Income Tax Fundamentals 2020

38th Edition

ISBN: 9780357391129

Author: WHITTENBURG

Publisher: Cengage

expand_more

expand_more

format_list_bulleted

Question

thumb_up100%

Please given answer general accounting

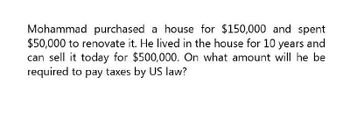

Transcribed Image Text:Mohammad purchased a house for $150,000 and spent

$50,000 to renovate it. He lived in the house for 10 years and

can sell it today for $500,000. On what amount will he be

required to pay taxes by US law?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Chelsea, who is single, purchases land for investment purposes in 2014 at a cost of 22,000. In 2019, she sells the land for 38,000. Chelseas taxable income without considering the land sale is 100,000. What is the effect of the sale of the land on her taxable income, and what is her tax liability?arrow_forwardIn each of the following problems, identify the tax issue(s) posed by the facts presented. Determine the possible tax consequences of each issue that you identify. Thans grandmother dies and leaves him jewelry worth 40,000. In addition, he is the beneficiary of a 100,000 life insurance policy that his grandmother had bought before she retired.arrow_forwardWade paid 7,000 for an automobile that needed substantial repairs. He worked nights and weekends to restore the car and spent 2,400 on parts for it. He knows that he can sell the car for 13,000, but he is very wealthy and does not need the money. On the other hand, his daughter, who has very little income, needs money to make the down payment on a house. a. Would it matter, after taxes, whether Wade sells the car and gives the money to his daughter or whether he gives the car to his daughter and she sells it for 13,000? Explain. b. Assume that Wade gave the car to his daughter after he had arranged for another person to buy it from his daughter. The daughter then transferred the car to the buyer and received 13,000. Who is taxed on the gain?arrow_forward

- On June 30, 2019, Kelly sold property for 240,000 cash and a 960,000 note due on September 30, 2020. The note will also pay 6% interest, which is slightly higher than the Federal rate. Kellys cost of the property was 400,000. She is concerned that Congress may increase the tax rate that will apply when the note is collected. Kellys after-tax rate of return on investments is 6%. a. What can Kelly do to avoid the expected higher tax rate? b. Assuming that Kellys marginal combined Federal and state tax rate is 25% in 2019, how much would the tax rates need to increase to make the option identified in part (a) advisable?arrow_forwardJarrod receives a scholarship of 18,500 from Riggers University to be used to pursue a bachelors degree. He spends 12,000 on tuition, 1,500 on books and supplies, 4,000 for room and board, and 1,000 for personal expenses. How much may Jarrod exclude from his gross income?arrow_forwardMartha is a self-employed tax accountant who drives her car to visit clients on a regular basis. She drives her car 4,000 miles for business and 10,000 for commuting and other personal use. Assuming Martha uses the standard mileage method, how much is her auto expense for the year? Where in her tax return should Martha claim this deduction? _________________________________________________ _______________________________________________________________________________ _______________________________________________________________________________arrow_forward

- Floyd, a cash basis taxpayer, has received an offer to purchase his land. The cash basis buyer will pay him either 100,000 at closing or 50,000 at closing and 56,000 two years after the date of closing. If Floyd recognizes the entire gain in the current year, his marginal tax rate will be 25% (combined Federal and state rates). However, if he spreads the gain over the two years, his combined marginal tax rate on the gain will be only 20%. Floyd does not consider the buyer a credit risk, and he understands that shifting the gain to next year with an installment sale will save taxes. Still, he realizes that the deferred payment will, in effect, earn only 6,000 for waiting two years for the other 50,000. Floyd believes he can earn a 10% before-tax rate of return on his after-tax cash. Floyds adjusted basis for the land is 25,000, the buyer is also a cash basis taxpayer, and the short-term Federal rate is 4%. Floyd has asked you to evaluate the two alternatives on an after-tax basis.arrow_forwardJohn purchased a house for $300,000. It is now worth $800,000 4 years later. Johns fiancee lived with him for two years but is not on the title. Joe would like to sell the house for a larger home, what might be the tax ramifications?arrow_forwardack purchases a house for $90,000 and spends $15,000 to renovate it. He holds the house for 35 years and then sells it in the middle of a real estate bubble for $400,000. How much of that amount does he have to pay taxes?arrow_forward

- Melissa had a $200,000 long-term capital gain when she sold some of her Bitcoin in 2021, bringing her total taxable income to $450,000. If she files her return as Head of Household, how much tax will she owe on her capital gain?arrow_forwardMelissa sold some of her Bitcoin in 2021 for a $200,000 long-term capital gain, bringing her total taxable income to $450,000. What is the tax on this capital gain if she files her return as Head of Household?arrow_forwardWhen Barry’s grandmother passed away, she gave Barry a diamond ring that was worth $6,000 at the time of death. Barry’s grandmother had purchased the ring for $5,400. What is Barry’s basis in the ring if he sells it for $7,000? What if he sells it for $5,000? What if he sells it for $5,800?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Individual Income TaxesAccountingISBN:9780357109731Author:HoffmanPublisher:CENGAGE LEARNING - CONSIGNMENT

Individual Income TaxesAccountingISBN:9780357109731Author:HoffmanPublisher:CENGAGE LEARNING - CONSIGNMENT

Individual Income Taxes

Accounting

ISBN:9780357109731

Author:Hoffman

Publisher:CENGAGE LEARNING - CONSIGNMENT