the following conditions:(a) In your new job you are paid each month, instead of weekly.(b) The rate of interest on bonds and other financial assets rises.(c) An automatic teller machine (ATM) is installed next door and you have a debit card.(d) Bond prices are expected to fall.Would you decide to increase or decrease your average holding of money (i.e. cash and/orcheque deposit balances)? Which of the three motives for holding money is involved in eachcase?arrow_forwardIn 2000, the ratio of people age 65 or older to people ages 20 to 64 in Ecocountry was 38,4 %. In the year 2060, this ratio is expected to be 56,8 %. Assuming a pay- as-you-go Social Security system, a) What change in the payroll tax rate between 2000 and 2060 would be needed to maintain the 2000 ratio of benefits to wages? b) If the tax rate were kept constant, what would happen to the ratio of benefits to wages? c) What other policies can be used for Social Security Reform?arrow_forward

- Which of the following is considered an annuity? OA share of common stock. A conventional fixed payment mortgage. A construction loan with varying costs and payments. A cash payment for a new car. O A savings account with occasional deposits for a newborn child.arrow_forwardYour employer asks you to consult on the better approach to a decision. What should the corporation pay for an asset that will return them $150,000 at the end of year 1, then zero in year 2, then $400,000 in years 3 & 4, then zero in year 5, then $200,000 in years 6-10, assuming their discount rate is 3% (ignoring taxes) ?arrow_forwardthe concept "pay yourself first". With this in mind, what is your advice to someone on paying off credit card debt and investing for their retirement? Do you feel as though they should pay off all credit card debt before investing for their retirement or is it best to start investing for retirement as soon as possible? Why? * 350 word minimumarrow_forward

- Subject - account Please help me. Thankyou .arrow_forward"As of today, Americans live on average 20 more years after retiring, which calls for well-designed retirement plans. There are different ways to save for retirement, such as retirement plans offered by the employer, savings and investments, and Social Security among other. " (Norrestad, 2021) Lifetime Savings Accounts, known as LSAS, would allow people to invest after-tax money without being taxed on any gains. If an engineer invests $10,000 now and $10,000 each year for the next 15 years, how much will be in the account immediately after the last deposit if the account grows by 8% per year? All the alternatives resented below were calculated using compound interest factor tables including all decimal places. O $271,521 O $303,243 $427,533 $359,497arrow_forwardJoe wants to own a home in the future. He asks you describe an advantages and disadvantage of a FRM versus an ARM. He then asks you to describe the advantages and disadvantages of a 15-year loan versus a 30-year loan. He also wants to know how the portion of the home payment that comprises interest changes over the years assuming he takes out an FRM. Is there anything he can do to reduce the total amount he’ll pay for the home? What else would be added to his monthly mortgage payment? What are three benefits of home ownership? What are three benefits of renting?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education