ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Question

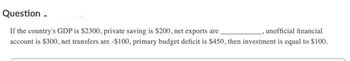

Transcribed Image Text:Question -

, unofficial financial

If the country's GDP is $2300, private saving is $200, net exports are

account is $300, net transfers are -$100, primary budget deficit is $450, then investment is equal to $100.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps with 14 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Similar questions

- Suppose that consumption is $2,800, investment is $500, and government spending is $600. The economy is closed so there are no net exports. Taxes are $450. Based on this information: National saving is $ Private saving is $ Government (public) saving is $ Enter whole numbers. « Previous Next ASUS 15 8arrow_forwarddo fast i will 5 upvotes. don't use chatgpt.arrow_forwardInstructions: Enter your answers as a whole number. If you are entering any negative numbers be sure to include a negative sign (-) in front of those numbers. (2) Aggregate Expenditures, Output (GDP = DI), Private Closed Economy, Billions (6) Aggregate Expenditures, Open Economy,. (5) Net Exports, (1) Real Domestic (3) Еxports, (4) Imports, Billions Billions Billions Billions Billions $300 $340 $30 $10 350 380 30 10 400 420 30 10 450 460 30 10 500 500 30 10 550 540 30 10 600 580 30 10 650 620 30 10 Net exports = $ billion Equilibrium GDP = $ billion d. What is the multiplier in this example?arrow_forward

- help please answer in text form with proper workings and explanation for each and every part and steps with concept and introduction no AI no copy paste remember answer must be in proper format with all workingarrow_forward. The government has proposed Rs1,289 billion for the defence budget for the year 2020-21, 5.1% more compared to last year’s revised defence estimates of Rs1,227 billion for the year 2019-20. If Government cut defence Budget, what happens to saving, investment, the trade balance, the interest rate, inflation rate and the exchange rate? And similarly, Government decreases the interest rate due to COVID-19 so explain what impact on consumption, investment and interest rate. Justify the answer with your own word and examples.arrow_forwardSuppose that the government decides to cut spending. In a three graphs diagram, show theimpact of this policy on real interest rate, national saving, investment, net capital outflows,demand for currency (NX), and supply of currency? Will the currency appreciate ordepreciate?arrow_forward

- National saving is equal to Y-T-C. Oa. True Ob. Falsearrow_forwardIf at a given real interest rate desired national saving is $115 billion, domestic investment is $60 billion, and net capital outflow is $40 billion, then at that real interest rate in the loanable funds market there is a A. surplus. The real interest rate will fall. B. surplus. The real interest rate will rise. C. shortage. The real interest rate will rise. D. shortage. The real interest rate will fall.arrow_forwardIn view of the large adverse impact of COVID-19 on the world economy, many governments have implemented expansionary fiscal policy. Together with a decrease in tax revenues, the governments have sufferedlarge deficits. How does a government deficit affect the interest rate, the quantity of loanable funds and economic growth? Explain your answers with a diagramarrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education