Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

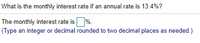

Transcribed Image Text:What is the monthly interest rate if an annual rate is 13.4%?

The monthly interest rate is %.

(Type an integer or decimal rounded to two decimal places as needed.)

Expert Solution

arrow_forward

Step 1

Given:

Annual rate = 13.4%

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- What is the periodic interest rate for an APR of 23% with daily compounding? Enter your answer using percent expression with two decimal places.arrow_forwardCalculating Real Rates of Return IfTreasury bills are currently paying 4.7 percent and the inflation rate is 1.9 percent, what is the approximate real rate of interest? The exact real rate?arrow_forwardSuppose $1,200 is deposited into an account which has an annual percentage rate of 9.81% per year. Assume it remains in the account for 18 years and no additional money is added to the account other than interest. (a) Complete the boxes below to write an expression for the amount (in dollars) at year x = 18, of assuming interest is compounded annually. Do not round any values. You can enter arithmetic expressions (containing +, -, *, /, or ^) in any of these boxes. Number 1200 •( Number What is the value in year x = 18 of an investment of $1,200 dollars which pays 9.81% compounded annually? $ Number (Round to the nearest 0.01 dollars) (b) Complete the boxes below to write an expression for the amount (in dollars) at year x = 18, assuming interest is compounded weekly (52 times per year). Do not round any values. You can enter arithmetic expressions (containing +, –, *, /, or ^) in any of these boxes. Number 1200 ( Number What is the value in year x = 18 of an investment of $1,200…arrow_forward

- Please answer and provide solutions for three questions. 1. Given i(26) = 3.150%, find the equivalent nominal interest rate compounded quarterly. 2. Given an effective quarterly rate of 2.22500%, find the equivalent effective semi-annual rate. (You might need to keep more than the usual number of decimal places!) 3. Given an effective quarterly rate of 1.25000%, find the equivalent nominal rate i(2).arrow_forwardanswer please lol!arrow_forward3. A bank CD that pays 7.58 percent compounded annually. (Round answer to 2 decimal places, e.g. 15.25%.) what is the Effective annual rate %?arrow_forward

- What is the effective annual rate (EAR) for a nominal rate (monthly compounding) of 15.2 %? SET YOUR CALCULATOR TO 4 DECIMAL PLACES THEN INPUT THE NUMBER AS PERCENTAGE ROUNDING TO 2 DECIMALS. DO NOT ENTER THE % SYMBOL..i.e. if your answer is 7.7711%, enter it as 7.77.arrow_forwardWhen $8,600 is invested in a savings account paying simple interest for the year, the interest, i in dollars, can obtained from the equation i=8,600r, where r is the rate of interest in decimal form. Graph i=8,600r, for r up to including a rate of 16%. If the rate is 7%, how much interest is earned? OA. $6,020 OB. $602 O C. $586 OD. $622 Iarrow_forwardA deposit of $8441 will amount to $11789 in 10 years with interest compounded monthly. What is the nominal rate of interest? (Round your answer to 2 decimal places)arrow_forward

- Suppose that the interest rate is 5 percent. Instructions: Enter your answers rounded to 2 decimal places. a. What is the future value of $100 six years from now? $ How much of the future value is total interest? $ b. By how much would total interest be greater at an interest rate of 7 percent than at an interest rate of 5 percent?arrow_forwardFind the APY corresponding to the following nominal rate. 8% compounded quarterly The APY is %. (Type an integer or a decimal. Round to the nearest hundredth as needed.)arrow_forwardWhat would be the annual percentage yield for a savings account that earned $51 in interest on $750 over the past 365 days? (Enter your answer as a percent rounded to 1 decimal place.)arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education