FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

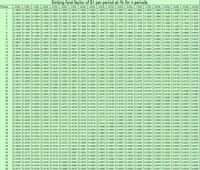

Transcribed Image Text:**Sinking Fund Factor Table**

The table below presents the sinking fund factor for $1 per period at different interest rates (%) for various periods (n).

**Sinking Fund Factor of $1 per Period at i% for n Periods**

| Period | 0.5% | 1.0% | 1.5% | 2.0% | 2.5% | 3.0% | 3.5% | 4.0% | 4.5% | 5.0% | 5.5% | 6.0% | 6.5% | 7.0% | 7.5% | 8.0% | 8.5% | 9.0% | 9.5% | 10.0% |

|--------|-------|-------|-------|-------|-------|-------|-------|-------|-------|-------|-------|-------|-------|-------|-------|-------|-------|-------|-------|

| 1 | 1.0000| 1.0000| 1.0000| 1.0000| 1.0000| 1.0000| 1.0000| 1.0000| 1.0000| 1.0000| 1.0000| 1.0000| 1.0000| 1.0000| 1.0000| 1.0000| 1.0000| 1.0000| 1.0000|

| 2 | 0.4988| 0.4975| 0.4963| 0.4951| 0.4939| 0.4928| 0.4916| 0.4904| 0.4892| 0.4878| 0.4866| 0.4853| 0.4842| 0.4829| 0.4817| 0.4805| 0.4793| 0.4781| 0.4769| 0.4756|

| 3 | 0.3317| 0.3290| 0.3264|

![### Financial Planning for Retirement

Recent statistics show that only 54% of workers participate in their company's retirement plan, meaning that 46% do not. This lack of participation presents a significant risk, as reliance on Social Security alone may leave individuals without adequate income during retirement years.

#### Example Calculation:

Let's consider an example to illustrate the importance of early investment for retirement.

**Case Study: Jill Collins**

- **Age:** 20 years old

- **Retirement Goal:** $280,000

- **Retirement Age:** 60 years

- **Annual Interest Rate:** 5% (compounded annually)

**Problem:** How much does Jill need to invest each year to achieve her retirement goal?

**Solution Steps:**

1. **Identify key variables:**

- Future Value (\( FV \)) = $280,000

- Annual interest rate (\( r \)) = 5% or 0.05

- Time period (\( t \)) = 60 - 20 = 40 years

2. **Use the Future Value of an Annuity formula:**

\[

FV = P \frac{(1 + r)^t - 1}{r}

\]

Where \( P \) is the annual investment.

Rearranging to solve for \( P \):

\[

P = \frac{FV \cdot r}{(1 + r)^t - 1}

\]

3. **Plug in the values:**

\[

P = \frac{280,000 \cdot 0.05}{(1 + 0.05)^{40} - 1}

\]

4. **Calculate intermediate steps:**

- \( (1 + 0.05)^{40} = 7.04 \) (approx.)

- \( 7.04 - 1 = 6.04 \)

5. **Compute the yearly investment:**

\[

P = \frac{280,000 \cdot 0.05}{6.04}

\]

6. **Final calculation:**

\[

P = \frac{14,000}{6.04} = 2319.87

\]

Therefore, Jill Collins would need to invest approximately **$2,320** each year (when rounded to the nearest dollar) to meet her retirement goal of $280](https://content.bartleby.com/qna-images/question/84e09e5b-10a3-44ad-9aa5-0e7c6771312d/cbde23ac-6b70-4ef8-9857-4f5e8a03d841/66km3c_thumbnail.png)

Transcribed Image Text:### Financial Planning for Retirement

Recent statistics show that only 54% of workers participate in their company's retirement plan, meaning that 46% do not. This lack of participation presents a significant risk, as reliance on Social Security alone may leave individuals without adequate income during retirement years.

#### Example Calculation:

Let's consider an example to illustrate the importance of early investment for retirement.

