ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Question

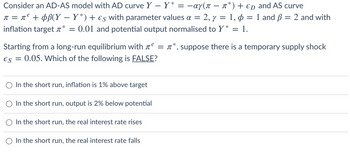

Transcribed Image Text:Consider an AD-AS model with AD curve Y - Y* = −αy(n − ñ*) + € and AS curve

π = π² + ¢ß(Y – Y*) + €s with parameter values a = 2, y = 1, p = 1 and ß = 2 and with

inflation target * = : 0.01 and potential output normalised to Y* :

= 1.

e

T

Starting from a long-run equilibrium with ² = *, suppose there is a temporary supply shock

€s = 0.05. Which of the following is FALSE?

In the short run, inflation is 1% above target

In the short run, output is 2% below potential

In the short run, the real interest rate rises

O In the short run, the real interest rate falls

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps with 8 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Similar questions

- Consider the ASAD model of a closed economy with zero ongoing inflation and workers misperceptions. Firms are perfectly competitive, produce output with diminishing marginal returns to labour and have perfect foresight over the price level. Workers, instead, expect zero inflation in each period. At time zero, the economy is in the potential equilibrium. There is a negative shock on aggregate demand – for example, a permanent fall in desired autonomous consumption at time t = 1. What are the effects of the shock on the equilibrium real wage in the short and in the medium run?arrow_forwarddid keynes believe that wages/prices were sticky in general-up and down? or just down?arrow_forwardcan you tell me if these answers are correct? they are true or false. 1)The output axis of the AD/AS curve is an approximation for the unemployment/employment level in the economy. -true 4) an increase in AD, given an upward sloping AS curve, will be inflationary, even beyond full employment output. -true 5) an increase in structural unemployment would be reflected as a shift of the vertical portion of the AS curve to the left- truearrow_forward

- Consider the short-term model characterized by the following AS and AD curves: Ý, = à – bm(x, – ñ) (AD] and A; = x; + vỶ, + õ, (AS). The economy is in steady state at time t = -1 (that is, a-1 = ñ, ō-1 = 0, and ā = 0). It is hit by a one-time inflation shock öy = .025 at time i = 0. For now, expectations are adaptive: 7 = ,-1. You'll use the answer to this question in several follow-up questions. To keep track of your results, you should use a spreadsheet application. If you don't already have one, you can use this hyperlinked template e (it's a Google Sheet). Calculate zo assuming b = 0.5, m = 2, ñ = 0.03, and ū = 1. Enter your answer as a percentage and round to the nearest hundredth.arrow_forwardConsider the ASAD model of a closed economy with zero ongoing inflation in the medium run. The aggregate demand curve is determined by the IS-LM model. The aggregate supply curve is derived from the imperfect competition model of the labour market (the WS-PS model where firms have perfect foresight, monopoly power, and use a linear technology with constant returns to labour; workers expect zero inflation in every period, and their wage requests are an increasing function of wage-push factors like unions' bargaining power). The economy is initially in the potential equilibrium. Assume a permanent increase in the bargaining power of unions. Fiscal and monetary authorities perfectly forecast this shock and decide to neutralize immediately its consequences for the price level by enacting a “policy of price stability” that successfully eliminates all fluctuations in the general price level in every period. Therefore, the economy is subject to two simultaneous shocks – the increase in…arrow_forwardSuppose that a given economy, in which the level of production (Y) is not at the natural level (Yn), an economy in which Y#Yn. 1) Using the AS/AD model, give an explanation of what will happen in the future and suggest a fiscal and/or a monetary policy to adjust the output and further analyse the effect of the suggested policy on employment and price level. 2) Illustrate your answer in part 1) by presenting and analysing data from the UK by identifying two occasions since 1950 (each covering a span of 2-5 years), where such an adjustment process occurred.arrow_forward

- Question 4: Stability of the IS-LM model Consider the following short-run dynamics in the closed-economy IS-LM model. It is assumed that the price level is fixed and (for convenience) has been normalized to unity (P = 1): Ř = ¢r [(Y, R) – M], Ý = 2 C(Y – T) + I(R) + G – Y, 2 >0, P1 > 0, where Y is output, R is the interest rate, M is the money stock, C is consumption, T is taxes, I is investment, and G is government consumption. As usual, a dot above a variables denotes that variable's time rate of change, i.e. Ř = dR/dt and Ý = dY/dt. (a) Interpret these equations. (b) Can you say something about the relative speeds of adjustment in the goods and financial markets?arrow_forwardWhich of the following is true the dynamic AS-AD model? The dynamic aggregate demand curve is downward sloping because the central bank follows the Taylor principle. An increase in the natural level of output increases the long-run inflation rate. To control inflation, the central bank should increase the nominal interest rate by less than one for one in response to an increase in the inflation rate. The monetary policy rule determines the slope of the dynamic aggregate supply curve.arrow_forwardLet's say you are the chair of economic advisors to the president. Assume that the economy, as depicted in an AD/AS framework is at: potential (full employment) output, The intersection of the SRAD, SRAS, and LRAS, all intersect at the level of potential (full employment) output and a corresponding price level ( or an acceptable rate of inflation). The economy's mpc is .75, which is presumed to remain constant. Now, global problems emerge, and the US decided to produce many new fighter jets immediately to the region under duress. The new jets will cost $55 b., and other expenditures by the government cannot be cut. The president is concerned that the new expenditures will create an inflation, but needs to produce the new jets immediately. What policies would you propose, that would enable the country to produce the new jets, without creating an inflation? Use the AD/AS framework to illustrate your answer. Assume any taxes are lump sum taxes. Specify the spending and taxing…arrow_forward

- Question 17 If the output gap is constant at minus 2 and the inflation rate has fallen from 6 percent to 5 percent, then next period's short-run aggregate supply curve might be TT= 5+2 (11-15) TT = 5-0.5 (13-15) TT = 4 +0.5 (13-15) TT = 5 +0.5 (13-15)arrow_forwardPlease draw the Philips curve with a positive relationship between aggregate output and inflation and another that shows an upward shift in the whole curve (brief explanation please as trying to understand it (: )arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education