Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

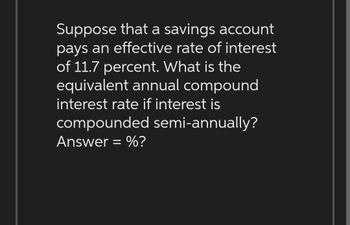

Transcribed Image Text:Suppose that a savings account

pays an effective rate of interest

of 11.7 percent. What is the

equivalent annual compound

interest rate if interest is

compounded semi-annually?

Answer = %?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- 3) An interest rate of 5% compounded quarterly is equivalent to what rate compounded monthly?arrow_forwardWhat is the effective rate (annually compounded rate) of interest corresponding to 9% compounded quarterly? What is the equivalent monthly rate?arrow_forwardWhat is the effective interest rate for quarterly transaction if the interest rate is 5% per year compounded monthly?arrow_forward

- Calculating Real Rates of Return IfTreasury bills are currently paying 4.7 percent and the inflation rate is 1.9 percent, what is the approximate real rate of interest? The exact real rate?arrow_forwardWhat is the PV of a 6-year, $149 annuity due if the annual interest rate is 5% ?arrow_forwardAssume that time is measured in months. Calculate the present value at time 0 of a payment of £131 paid at time 18, using an interest rate of 9% per annum effective.arrow_forward

- H1.arrow_forwardIf the annual interest rate is 8%, what is the daily interest rate that would be used as the "r" in the time value of money equation? Hint: the equation uses the decimal equivalent of the percent Enter your answer to four decimal places.arrow_forwardSuppose Snli 40 and (1 + i)n = 3.7, where i is an effective annual interest rate. What is the present value of an annuity-immediate which has annual payments of 150 for 3n years?arrow_forward

- Given i = 10% compounded quarterly. Find the effective interest rate if payments are made monthly.arrow_forwardWhat is the present value of a 8-year ordinary annuity with annual payments of $511, evaluated at a 4 percent interest rate? Round your answer to 2 decimal places; for example 2345.25.arrow_forwardThe current amount A of a principal P invested in a savings account paying an annual interest rate r is given by A = P(1+r/n)^(rt) where n is the number of times per year the interest is compounded. For continuous compounding, A = Pe^(rt). Suppose $10,000 is initially invested at 2.5 percent (r = 0.025). a. Plot A versus t for 0 ≤ t ≤ 20 years for four cases: continuous compounding, annual compounding (n = 1), quarterly compounding (n = 4), and monthly compounding (n = 12). Show all four cases on the same subplot and label each curve. On a second subplot, plot the difference between the amount obtained from continuous compounding and the other three cases. b. Redo part a, but plot A versus t on log-log and semilog plots. Which plot gives a straight line?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education