**Case Study: Jill Collins**

- **Age:** 20 years old

- **Retirement Goal:** $280,000

- **Retirement Age:** 60 years

- **Annual Interest Rate:** 5% (compounded annually)

**Problem:** How much does Jill need to invest each year to achieve her retirement goal?

**Solution Steps:**

1. **Identify key variables:**

- Future Value (\( FV \)) = $280,000

- Annual interest rate (\( r \)) = 5% or 0.05

- Time period (\( t \)) = 60 - 20 = 40 years

2. **Use the Future Value of an Annuity formula:**

\[

FV = P \frac{(1 + r)^t - 1}{r}

\]

Where \( P \) is the annual investment.

Rearranging to solve for \( P \):

\[

P = \frac{FV \cdot r}{(1 + r)^t - 1}

\]

3. **Plug in the values:**

\[

P = \frac{280,000 \cdot 0.05}{(1 + 0.05)^{40} - 1}

\]

4. **Calculate intermediate steps:**

- \( (1 + 0.05)^{40} = 7.04 \) (approx.)

- \( 7.04 - 1 = 6.04 \)

5. **Compute the yearly investment:**

\[

P = \frac{280,000 \cdot 0.05}{6.04}

\]

6. **Final calculation:**

\[

P = \frac{14,000}{6.04} = 2319.87

\]

Therefore, Jill Collins would need to invest approximately **$2,320** each year (when rounded to the nearest dollar) to meet her retirement goal of $280

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps with 3 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- June Xu is a registered nurse who earns $3,250 per month after taxes. She has been reviewing her savings strategies and current banking arrangements to determine if she should make any changes. June has a regular checking account that charges her a flat fee per month, writes an average of 18 checks a month, and carries an average balance of $795 (although it has fallen below $750 during 3 months of the past year). Her only other account is a money market deposit account with a balance of $4,250. She tries to make regular monthly deposits of $50–$100 into her money market account but has done so only about every other month. Of the many checking accounts June’s bank offers, here are the three that best suit her needs.• Regular checking, per-item plan: Service charge of $3 per month plus 35 cents per check.• Regular checking, flat-fee plan (the one June currently has): Monthly fee of $7 regardless of how many checks written. With either of these regular checking accounts, she can avoid…arrow_forward30 After reviewing her financial affairs, Jasmine has determined that she would like the $75,000 death benefit from one of her insurance policies to go to a local registered charity. The whole life policy in question has a $45,000 cash surrender value (CSV) and she pays an annual premium of $500. Jasmine's current cash flow situation is quite good. She is living a comfortable retirement. However, she is worried as she has assets, that of the taxes that will be payable after her death will result in considerable capital gains. She is unable to purchase a new life insurance to cover the income tax triggered at death because of her health. What should Jasmine do to fulfill her desire to donate $75,000 to the registered charity and alleviate the taxes payable following her death? NVBDQncreUJQWW1 Ya0w4cWZjYVhIQT09 → a. O Surrender the life insurance policy and donate the CSV. b. O Name the registered charity as beneficiary of the life insurance policy. c. O Assign the life insurance policy…arrow_forwardAn engineer will deposit 15% of her salary each year into a retirement fund. If her current annual salary is $80000 and she expects that it will increase by 5% (g) each year, what will be the present worth of the fund after 35 years if it earns 5% interest? (Answer: $400,000) Note:- Do not provide handwritten solution. Maintain accuracy and quality in your answer. Take care of plagiarism. Answer completely. You will get up vote for sure.arrow_forward

