If in 5.8% per semiannual, compounded manthly, What is the nominal quarter rate. CABET, SO1)

If in 5.8% per semiannual, compounded manthly, What is the nominal quarter rate. CABET, SO1)

Chapter1: Financial Statements And Business Decisions

Section: Chapter Questions

Problem 1Q

Related questions

Question

Transcribed Image Text:If i 5.8% per semiannual, compounded monthly, What is the nominal quarter rate.

(ABET, SO1)

Answer:

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps with 2 images

Follow-up Questions

Read through expert solutions to related follow-up questions below.

Follow-up Question

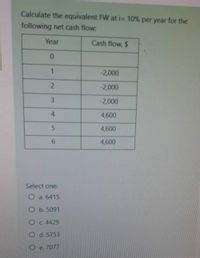

Transcribed Image Text:Calculate the equivalent FW at i= 10% per year for the

following net cash flow:

Year

Cash flow, $

-2,000

-2,000

3

-2,000

4.

4,600

5

4,600

4,600

Select one:

O a. 6415

O b. 5091

O c. 4429

O d. 5753

O e. 7077

Solution

Follow-up Question

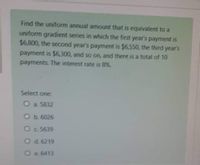

Transcribed Image Text:Find the uniform annual amount that is equivalent to a

uniform gradient series in which the first year's payment is

$6,800, the second year's payment is $6,550, the third year's

payment is $6,300, and so on, and there is a total of 10

payments. The interest rate is 8%.

Select one:

O a. 5832

O b. 6026

O c 5639

O d. 6219

O e 6413

Solution

Follow-up Question

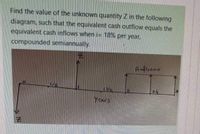

Transcribed Image Text:Find the value of the unknown quantity Z in the following

diagram, such that the equivalent cash outflow equals the

equivalent cash inflows when i= 18% per year,

compounded semiannually.

Ycars

Solution

Follow-up Question

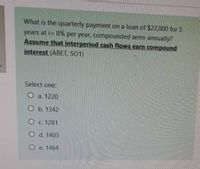

Transcribed Image Text:What is the quarterly payment on a loan of $22,000 for 5

years at i= 8% per year, compounded semi-annually?

Assume that interperiod cash flows earn compound

interest (ABET, SO1)

Select one:

O a. 1220

O b. 1342

O c. 1281

O d. 1403

O e. 1464

Solution

Follow-up Question

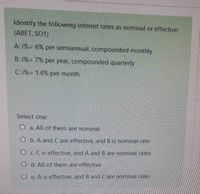

Transcribed Image Text:Identify the following interest rates as nominal or effective:

(ABET, SO1)

A: 1%= 6% per semiannual, compounded monthly

B: 1%= 7% per year, compounded quarterly

C: 1%= 1.4% per month

Select one:

O a. All of them are nominal

O b. A and C are effective, and B is nominal rate

O c. C is effective, and A and B are nominal rates

O d. All of them are effective

O e. A is effective, and B and Care nominal rates

Solution

Follow-up Question

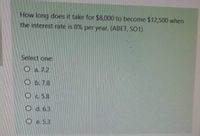

Transcribed Image Text:How long does it take for $8,000 to become $12,500 when

the interest rate is 8% per year. (ABET, SO1)

Select one:

O a 72

Ob.7.8

Oc.58

O d.6.3

O e. 5.3

Solution

Follow-up Question

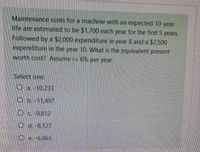

Transcribed Image Text:Maintenance costs for a machine with an expected 10-year

life are estimated to be $1,700 each year for the first 5 years

Followed by a $2,000 expenditure in year 8 and a $2,500

expenditure in the year 10. What is the equivalent present

worth cost? Assume i= 6% per year.

Select one:

O a.-10,233

O b.-11.497

Oc-9,812

O d.-8,127

O e.-6863

Solution

Follow-up Question

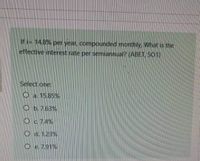

Transcribed Image Text:If i= 14.8% per year, compounded monthly What is the

effective interest rate per semiannual? (ABET, SO1)

Select one:

O a. 15.85%

O b. 7.63%

O c 74%

O d. 1.23%

O e. 7.91%

Solution

Follow-up Question

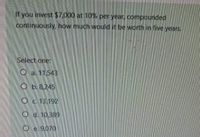

Transcribed Image Text:If you invest $7,000 at 10% per year, compounded

continuously, how much would it be worth in five years.

Select one:

O a. 11,543

O b.8,245

Oc.13,192

O d. 10,389

O e. 9,070

Solution

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Accounting

Accounting

ISBN:

9781337272094

Author:

WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:

Cengage Learning,

Accounting Information Systems

Accounting

ISBN:

9781337619202

Author:

Hall, James A.

Publisher:

Cengage Learning,

Accounting

Accounting

ISBN:

9781337272094

Author:

WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:

Cengage Learning,

Accounting Information Systems

Accounting

ISBN:

9781337619202

Author:

Hall, James A.

Publisher:

Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis…

Accounting

ISBN:

9780134475585

Author:

Srikant M. Datar, Madhav V. Rajan

Publisher:

PEARSON

Intermediate Accounting

Accounting

ISBN:

9781259722660

Author:

J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:

McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:

9781259726705

Author:

John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:

McGraw-Hill Education