EBK CONTEMPORARY FINANCIAL MANAGEMENT

14th Edition

ISBN: 9781337514835

Author: MOYER

Publisher: CENGAGE LEARNING - CONSIGNMENT

expand_more

expand_more

format_list_bulleted

Question

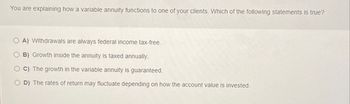

Transcribed Image Text:You are explaining how a variable annuity functions to one of your clients. Which of the following statements is true?

A) Withdrawals are always federal income tax-free.

B) Growth inside the annuity is taxed annually.

C) The growth in the variable annuity is guaranteed.

D) The rates of return may fluctuate depending on how the account value is invested.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 4 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- Scenario 1: Individual Retirement Accounts (IRAs) allow people to shelter some of their income from taxation. Suppose the maximum annual contribution to such accounts is $5,000 per person. Now suppose there is a decrease in the maximum contribution, from $5,000 to $3,000 per year. Shift the appropriate curve on the graph to reflect this change. This change in the tax treatment of interest income from saving causes the equilibrium interest rate in the market for loanable funds to and the level of investment spending to .arrow_forwardPlease answer fast I will rate for you sure....arrow_forwardWhich one of these statements related to growing annuities and perpetuities is correct? In computing the present value of a growing annuity, you discount the cash flows using the growth rate as the discount rate. You can compute the present value of a growing annuity but not a growing perpetuity. The future value of an annuity will decrease if the growth rate is increased. An increase in the rate of growth will decrease the present value of an annuity. The present value of a growing perpetuity will decrease if the discount rate is increased.arrow_forward

- In comparing an ordinary annuity and an annuity due, which of the following is true? a. The future value of an annuity due is always less than the future value of an otherwise identical ordinary annuity, since one less payment is received with an annuity due. b. The future value of an annuity due is always greater than the future value of an otherwise identical ordinary annuity. c. The future value of an ordinary annuity is always greater than the future value of an otherwise identical annuity due.arrow_forwardHow would an increase in the interest rate effect the present value of an annuity problem (all other variables remain the same)arrow_forwardwe compare the same regular monthly deposits made into an annuity due with an ordinary annuity with the same positive interest rate, and over the same period of time, the ordinary annuity will havE____lower pricesarrow_forward

- A financial analyst is treating a cash flow stream as a perpetuity. The present value of the perpetuity will __________ (increase, decrease, or not change) if the interest rate increases, and will ___________ (increase, decrease, or not change) if the growth rate increases.arrow_forwardThe larger the periodic payment of an annuity, the greater its present value. True or False?arrow_forwardIn the present value of an annuity due table, the factors ________. Group of answer choices decrease as the interest rates increase, given a set number of periods decrease as the periods increase, given a set interest rate increase as the periods decrease, given a set interest rate increase as the interest rates increase, given a set number of periodsarrow_forward

- ordinary annuity, annuity due, perpetuity, growing annuity or amortization topics. Then describe steps involved in calculating it and provide an example using your financial calculator. there is a difference between EAR and APR when compounding interest. Describe this difference. Assume you are a financial investor and have to advise a customer on the difference. How would you describe the differences to them and what would you advise?arrow_forwardWhich of the following is true about perpetuities? O All else equal, the present value of a perpetuity is higher when the interest rate is lower. O All of those three statements are true. O If two perpetuities have the same present value and the same interest rate, they must have the same cash flows. O All else equal, the present value of a perpetuity is higher when the periodic cash flow is higher.arrow_forwardConsider two annuities with the same payment frequency and term. If one is an ordinary annuity and the other is an annuity due, we can say that: both annuities will have the same number of payments the annuity due will have one extra payment the annuity due will have one less paymentarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:9781337514835

Author:MOYER

Publisher:CENGAGE LEARNING - CONSIGNMENT