- 13–18. Bankrate.com reported on a shocking statistic: only 54% of workers participate in their company’s retirement plan. This means that 46% do not. With such an uncertain future for Social Security, this can leave almost 1 in 2 individuals without proper income during retirement. Jill Collins, 20, decided she needs to have $250,000 in her retirement account upon retiring at 60. How much does she need to invest each year at 5% compounded annually to meet her goal? Tip: She is setting up a sinking fund. PROVIDE THE FOLLOWING FOR EACH PROBLEM N= I= PV= PMT= FV= C/Y= P/Y =arrow_forwardBankrate.com reported on a shocking statistic: only 55% of workers participate in their company’s retirement plan. This means that 45% do not. With such an uncertain future for Social Security, this can leave almost 1 in 2 individuals without proper income during retirement. Jill Collins, 25, decided she needs to have $190,000 in her retirement account upon retiring at 60. How much does she need to invest each year at 4% compounded annually to meet her goal? (Please use the following provided Table.) (Do not round intermediate calculations. Round your answer to the nearest dollar amount.)arrow_forwardEngineering Econ: You’re looking at your parents’ retirement plans and studying the differences between their saving habits. On her thirty-first birthday, your mother Virginia invested $1,500 into her employer’s retirement plan, and she makes annual $1,500 payments for 10 years, so that her total contribution (principal) is $15,000. Your mother then stops making payments into her plan and keeps her money in the savings plan, untouched for 25 more years until retirement at age 65. Your father Anthony starts putting money aside on his forty-sixth birthday, when he deposits $2,000, and he continues these annual payments for 20 years until he reaches 65 years old. Thus, Anthony’s contributed principal amounts to $40,000 over this period of time. If Virginia’s and Anthony’s retirement plans both earn interest at a rate of 6% per year, compounded annually, then what is the difference in the future value of their savings when your parents turn 65? (e.g., FW(Virginia)-FW(Anthony)) Round…arrow_forward

- Angela wants to take the next five years off work to travel around the world. She estimates her annual cash needs at $34,000 (if she needs more, she will work odd jobs). Angela believes she can invest her savings at 8% until she depletes her funds. (Click the icon to view Present Value of $1 table.) of $1 table.) (Click the icon to view Future Value of $1 table.) of $1 table.) Read the requirements. (Click the icon to view Present Value of Ordinary Annuity (Click the icon to view Future Value of Ordinary Annuity Requirement 1. How much money does Angela need now to fund her travels? (Round your answer to the nearest whole dollar.) With the 8% interest rate, Angela needsarrow_forward1) Betty Smith (that scoundrel Bob’s wife) wants to save $500,000 in four years. She knows that Bob isno good and is planning on leaving him. She wants to make monthly deposits into an account thatpays 5%monthly. How much should she deposit at the end of each month? For those that are curious,Betty makes money by selling poodle prints. She dips her poodle in a giant ink well and presses it ontoa canvas. Dog lovers will buy anything.arrow_forwardYour uncle has $400,000 invested at 7.5%, and he now wants to retire. He wants to withdraw $35,000 at the end of each year, beginning at the end of this year. He also wants to have $25,000 left to give you when he ceases to withdraw funds from the account. What is the maximum number of $35,000 withdrawals that he can make and still have at least $25,000 left in the account? Round your answer to 2 decimal places. Select the correct answer. a. 26.15 b. 24.65 ○ c. 30.65 ○ d. 27.65 Oe. 29.15arrow_forward

- Hi I have a question regarding Austrlian Retirement and Financial Planning. In this example, the couple are retired and one of them is ill and looking for a retirement home, the home is going to cost $450,000 deposit. Neither of the couple work and draw 50,000 from their super in order to stay afloat. They have 20,000 and 562,000 in super combined, have a 900,000 dollar home. They also have 10,000 worth of home contents, a 15,000 dollar vehicle, and 55,000 cash in the bank. It is important to note they have 0 debt and everything is fully paid off. Neither of them have ever received pension money or government support. Myrtle wishes to put bob in an aged care facility, and when that is done she wants to return to work part time. 1. How will Myrtle's income be funded of $40,000 per annum be financed now, in the future and when she retires in 10 years time?arrow_forwardthat explains why Tim does or does not have enough money to pay $200 each month on his credit card. If he does have enough, give him some advice as to whether or not paying $200 each month on his credit card is a good idea. If he does not have enough, give him some advice about what he should do instead. Assume all of his taxes And expenses are as listed in #1-3, and assume that he is 20 years old and is wanting to retire at age 65. Tim will pay 5,812.5 for federal taxes 2,544.8 is the amount Tim takes home each month. Total monthly expenses= $2,15arrow_forwardImagine that you have worked every summer for the last four years in order to save money to buy a car. You have $23,000 deposited in a savings account at your local bank. One day, you turn on the news and discover that the stock market is crashing and people are rushing to banks to withdraw all of their money. Your best course of action is to:arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education