ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Question

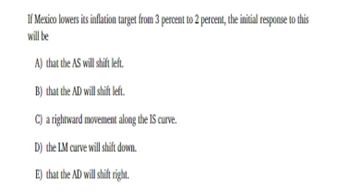

Transcribed Image Text:If Mexico lowers its inflation target from 3 percent to 2 percent, the initial response to this

will be

A) that the AS will shift left.

B) that the AD will shift left.

C) a rightward movement along the IS curve.

D) the LM curve will shift down.

E) that the AD will shift right.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Similar questions

- Use the following figure to answer the next question. Price Level AS AD₂ AD₁ Y₁ Y₂ Real GDP Suppose the economy is currently at full employment with aggregate demand curve AD2. A further increase in consumption and investment spending will cause Multiple Choice Odemand-pull Inflation, and the new equilibrium output will be less than Y2. O cost-push inflation, and the new equilibrium output will be less than Y2. 0 O cost-push inflation, and the new equilibrium output will be more than Y2. demand-pull inflation, and the new equilibrium output will be more than Y2. MacBook Pro 66 27 & + ✓ 8 9 R T Y U ull 0 0 LL F G H J Karrow_forwardConsider the classical AS-AD model with misperceptions. Assume that the economy is initially at its general equilibrium. Now, suppose the central bank considers an increase in the nominal money supply that is not anticipated by households or firms. b. How does the misperception theory work? c. Which of the three markets discussed in class is first affected (labor, goods, or asset market)? Explain and show graphically how this market is affected by an unanticipated increase in the nominal money supply.arrow_forwardQUESTION 7 Consider the following Taylor rule i=0.02+0.5y+0.5 (n- 2% ) where y is the percentage difference between the actual output and its full-employment level, while is inflation over the last 12 months. The evolution of the economy is described by the following data: Full-emp't output Actual output Price level January, 2050 February, 2050 March, 2050 100.00 100.00 100.00 100.00 101.41 99.52 100.00 102.31 104.71 April, 2050 Мay, 2050 100.00 101.31 102.58 100.00 100.10 99.64 June, 2050 100.00 101.89 100.07 July, 2050 August, 2050 September, 2050 October, 2050 100.00 100.55 100.71 100.00 100.83 99.20 100.00 99.75 98.40 100.00 99.95 101.82 November, 2050 100.00 98.54 98.83 December, 2050 100.00 97.52 98.68 100.00 97.43 percent. January, 2051 98.10 According to the Taylor rune, in January 2051 the central bank must have set the interest rate at Note: Type in your answer rounded to two decimal places, i.e., your answer must be of the form "999.99". I will not be able to fix correct…arrow_forward

- QUESTION 25 If the marginal propensity to consume is 0.75, the multiplier for taxes and transfer payments is: a. equal to 4. b. equal to 0.75. c. greater than 4. d. less than 4. QUESTION 26 If workers expect a lower rate of inflation, the short-run Phillips curve will: a. shift up. b. remain constant, but there will be a movement down the curve. c. shift down. d. be unaffected.arrow_forwardBrent, the international oil marker, hit US$130 a barrel on 8th March 2022. The oil price is close to 90 per cent above their level at the same point in time last year. Suppose that the rise in oil price is permanent. It creates an inflation shock and, at the same time, reduces potential output. With the aid of AD-AS model, show the difference in the effects of the oil price increase on output and the inflation rate in the long run if the government does not engage in stabilization policy and if the government does engage in stabilization policy to keep the inflation level low. Please elaborate your answer verbally.arrow_forwardConsider the classical AS-AD model with misperceptions. Assume that the economy is initially at its general equilibrium. Now, suppose the central bank considers an increase in the nominal money supply that is not anticipated by households or firms. a. How does the misperception theory work? b. Which of the three markets is first affected (labor, goods, or asset market)? Explain and show graphically how this market is affected by an unanticipated increase in the nominal money supply. c. Use the classical version of the AS-AD model with misperceptions to explain and to show graphically how an unanticipated increase in the nominal money supply affects the short-run equilibrium. d. Use the classical version of the AS-AD model with misperceptions to explain and to show graphically how an unanticipated increase in the nominal money supply affects the long-run (general) equilibrium.arrow_forward

- 1. Imagine an economy, where the SRAS in terms of inflation is given by II=5+Y, where Y is output. Imagine that the long run AS curve is given by Y=2. (25 marks) a) Give the equation of the AD curve (you can take liberties), if we assume that initially, the economy is at its long-run equilibrium. Justify. b) Imagine that your chosen AD curve's intercept goes up by one unit due to an expansionary monetary policy. What will be the new final equilibrium after this change? Justify. c) What will be the equilibrium after two periods of adjustment? Justify. d) Assume that before all the changes in the economy, in the initial, long-run equilibrium, the interest rate was 4 percent. Give an IS and an LM curve that are compatible with this initial equilibrium. Justify. e) What are the IS and LM curves going to be at the very end of the adjustment process, i.e., in the new long run equilibrium? Justify.arrow_forwardWhich of the following would cause the dynamic DAD curve to shift in (back)? A) a decrease in consumer confidence. B) a decrease in the inflation rate. C) an increase in consumer wealth. D) an increase in the short-run aggregate supply (SRAS) curve.arrow_forwardquestion 2: In Figure 2, what are the factors that may cause the aggregate demand to shift from AD to AD1? What is the difference between demand pull inflation, cost push inflation, and recession?arrow_forward

- We have discussed two models that describe the relationship between inflation and economicgrowth. Which of the following is a property of the New Keynesian Model but NOT the RealBusiness Cycle (RBC) Model?a.Monetary policy has no effect on long run economic growth b.Recessions can be caused by a fall in aggregate demand. c.Prices are fully flexible in both the short and long run. d.All the above are properties of the RBC model. e.None of the above are properties of the New Keynesian model.arrow_forwardAssume an economy that starts with Y = Y₂. Illustrate graphically and explain the impact of a fall in energy prices in the IS-LM-PC model with anchored expectations. Illustrate graphically, explain, and discuss the impact of the fall in energy prices depending on whether the central bank, firms, or workers have the power to adjust the economy to keep inflation at its target rate after the fall in energy prices. ་པཕབ་པ་arrow_forwardPrice Level LRAS I о, он ог Real GDP SRAS, SRAS SRAS₂ ON=Natural Real GDP AD Refer to Figure 9-3. If the economy is in short-run equilibrium at point C, the (actual) unemployment rate is less than the natural unemployment rate. the (actual) unemployment rate is equal to the natural unemployment rate. the (actual) unemployment rate is greater than the natural unemployment rate. the relationship between the (actual) unemployment rate and the natural unemployment rate cannot be determined from the available information.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education