ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Question

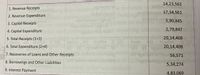

From the data given below calculate the revenue deficit?

Transcribed Image Text:14,23,563

Ohe domestic

indlaai Exchange

1. Revenue Receipts

cpxs 17,34,561

2. Revenue Expenditure=

5,90,845

imports

sibo eaqisss hna Penses pn

rotHos ast importing

Pomestic imtes

3. Capital Receipts

eme

4. Capital Expenditure

2,79,847

5. Total Receipts (1+3)

sta

20,14,408

2339

20,14,408

6. Total Expenditure (2+4)

20NIWOTIOO

7. Recoveries of Loans and Other Receipts

56,571

8. Borrowings and Other Liabilities

5,34,274

9. Interest Payment

the

4,83,069

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Similar questions

- Briefly explain what is a debt trap for a country?arrow_forwardHow fiscal policy tools differ in islamic economy?arrow_forwardUse some of the information below to determine which statement is TRUE. Corporate profits: 45 Depreciation: 28 Exports: 100 Government Purchases of Goods and Services: 320 Government Transfer Payments: 255 Gross Private Domestic Investment: 160 Imports: 119 (Net) Indirect Business Taxes: 7 Net Factor Payments to Rest of World: 25 Personal Consumption Expenditures: 626 Total government tax and fee revenue: 368 Wages and Salaries: 829 The trade deficit is 19 The trade deficit is 12 The trade deficit is 20 The trade surplus is 58 The trade surplus is 24arrow_forward

- Please answer the questions related to the national budget deficit in the United States. Which of the reasons given is often cited as a benefit of running a budget deficit? operating with a budget deficit lesses the impact of a recession budget deficits reduce tax costs for American workers working under deficit conditions helps to smooth out tax rates over time running a deficit helps to increase spending for public assistance programsarrow_forwardThe imaginary country of Acordia lists the following projected revenues and outlays for 2020: $30 million in personal income tax, $20 million in corporate income tax, $7 million in indirect taxes, $2 million in investment income, $35 million in transfer payments, $14 million in government expenditures, and $4 million in debt interest. What is the projected budget surplus (or deficit) for 2021? Calculate the amount and indicate whether it is a surplus or deficit.arrow_forwardWhat do you understand by the term Fiscal Policy?arrow_forward

- Which of the following might increase the government budget deficit? contractionary fiscal policy expansionary fiscal policy expansionary monetary policy contractionary monetary policyarrow_forwardChoose one: Ο Α. Ο OB. 3 O C. 4 O D. 18arrow_forwardCalculate the value of revenue deficit when the given values are:- Revenue expenditure = 140 Tax revenue = 60 Non tax revenue = 20arrow_forward

- What are the potential issues with fiscal policy?arrow_forwardAre we passing the national debt burden onto our children? Is this a problem?arrow_forwardSuppose that the amount of taxes in the US is equal to $1800. Suppose that the government expenditures is equal to $1800. In addition, you know that the current level of debt in the US is equal to $380000 (all numbers in billions of domestic currency). Given this data, what is the new level of the US's debt? $ Hint ow Transcribed Text $ Suppose that the amount of taxes in Slovenia is equal to 1300. Suppose that the government expenditures are equal to 1700 (All numbers in billions of domestic currency) Given this data, what can you say about Slovenia's budget? What is the size of Slovenia's deficit? Hint ow Transcribed Text 4 3 Consider the following statistics for banking sector in Mexico displayed in the table below (all numbers in billions of domestic currency). Coins and Currency in Circulation Checkable Deposits Traveler's Checks Hint 1400 1 1900 Savings Accounts 8600 Money Market Mutual Funds 500 Time Deposits 600 Using the data above, calculate M2 for Mexico. Use the new…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education