Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

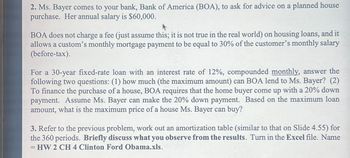

Transcribed Image Text:2. Ms. Bayer comes to your bank, Bank of America (BOA), to ask for advice on a planned house

purchase. Her annual salary is $60,000.

BOA does not charge a fee (just assume this; it is not true in the real world) on housing loans, and it

allows a custom's monthly mortgage payment to be equal to 30% of the customer's monthly salary

(before-tax).

For a 30-year fixed-rate loan with an interest rate of 12%, compounded monthly, answer the

following two questions: (1) how much (the maximum amount) can BOA lend to Ms. Bayer? (2)

To finance the purchase of a house, BOA requires that the home buyer come up with a 20% down

payment. Assume Ms. Bayer can make the 20% down payment. Based on the maximum loan

amount, what is the maximum price of a house Ms. Bayer can buy?

3. Refer to the previous problem, work out an amortization table (similar to that on Slide 4.55) for

the 360 periods. Briefly discuss what you observe from the results. Turn in the Excel file. Name

= HW 2 CH 4 Clinton Ford Obama.xls.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 4 steps with 5 images

Knowledge Booster

Similar questions

- Review the following scenario. Identify how much each lienholder would receive. Mrs. Smith takes out a $450,000 mortgage loan to construct her home. Unfortunately she loses her job and defaults on her payments, leading the lender to foreclose on her house. The lender only receives $375,000 at the foreclosure option. (Enter answers using exactly this format "$x,xxx.xx") $350,000 filed by mortgage lender in 2016 $20,000 filed by Court for lawsuit in 2012 $15,000 filed in 2018 for property taxes $10,000 filed by a contractor in 2014arrow_forwardYour brother is considering the purchase of a home rather than renewing the lease on his two-bedroom apartment. He is currently paying $800 per month for rent. He has asked you to help decide what sort of home he might be able to afford with his current monthly rent payment. His bank offers first-time home buyers (with good credit) a 25-year mortgage at a fixed rate of 8.95%. Use this information to answer the questions below. Express your answers rounded correctly to the nearest cent! () If the cost of insurance and property taxes is about $290 per month in the neighborhood where he'd like to live, what monthly mortgage payment can he afford? (Refer to your class notes for the formula.) Payment = $ 650 (i) Use Excel's P function to determine how much your sister could afford to borrow for a home. Amount to Borrow $ 629.9arrow_forwardAsher wants to buy a car that costs $29,660. He qualifies for a 4-year loan at a 2.8% annual interest rate, and he can afford a $500 monthly payment. What minimum down payment must Asher make to keep his monthly payment at or below $500? Round your answer to the nearest dollar. $6,980 $20,325 $22,680 $9,336arrow_forward

- Alan and Samantha Brown have a mortgage with the Bank of America. The bank requires the Browns to pay their homeowner's insurance, property taxes, and mortgage in one monthly payment to the bank. Their monthly mortgage payment is $1,450.30, their semi-annual property tax bill is $6,470, and their annual homeowner's insurance bill is $980. How much is the monthly payment they make to Bank of America?arrow_forwardYou are down on your luck and need a loan, quick! You locate Mr. Loa N. Shark who advertises weekly loans for “an almost imperceptibly small rate” of only 3%, prepaid at the time of the loan. You sign over your federal tax refund for $1,000 to Mr. Shark, with proof that it is correct and will be forth coming from the IRS in one week. Solve, a. How much money does Mr. Shark hand you? b. How much weekly interest are you really paying? c. What is the nominal annual interest rate? d. What is the effective annual interest rate?arrow_forwardMs. Dory asks Axis Bank to lend her Rs. 100 today. She says she will not be able to pay anything at the end of the first & second years but will pay the entire loan amount due at the end of 3rd year. Tenor Borrowing/Lending Rates 1 yr 3.5% 2 yr 5.5% 3 yr 7.5% What combination of products would enable Ms. Dory to ascertain the amount that should be repaid at the end of 3 years? Skiparrow_forward

- Michelle wants to borrow $4,500. Bank A will lend Michelle the money at a simple annual interest rate of 9% for 6 years. Bank B will lend her the money at 11% for 4 years. Which bank would charge Michelle the least amount of interest? Explain. Introarrow_forwardFinancial contracts involving investments, mortgages, loans, and so on are based on either a fixed or a variable interest rate. Assume that fixed interest rates are used throughout this question. Zoe deposited $900 in a savings account at her bank. Her account will earn an annual simple interest rate of 7%. If she makes no additional deposits or withdrawals, how much money will she have in her account in 13 years? O $967.41 $2,168.86 O $163.00 O $1,719.00 Now, assume that Zoe's savings institution modifies the terms of her account and agrees to pay 7% in compound interest on her $900 balance. All other things being equal, how much money will Zoe have in her account in 13 years? O $1,719.00 O $963.00 O $2,168.86 O $151.82arrow_forwardPlease see attachedarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education