ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Question

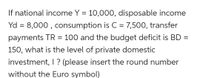

Transcribed Image Text:If national income Y = 10,000, disposable income

Yd = 8,000 , consumption is C = 7,500, transfer

payments TR = 100 and the budget deficit is BD =

150, what is the level of private domestic

investment, I ? (please insert the round number

without the Euro symbol)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Similar questions

- Because of the relationship between net capital outflow and net exports, the level of net capital outflow at the equilibrium real interest rate implies that the economy is experiencing (Balanced trade/ a trade deficit/ a trade surplus) Now, suppose the government is experiencing a budget deficit. This means that ( National saving will increase/ national saving will decrease/ Domestic investment will increase / domestic investment will decrease) which leads to ( an increase in the supply of / a decrease in the supply of / an increase in the demand for/ a decrease in the demand for) loanable funds. After the budget deficit occurs, suppose the new equilibrium real interest rate is 6%. The following graph shows the demand curve in the foreign-currency exchange market. Use the green line (triangle symbol) to show the supply curve in this market before the budget deficit. Then use the purple line (diamond symbol) to show the supply curve after the budget deficit. Summarize the…arrow_forwardSolution all part Very fast solution sent me and I give u thumarrow_forwardQuestion - , unofficial financial If the country's GDP is $2300, private saving is $200, net exports are account is $300, net transfers are -$100, primary budget deficit is $450, then investment is equal to $100.arrow_forward

- For upvote solve in one hourarrow_forwardSuppose that consumption is $2,800, investment is $500, and government spending is $600. The economy is closed so there are no net exports. Taxes are $450. Based on this information: National saving is $ Private saving is $ Government (public) saving is $ Enter whole numbers. « Previous Next ASUS 15 8arrow_forwardAn open economy with absolute mobility of capital is described as follows: consumption function is given as C = 50 + 0, 8(Y -T), where Y is output, andT is net taxes. Investment function is given as I = 20-10i, where I is nominal interest rate. Government spending G = 20, tax Tx = 10, export Ex = 6E + 10, import Im = 22-4E+0, 3Y where E- nominal exchange rate (price of foreign currency in terms of domestic currency). For one unit of foreign currency, you can get 3 units of domestic currency. The real money supply is M /P= 50. The demand for real money is described by the following function: L(Y,i) = 0, 5Y-10i. Suppose that the nominal exchange rate is fixed. The government has increased government spending by 10. What is the level of the exchange rate in the new external and internal equilibrium?arrow_forward

- or An economy is currently at it's steady state. Their depreciation rate is 6% and their capital stock is 1,830. What will be their level of investment? Do not round until your final answer, when you may round to two decimal places. Country A produces GDP according to the following equation: GDP = 5√K and has a capital stock of 10,351. If the country devotes 11% of its GDP to producing or repairing investment goods, how much is this country currently investing? Rounds your answer to two decimal places.arrow_forwardIf a country is experiencing a budget deficit and the government reduced spending, resulting in a balanced budget. How a country’s shift from budget deficit to balanced budget would affect its investments, economic growth, net capital outflow and currency exchange rate? Use diagrams where necessary?arrow_forwardEe 365.arrow_forward

- Graphs and questions in images. Thank you!arrow_forwardAn open economy with absolute mobility of capital is described as follows: consumption function is given as C = 50 + 0, 8(Y T), where Y is output, andT is net taxes. Investment function is given as I = 20–10i, where I is nominal interest rate. Government spending G = 20, taxTr = 10, export Ex = 6E+ 10, import Im= 22-4E+0, 3Y where E - nominal exchange rate (price of foreign currency in terms of domestic currency). For one unit of foreign currency, you can get 3 units of domestic currency. The real money supply is M /P=50. The demand for real money is described by the following function: L(Y, i) = 0, 5Y-10i. Find IS curve in the form Y=a-bi+cE, where a,b,c are constants. Type in the answer these constants with spaces and commas between them, that is: a, b, c.arrow_forwardIt is known that the economic data of a country is as follows: Y=C+I+G+NX, C=800+0.8(Yd), I=300-100r, G=2750, T=2900, NX=1500-600r a. Question: The balance of national income closed Economics and open economics, national saving, State Budget If r=10% b. If state spending increases by 150 from before, the question is the same as (a)arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education