ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Question

Only typed answer

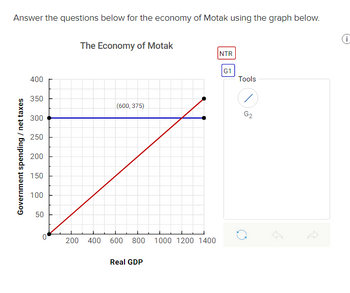

a. If

b. If government spending is decreased by the size of the deficit in part (a), draw the new curve labelled G2 in the graphing area above.

c. Suppose the multiplier has a value of 3, the new level of equilibrium GDP is $ billion.

d. Motak's deficit at this new level of equilibrium GDP is $ billion.

Transcribed Image Text:Answer the questions below for the economy of Motak using the graph below.

Government spending / net taxes

400

350

300

250

200

150

100

50

The Economy of Motak

(600, 375)

200 400 600 800 1000 1200 1400

Real GDP

NTR

G1

Tools

/

G2

@

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Similar questions

- Answer the questions below for the economy of Motak using the graph below. Government spending / net taxes 400 350 300 250 200 150 100 50 0 The Economy of Motak 200 400 600 800 1000 1200 1400 Real GDP INTR G1 Tools G₂ 2arrow_forwardSuppose that real GDP is currently $1.45 trillion, potential GDP is $1.51 trillion, the government purchases multiplier is 2.4, and the tax multiplier is 2. a. Holding other factors constant, government purchases will need to be increased by $ 0.0250 trillion to bring the economy to equilibrium at potential GDP. (Round to four decimal places as needed.) b. Holding other factors constant, taxes have to be cut by $ 0.0300 trillion to bring the economy to equilibrium at potential GDP. (Round to four decimal places as needed.) c. Construct an example of a combination of increased government spending and tax cuts that will bring the economy to equilibrium at potential GDP. The combination of increasing government spending by $0.0600 trillion and cutting taxes by $ trillion will bring the economy to equilibrium at potential GDP (Round to four decimal places as needed.) $0.0600 trillion $0.1440 trillion $0.1200 trillion $0.0100 trillionarrow_forward2. The multiplier effect of a change in government purchases Consider a hypothetical closed economy in which households spend $0.80 of each additional dollar they earn and save the remaining $0.20. The marginal propensity to consume (MPC) for this economy is, and the spending multiplier for this economy is ▼. Suppose the government in this economy decides to decrease government purchases by $300 billion. The decrease in government purchases will lead to a decrease in income, generating an initial change in consumption equal to . This decreases income yet again, causing a second change in consumption equal to .The total change in demand resulting from the initial change in government spending is The following graph shows the aggregate demand curve (AD1) for this economy before the change in government spending. Use the green line (triangle symbol) to plot the new aggregate demand curve (AD₂) after the spending multiplier effect takes place. Hint: Be sure that the new aggregate demand…arrow_forward

- 3arrow_forward3. Explain how expansionary fiscal policy can close a recessionary gap using an appropriate diagram. Note: Use the following terms. They are: Long-run aggregate supply curve (LRAS). short-run aggregate supply curve (SRAS), Aggregate demand (AD). Real GDP price level. potential GDP, etc.arrow_forwardAttempts 10. Crowding out effect Keep the Highest/2 Suppose economists observe that an increase in government spending of $13 billion raises the total demand for goods and servic If these economists ignore the possibility of crowding out, they would estimate the marginal propensity to consume (MPC) to be Now suppose the economists allow for crowding out. Their new estimate of the MPC would be than their initial one. Grade It Now 3/4 1/4 4 52 billion. Save & Continuearrow_forward

- 4 HOMEY set of any of yes to $30 -0- -o- My ly Suppose that for every increase in the sterest rate ens peresage the end of westmant spending decies by 565 bon Based on the anes the level of investments to b Suppose that for every increase in the interest rate of one percentage point, the level of investment spending declines by $0.5 billion. Based on the changes made to the money market in the previous scenario, the new interest rate causes the level of investment spending to by Taking the multiplier effect into account, the change in investment spending will cause the quantity of output demanded to known as the by at every price level. The impact of an increase in government purchases on the interest rate and the level of investment spending is effect. Use the purple line (diamond symbol) on the graph at the beginning of this problem to show the aggregate demand curve (ADS) after accounting for the impact of the increase in government purchases on the interest rate and the level of…arrow_forward6. Graphical treatment of taxes and fiscal policy The main difference between variable taxes and fixed taxes is that unlike fixed taxes, variable taxes The following graph shows the consumption schedule for an economy with a given level of taxes. Suppose the government implements a tax increase through a fixed tax. Use two green points (triangle symbol) to connect the two black points (plus symbols) representing the consumption schedule after the change in taxes. Hint: The new consumption schedule must pass through one point on the left and one point on the right. REAL CONSUMER SPENDING (Billions of dollars) 8 40 30 8 0 + + + O + ++ 20 40 60 REAL GDP (Billions of dollars) 80 + O + 100 Consumption with Tax Increase through a Fixed Tax Consumption with Tax Increase through a Variable Tax The blue line on the next graph represents the original total expenditure line for this economy before the change in tax structure. Use the new consumption line you just plotted to calculate the new…arrow_forwardFigure 16-7 Price level P3 a P₂ P₁ 0 LRAS A increase taxes LRAS 8 с Y₂ Ya contractionary fiscal policy O increase government spending O decrease interest rates SRAS₁ AD₁ SRAS AD₂ Refer to Figure 16-7. Given that the economy has moved from A to B in the graph above, which of the following would be the appropriate fiscal policy to achieve potential GDP? Real GDP (trillions of dollars)arrow_forward

- Suppose the economy reaches equilibrium GDP at $1,250,000 while potential GDP is at $1,500,000. Currently G=$180,000 while taxes are equal to 0.1Y (where Y is the same as real GDP). a. How large is the recessionary gap in this economy? b. At equilibrium GDP, is there a budget surplus or deficit? Solve for the value of this surplus or deficit. At the potential GDP, is there a surplus or deficit? Solve for the value of the full- employment surplus or deficit. d. Does there exist a cyclical surplus or deficit? Solve for its value C.arrow_forward3. Assume that initially G is $300 and equilibrium real GDP is $5000. If the multiplier is 5, what would be the new equilibrium level of GDP if Government expenditures increase to $600.arrow_forwardSuppose that the government allocates $1 billion for new roads. It also raises taxes by $1 billion to keep the deficit from growing. The absolute value of the government purchase multiplier is 3.33 and that of the tax multiplier is 2.33. What is the effect on equilibrium GDP? GDP does not change. ● GDP increases by $ 2.33 billion. GDP increases by $3.33 billion ⒸGDP increases by $1 billion.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education